- Hong Kong

- /

- Retail Distributors

- /

- SEHK:33

Revenues Tell The Story For International Genius Company (HKG:33) As Its Stock Soars 29%

Those holding International Genius Company (HKG:33) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days were the cherry on top of the stock's 315% gain in the last year, which is nothing short of spectacular.

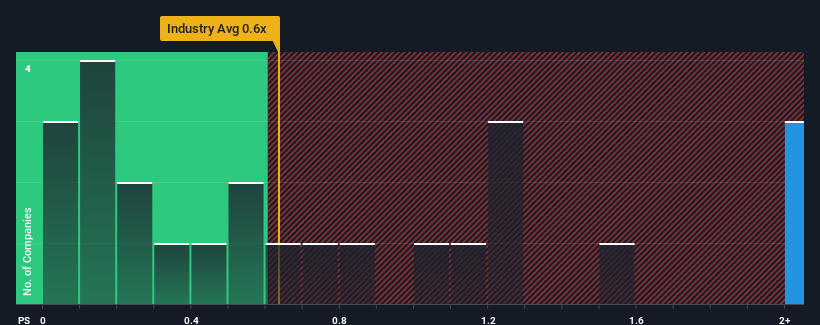

After such a large jump in price, when almost half of the companies in Hong Kong's Retail Distributors industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider International Genius as a stock not worth researching with its 11.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for International Genius

What Does International Genius' Recent Performance Look Like?

Revenue has risen firmly for International Genius recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on International Genius' earnings, revenue and cash flow.How Is International Genius' Revenue Growth Trending?

In order to justify its P/S ratio, International Genius would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. The latest three year period has also seen an excellent 287% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 18%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why International Genius' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Shares in International Genius have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that International Genius can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

You always need to take note of risks, for example - International Genius has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:33

International Genius

An investment holding company, engages in the trading of party products in the Mainland China and Singapore.

Flawless balance sheet and fair value.

Market Insights

Community Narratives