- Hong Kong

- /

- Retail Distributors

- /

- SEHK:8026

After Leaping 34% China Brilliant Global Limited (HKG:8026) Shares Are Not Flying Under The Radar

China Brilliant Global Limited (HKG:8026) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

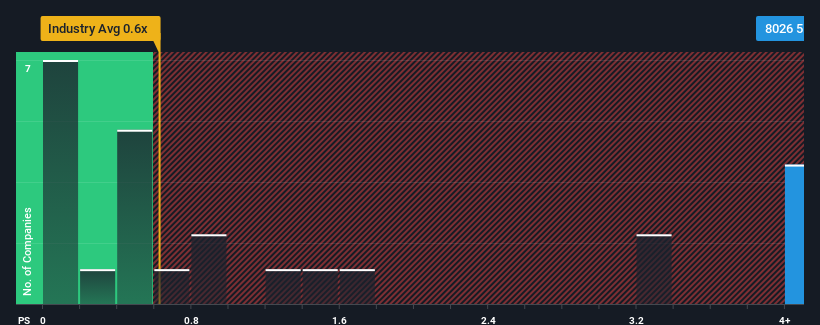

Since its price has surged higher, given around half the companies in Hong Kong's Retail Distributors industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider China Brilliant Global as a stock to avoid entirely with its 5.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for China Brilliant Global

How Has China Brilliant Global Performed Recently?

As an illustration, revenue has deteriorated at China Brilliant Global over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Brilliant Global will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, China Brilliant Global would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. Still, the latest three year period has seen an excellent 115% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 21%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why China Brilliant Global is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

The strong share price surge has lead to China Brilliant Global's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China Brilliant Global maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

And what about other risks? Every company has them, and we've spotted 2 warning signs for China Brilliant Global you should know about.

If you're unsure about the strength of China Brilliant Global's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8026

China Brilliant Global

An investment holding company, engages in the research and development, design, wholesale, and retail of gold and jewelry, and related ancillary businesses in Hong Kong and the Peoples’ Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives