- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:6618

The past year for JD Health International (HKG:6618) investors has not been profitable

Taking the occasional loss comes part and parcel with investing on the stock market. Unfortunately, shareholders of JD Health International Inc. (HKG:6618) have suffered share price declines over the last year. The share price has slid 61% in that time. We wouldn't rush to judgement on JD Health International because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 21% in the last three months.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Check out our latest analysis for JD Health International

JD Health International wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

JD Health International grew its revenue by 66% over the last year. That's a strong result which is better than most other loss making companies. Meanwhile, the share price slid 61%. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). Generally speaking investors would consider a stock like this less risky once it turns a profit. But when do you think that will happen?

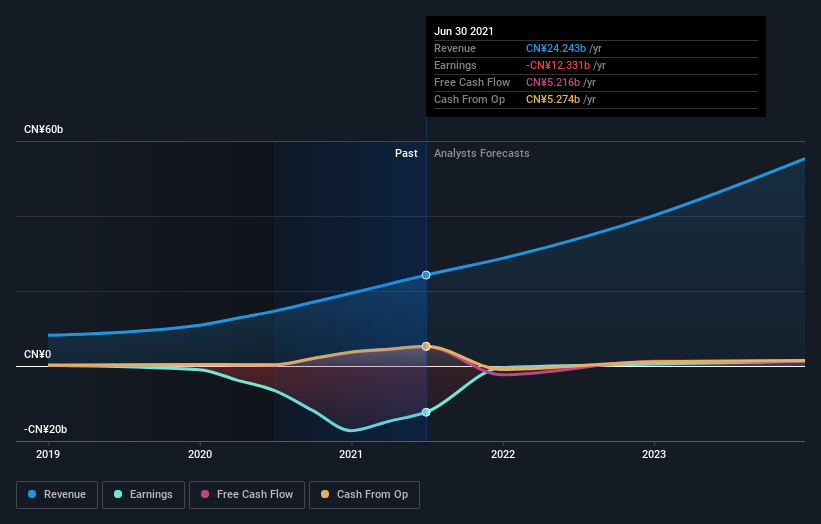

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

JD Health International is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think JD Health International will earn in the future (free analyst consensus estimates)

A Different Perspective

We doubt JD Health International shareholders are happy with the loss of 61% over twelve months. That falls short of the market, which lost 7.3%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 21%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with JD Health International .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you're looking to trade JD Health International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6618

JD Health International

An investment holding company, engages in the operation of an online healthcare platform in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives