- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

Is Meituan Dianping's (HKG:3690) 135% Share Price Increase Well Justified?

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Meituan Dianping (HKG:3690) share price has soared 135% return in just a single year. On top of that, the share price is up 13% in about a quarter. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for Meituan Dianping

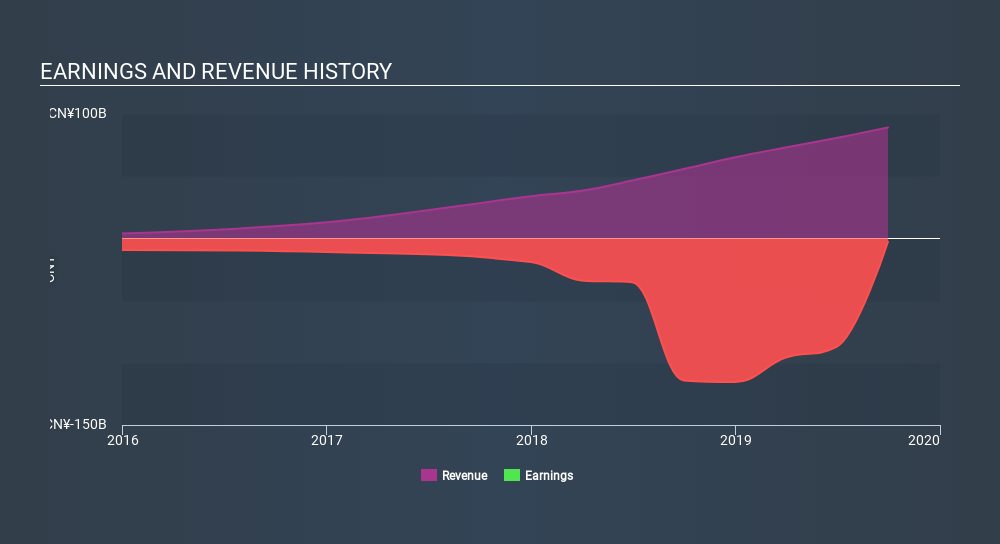

Given that Meituan Dianping didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Meituan Dianping saw its revenue grow by 60%. That's a head and shoulders above most loss-making companies. And the share price has responded, gaining 135% as we previously mentioned. It's great to see strong revenue growth, but the question is whether it can be sustained. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Meituan Dianping is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Meituan Dianping will earn in the future (free analyst consensus estimates)

A Different Perspective

Meituan Dianping shareholders should be happy with the total gain of 135% over the last twelve months. That's better than the more recent three month gain of 13%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). It's always interesting to track share price performance over the longer term. But to understand Meituan Dianping better, we need to consider many other factors. Be aware that Meituan Dianping is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:3690

Meituan

Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives