- Hong Kong

- /

- Wireless Telecom

- /

- SEHK:3773

Here's Why I Think NNK Group (HKG:3773) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like NNK Group (HKG:3773). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for NNK Group

NNK Group's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that NNK Group's EPS went from CN¥0.0018 to CN¥0.073 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

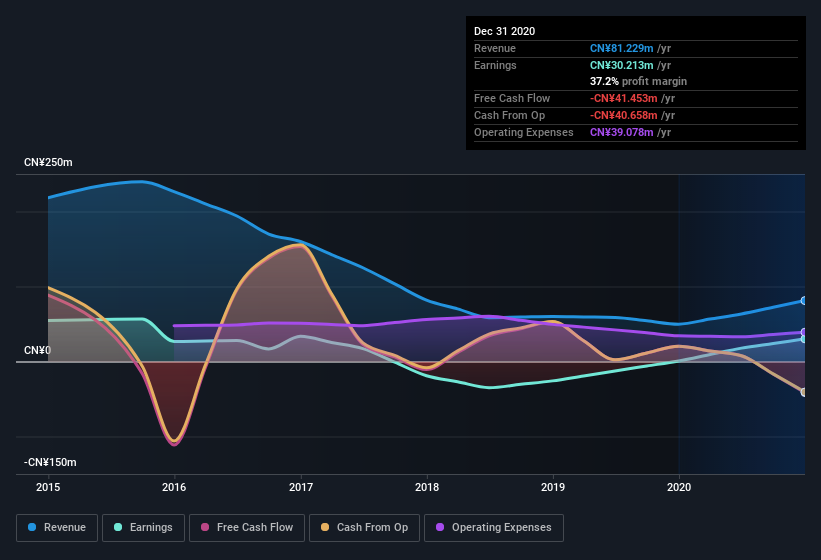

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that NNK Group is growing revenues, and EBIT margins improved by 38.6 percentage points to 29%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Since NNK Group is no giant, with a market capitalization of HK$166m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are NNK Group Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that NNK Group insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 72%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have CN¥120m invested in the business, using the current share price. That's nothing to sneeze at!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like NNK Group with market caps under CN¥1.3b is about CN¥1.5m.

The NNK Group CEO received CN¥1.2m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is NNK Group Worth Keeping An Eye On?

NNK Group's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so I do think NNK Group is worth considering carefully. Before you take the next step you should know about the 3 warning signs for NNK Group (2 can't be ignored!) that we have uncovered.

Although NNK Group certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3773

Yinsheng Digifavor

Provides mobile and data usage top-up services to mobile subscribers in the People’s Republic of China.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives