Three Undiscovered Gems In Hong Kong To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

The Hong Kong market has shown resilience amid global economic fluctuations, with the Hang Seng Index recently gaining 1.99%. This positive sentiment provides a fertile ground for investors seeking opportunities in lesser-known stocks that have strong potential. In this context, identifying promising small-cap stocks can be particularly rewarding as they often offer unique growth prospects and are less influenced by broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

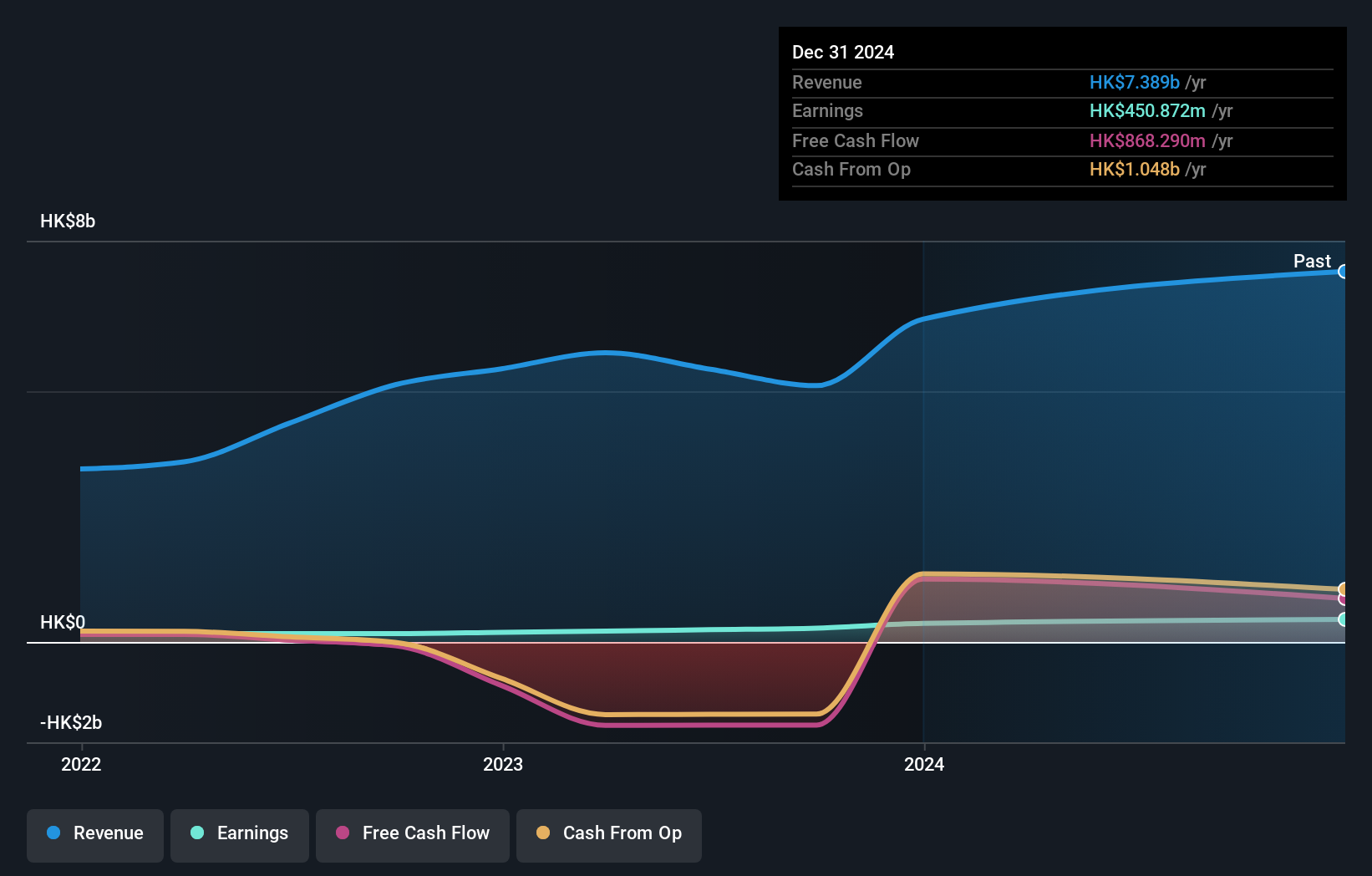

Overview: Time Interconnect Technology Limited, with a market cap of HK$7.16 billion, manufactures and sells cable assembly and networking cable products across various international markets including China, the United States, and the Netherlands.

