- Hong Kong

- /

- Semiconductors

- /

- SEHK:6865

Flat Glass Group Co., Ltd.'s (HKG:6865) 38% Jump Shows Its Popularity With Investors

Despite an already strong run, Flat Glass Group Co., Ltd. (HKG:6865) shares have been powering on, with a gain of 38% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

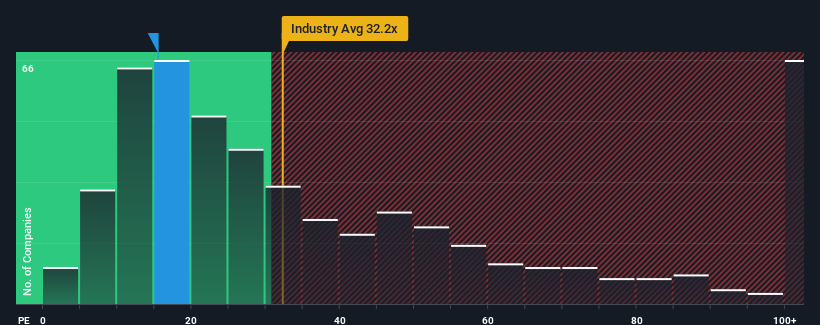

After such a large jump in price, Flat Glass Group may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 15.5x, since almost half of all companies in Hong Kong have P/E ratios under 8x and even P/E's lower than 4x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Flat Glass Group has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Flat Glass Group

Is There Enough Growth For Flat Glass Group?

In order to justify its P/E ratio, Flat Glass Group would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 34% gain to the company's bottom line. Pleasingly, EPS has also lifted 106% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 19% per year over the next three years. With the market only predicted to deliver 16% each year, the company is positioned for a stronger earnings result.

With this information, we can see why Flat Glass Group is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Flat Glass Group's P/E

The strong share price surge has got Flat Glass Group's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Flat Glass Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Flat Glass Group (including 1 which doesn't sit too well with us).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6865

Flat Glass Group

Engages in the manufacture and sale of glass products in the People's Republic of China, the rest of Asia, Europe, North America, and internationally.

Undervalued with adequate balance sheet.