- Hong Kong

- /

- Specialty Stores

- /

- SEHK:393

Glorious Sun Enterprises Limited's (HKG:393) CEO Compensation Looks Acceptable To Us And Here's Why

Performance at Glorious Sun Enterprises Limited (HKG:393) has been rather uninspiring recently and shareholders may be wondering how CEO Chun Fan Yeung plans to fix this. At the next AGM coming up on 02 June 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for Glorious Sun Enterprises

Comparing Glorious Sun Enterprises Limited's CEO Compensation With the industry

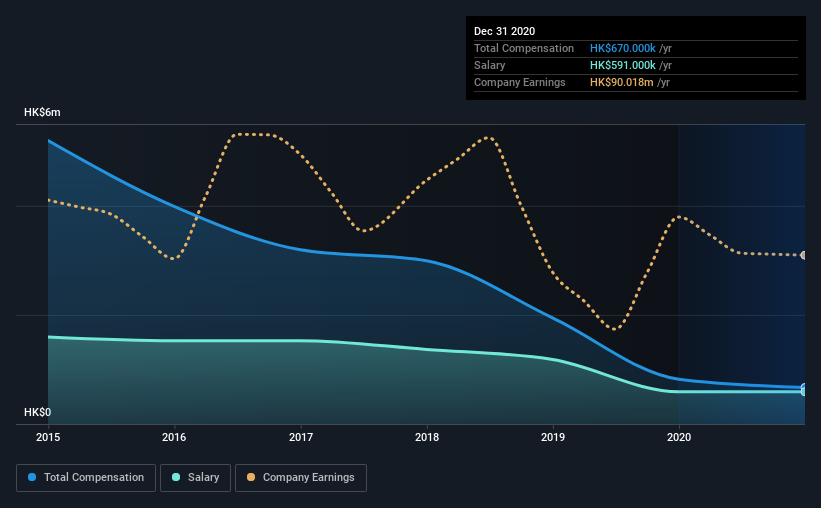

At the time of writing, our data shows that Glorious Sun Enterprises Limited has a market capitalization of HK$1.3b, and reported total annual CEO compensation of HK$670k for the year to December 2020. That's a notable decrease of 18% on last year. We note that the salary portion, which stands at HK$591.0k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from HK$776m to HK$3.1b, we found that the median CEO total compensation was HK$2.8m. This suggests that Chun Fan Yeung is paid below the industry median. What's more, Chun Fan Yeung holds HK$121m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$591k | HK$591k | 88% |

| Other | HK$79k | HK$231k | 12% |

| Total Compensation | HK$670k | HK$822k | 100% |

Speaking on an industry level, nearly 91% of total compensation represents salary, while the remainder of 9% is other remuneration. Our data reveals that Glorious Sun Enterprises allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Glorious Sun Enterprises Limited's Growth

Glorious Sun Enterprises Limited has reduced its earnings per share by 11% a year over the last three years. In the last year, its revenue is down 42%.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Glorious Sun Enterprises Limited Been A Good Investment?

With a total shareholder return of 17% over three years, Glorious Sun Enterprises Limited shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Shareholder returns while positive, need to be looked at along with earnings, which have failed to grow and this could mean that the current momentum may not continue. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 2 warning signs for Glorious Sun Enterprises (1 can't be ignored!) that you should be aware of before investing here.

Switching gears from Glorious Sun Enterprises, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:393

Glorious Sun Enterprises

An investment holding company, engages in interior decoration and renovation business in Mainland China, Hong Kong, Australia, New Zealand, Canada, the United States, and internationally.

Flawless balance sheet with acceptable track record.