Operations: Time Interconnect Technology Limited generates revenue primarily from its Server (HK$2.98 billion), Digital Cable (HK$1.18 billion), and Cable Assembly (HK$2.31 billion) segments.

Time Interconnect Technology has shown robust growth with earnings surging by 93% over the past year, outpacing the Electrical industry’s 11%. The company repurchased shares in 2024 and announced a final dividend of HK$0.007 per share for nine months ending December 2023. Despite high debt levels, with a net debt to equity ratio at 184.9%, their EBIT covers interest payments nine times over, indicating strong financial health.

First Tractor (SEHK:38)

Simply Wall St Value Rating: ★★★★★★

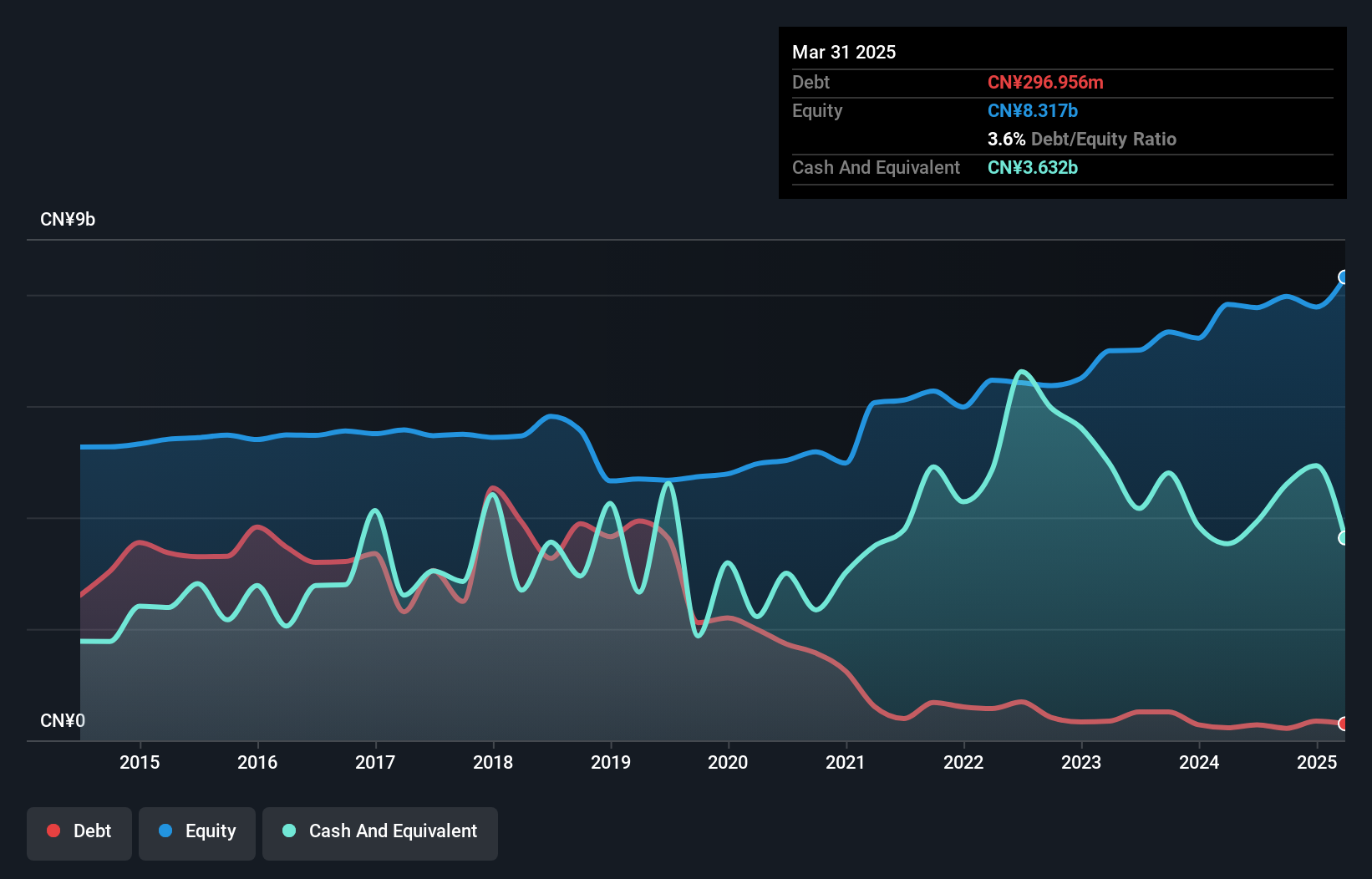

Overview: First Tractor Company Limited engages in the research and development, manufacture, and sale of agricultural and power machinery, with a market cap of HK$14.41 billion.

Operations: First Tractor generates revenue primarily from the sale of agricultural and power machinery. The company's net profit margin is 4.5%.

First Tractor has a P/E ratio of 6.9x, lower than Hong Kong's market average of 8.8x, indicating good value. Earnings grew by an impressive 61.9% over the past year, outpacing the Machinery industry’s modest 1.9%. The company is debt-free with more cash than total liabilities and has reduced its debt-to-equity ratio from 84% to just 2.9% in five years. Recent board changes include electing Li Xiaoyu as chairman and adding new committee members for strategic roles.

- Click here to discover the nuances of First Tractor with our detailed analytical health report.

Gain insights into First Tractor's past trends and performance with our Past report.

China Tobacco International (HK) (SEHK:6055)

Simply Wall St Value Rating: ★★★★☆☆

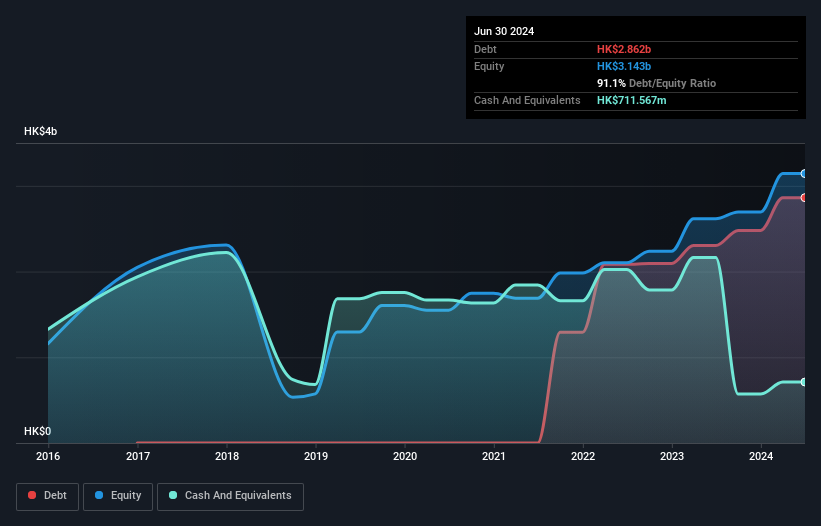

Overview: China Tobacco International (HK) Company Limited engages in the tobacco business, with a market cap of HK$10.51 billion.

Operations: The company generates revenue primarily from its Tobacco Leaf Products Import Business (HK$8.08 billion) and Tobacco Leaf Products Export Business (HK$1.65 billion). Additional revenue streams include the Cigarettes Export Business (HK$1.21 billion), Brazil Operation Business (HK$766.28 million), and New Tobacco Products Export Business (HK$129.98 million).

China Tobacco International (HK) has demonstrated notable growth, with earnings up 59.7% in the past year, outpacing the Retail Distributors industry at 48.1%. The company is trading at a significant discount of 77.6% below its estimated fair value, suggesting potential undervaluation. Despite a high net debt to equity ratio of 70.9%, interest payments are well covered by EBIT (16.8x). Recent guidance indicates expected revenue and profit increases of at least 10% and 30%, respectively, driven by strategic portfolio optimization and increased tobacco leaf imports and exports.

- Dive into the specifics of China Tobacco International (HK) here with our thorough health report.

Learn about China Tobacco International (HK)'s historical performance.

Next Steps

- Discover the full array of 167 SEHK Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade First Tractor, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:38

First Tractor

Engages in the manufacturing and sale of agricultural machinery and power machinery.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives