- Hong Kong

- /

- Retail Distributors

- /

- SEHK:8026

Are Insiders Buying China Brilliant Global Limited (HKG:8026) Stock?

We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So shareholders might well want to know whether insiders have been buying or selling shares in China Brilliant Global Limited (HKG:8026).

Do Insider Transactions Matter?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

See our latest analysis for China Brilliant Global

The Last 12 Months Of Insider Transactions At China Brilliant Global

Over the last year, we can see that the biggest insider purchase was by Executive Chairman Chunhua Zhang for HK$3.5m worth of shares, at about HK$0.52 per share. That means that an insider was happy to buy shares at around the current price of HK$0.56. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. In this case we're pleased to report that the insider bought shares at close to current prices. The only individual insider to buy over the last year was Chunhua Zhang.

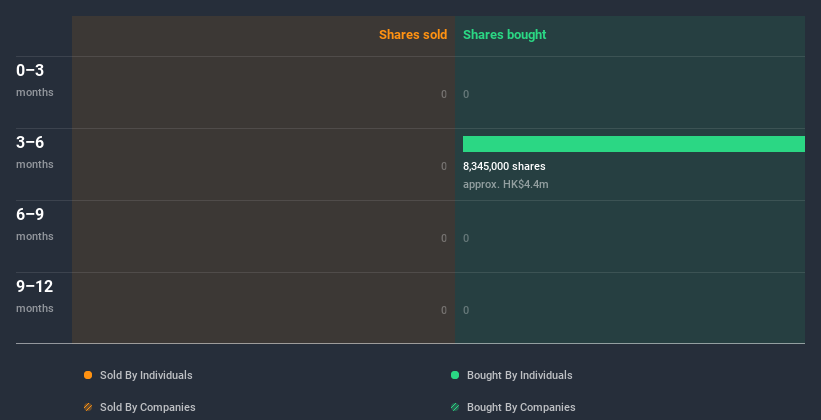

Chunhua Zhang bought a total of 8.35m shares over the year at an average price of HK$0.52. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

China Brilliant Global is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Our information indicates that China Brilliant Global insiders own about HK$7.6m worth of shares. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. We might be missing something but that seems like very low insider ownership.

So What Does This Data Suggest About China Brilliant Global Insiders?

There haven't been any insider transactions in the last three months -- that doesn't mean much. But insiders have shown more of an appetite for the stock, over the last year. The transactions are fine but it'd be more encouraging if China Brilliant Global insiders bought more shares in the company. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing China Brilliant Global. For example, China Brilliant Global has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade China Brilliant Global, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8026

China Brilliant Global

An investment holding company, engages in the research and development, design, wholesale, and retail of gold and jewelry, and related ancillary businesses in Hong Kong and the Peoples’ Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives