- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2185

3 Asian Penny Stocks With Market Caps Over US$100M To Consider

Reviewed by Simply Wall St

As global markets navigate the complexities of new U.S. tariffs, Asian economies are showing resilience, with China's potential for further stimulus and Japan's mixed economic data capturing investor attention. In this context, penny stocks—often seen as a gateway to affordable growth opportunities—remain relevant for investors seeking exposure to smaller or newer companies with solid financials. This article will explore three such Asian penny stocks that demonstrate financial strength and potential for growth in today's market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.39 | HK$877.02M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.11 | HK$3.65B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.27 | HK$1.89B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.17 | HK$1.95B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.58 | THB2.75B | ✅ 3 ⚠️ 3 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.61 | SGD581.56M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.37 | SGD9.33B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.92 | THB1.35B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.235 | SGD47.52M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 982 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

BAIOO Family Interactive (SEHK:2100)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BAIOO Family Interactive Limited is an investment holding company that offers internet content and services in China and internationally, with a market cap of HK$2.29 billion.

Operations: The company's revenue is primarily derived from its Online Entertainment Business, which generated CN¥545.13 million.

Market Cap: HK$2.29B

BAIOO Family Interactive, with a market cap of HK$2.29 billion, remains debt-free, which can be appealing for risk-averse investors in the penny stock space. Despite being unprofitable and experiencing increasing losses over the past five years, its short-term assets significantly exceed both short and long-term liabilities. The company recently announced a special dividend of HKD 0.012 per share and renewed agreements to facilitate WeChat Pay services with Tencent Group, potentially enhancing user engagement through improved payment channels. Quarterly metrics show growth in active accounts and revenue per paying account, indicating some operational progress amidst financial challenges.

- Unlock comprehensive insights into our analysis of BAIOO Family Interactive stock in this financial health report.

- Learn about BAIOO Family Interactive's historical performance here.

Shanghai Bio-heart Biological Technology (SEHK:2185)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shanghai Bio-heart Biological Technology Co., Ltd. (SEHK:2185) focuses on developing and commercializing cardiovascular medical devices, with a market cap of HK$1.14 billion.

Operations: No revenue segments have been reported for this company.

Market Cap: HK$1.14B

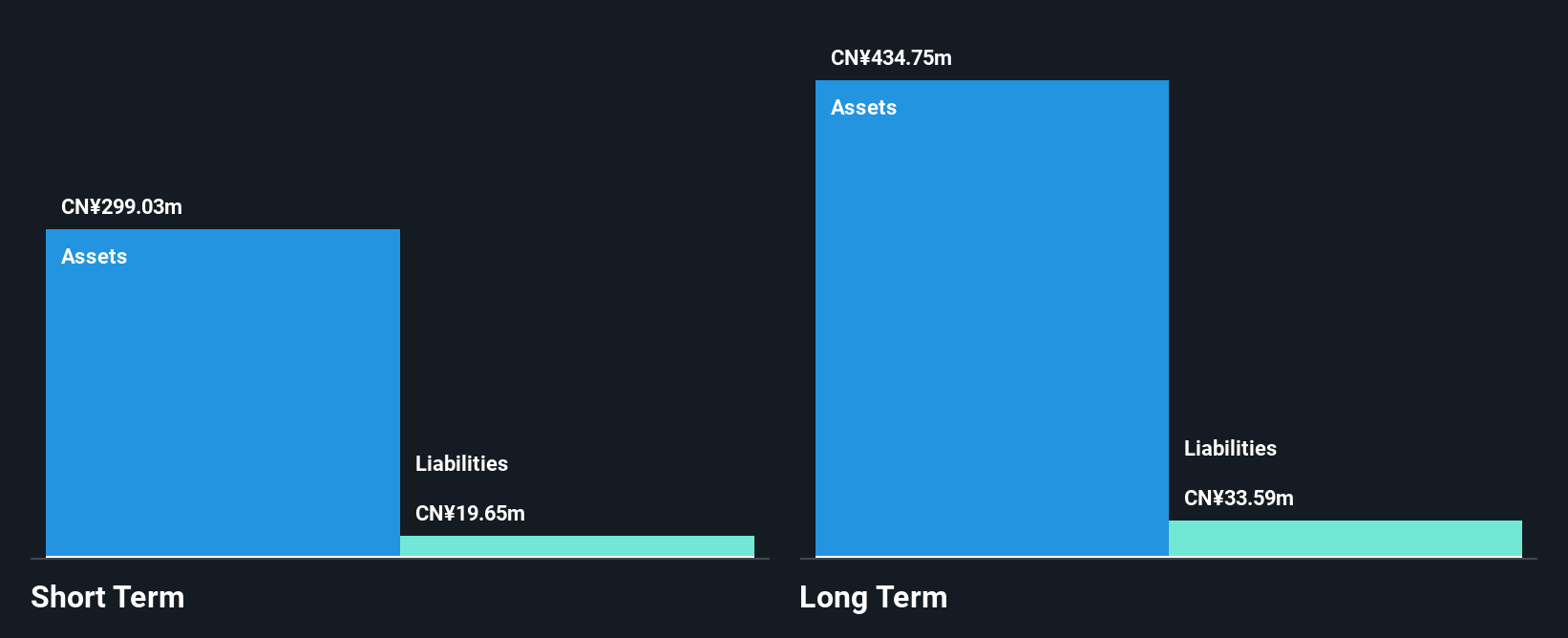

Shanghai Bio-heart Biological Technology, with a market cap of HK$1.14 billion, is a pre-revenue company focusing on cardiovascular medical devices. Despite being unprofitable, it has reduced losses by 20.7% annually over the past five years and maintains a stable cash runway exceeding one year without incurring debt. The company's short-term assets (CN¥299 million) comfortably cover both short-term (CN¥19.6 million) and long-term liabilities (CN¥33.6 million). However, volatility remains high compared to most Hong Kong stocks, and its board lacks extensive experience with an average tenure of 2.7 years per member.

- Get an in-depth perspective on Shanghai Bio-heart Biological Technology's performance by reading our balance sheet health report here.

- Assess Shanghai Bio-heart Biological Technology's previous results with our detailed historical performance reports.

China Yongda Automobiles Services Holdings (SEHK:3669)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Yongda Automobiles Services Holdings Limited operates as a retailer and service provider for luxury and ultra-luxury passenger vehicles in the People's Republic of China, with a market cap of HK$4.19 billion.

Operations: The company generates revenue primarily from Passenger Vehicle Sales and Services, amounting to CN¥63.01 billion, and Automobile Operating Lease Services, contributing CN¥465.96 million.

Market Cap: HK$4.19B

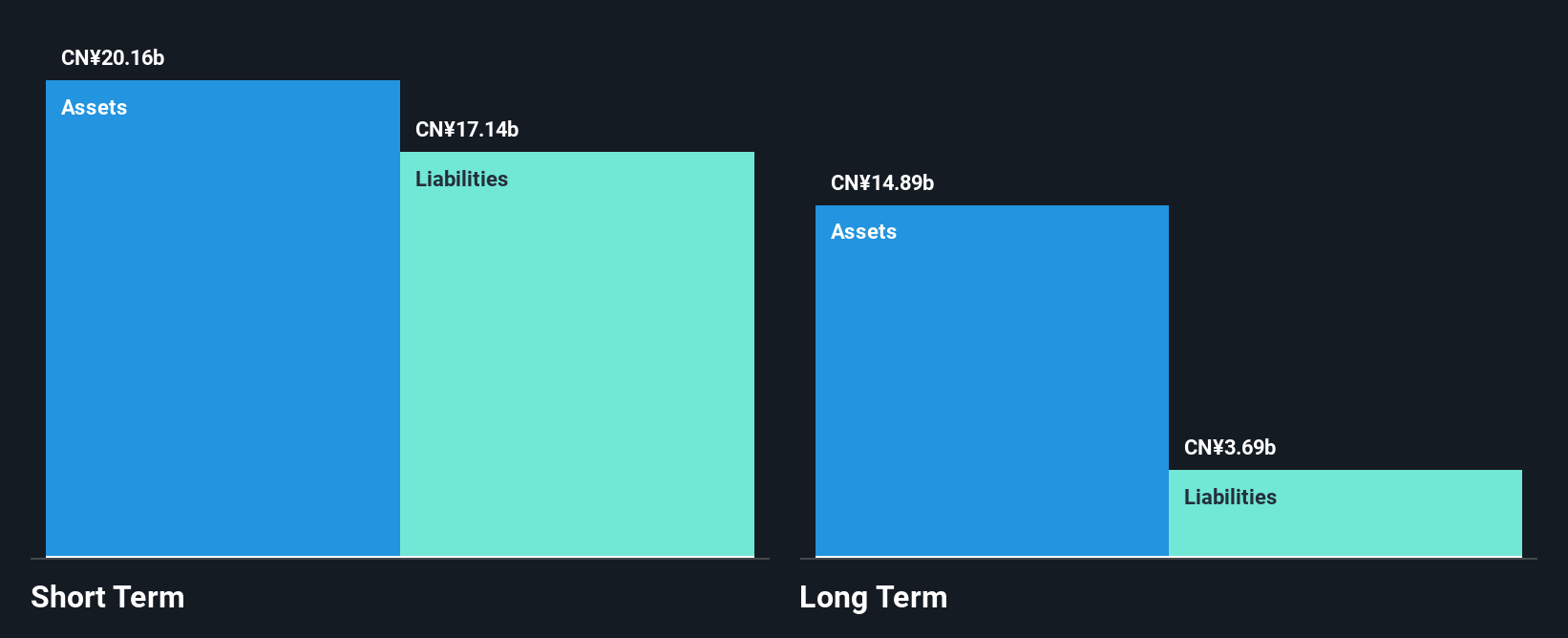

China Yongda Automobiles Services Holdings, with a market cap of HK$4.19 billion, is trading significantly below its estimated fair value. The company has a seasoned management team and board, but faces challenges with low return on equity at 1.2% and declining profit margins from 0.8% to 0.3%. Despite negative earnings growth last year, debt levels have improved over five years from 123.8% to 20.8%, and short-term assets cover liabilities well. Recent share buybacks aim to enhance shareholder value while dividend sustainability remains questionable due to insufficient earnings coverage despite a high yield of 6.19%.

- Click here and access our complete financial health analysis report to understand the dynamics of China Yongda Automobiles Services Holdings.

- Gain insights into China Yongda Automobiles Services Holdings' outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Discover the full array of 982 Asian Penny Stocks right here.

- Contemplating Other Strategies? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2185

Shanghai Bio-heart Biological Technology

Shanghai Bio-heart Biological Technology Co., Ltd.

Excellent balance sheet low.

Market Insights

Community Narratives