- Hong Kong

- /

- Retail Distributors

- /

- SEHK:8026

China Brilliant Global Limited's (HKG:8026) 28% Cheaper Price Remains In Tune With Revenues

China Brilliant Global Limited (HKG:8026) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

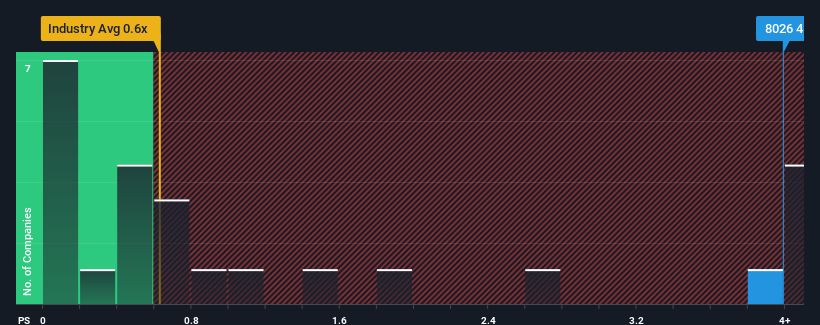

In spite of the heavy fall in price, given around half the companies in Hong Kong's Retail Distributors industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider China Brilliant Global as a stock to avoid entirely with its 4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for China Brilliant Global

How China Brilliant Global Has Been Performing

As an illustration, revenue has deteriorated at China Brilliant Global over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Brilliant Global will help you shine a light on its historical performance.How Is China Brilliant Global's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as China Brilliant Global's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. Even so, admirably revenue has lifted 115% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 20% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that China Brilliant Global's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

A significant share price dive has done very little to deflate China Brilliant Global's very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of China Brilliant Global revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for China Brilliant Global (1 is significant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8026

China Brilliant Global

An investment holding company, engages in the research and development, design, wholesale, and retail of gold and jewelry, and related ancillary businesses in Hong Kong and the Peoples’ Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives