- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1931

Undiscovered Gems In Hong Kong To Watch This September 2024

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, the Hong Kong market has shown resilience, particularly in its small-cap sector. With key indices reflecting mixed sentiments and economic indicators suggesting cautious optimism, now might be an opportune time to identify promising stocks that could offer growth potential despite broader market challenges. In this context, a good stock typically exhibits strong fundamentals, innovative business models, and the ability to navigate economic headwinds effectively. Here are three undiscovered gems in Hong Kong that merit close attention this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| HBM Holdings | 52.89% | 66.59% | 31.70% | ★★★★★☆ |

| TIL Enviro | 47.97% | -23.09% | -8.84% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★★☆

Overview: IVD Medical Holding Limited, with a market cap of HK$1.99 billion, is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally.

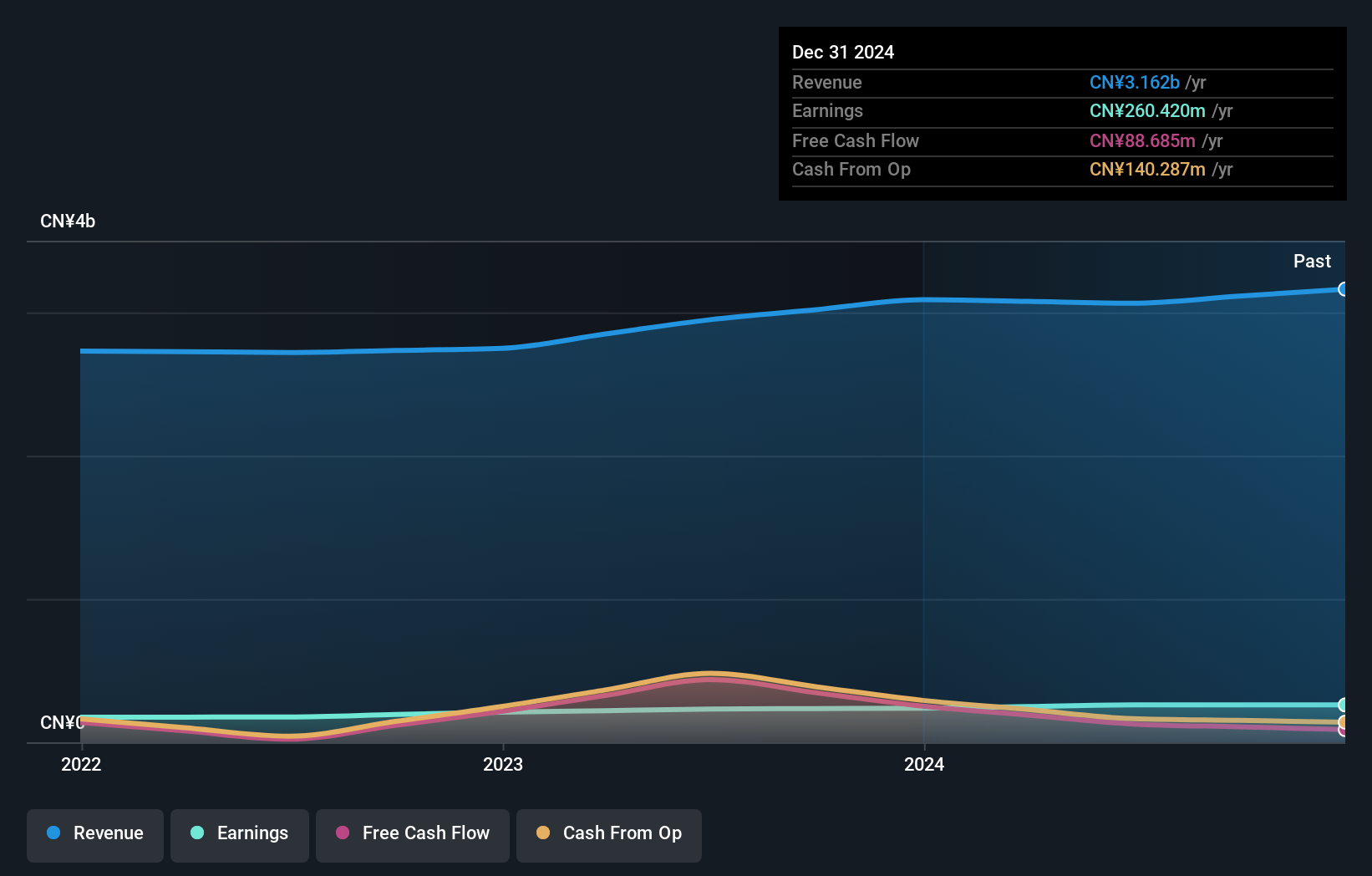

Operations: IVD Medical Holding generates revenue primarily from its Distribution Business (CN¥2.86 billion), followed by After-sales services (CN¥196.47 million) and Self-Branded Products Business (CN¥9.05 million).

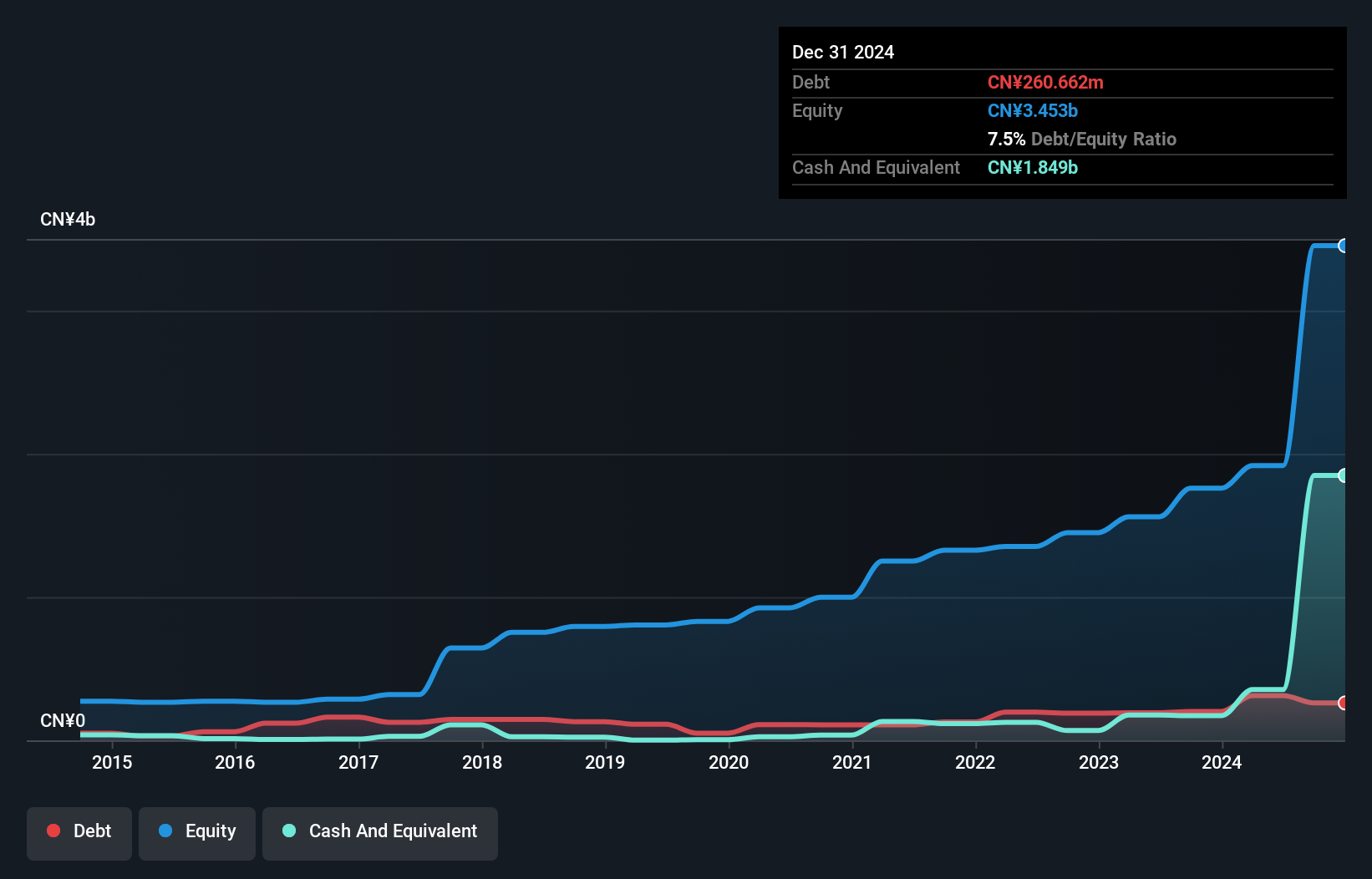

IVD Medical Holding reported half-year sales of CNY 1.35 billion, slightly down from CNY 1.38 billion last year, but net income rose to CNY 125.29 million from CNY 103.01 million. Earnings per share increased to CNY 0.0927 from CNY 0.0762 a year ago, despite the company’s debt-to-equity ratio climbing from 5.4% to 23% over five years and recent shareholder dilution due to a HKD189 million equity offering in June.

YesAsia Holdings (SEHK:2209)

Simply Wall St Value Rating: ★★★★★★

Overview: YesAsia Holdings Limited, with a market cap of HK$2.63 billion, is an investment holding company that focuses on the procurement, sale, and trading of Asian fashion and lifestyle, beauty, cosmetics, accessories, and entertainment products.

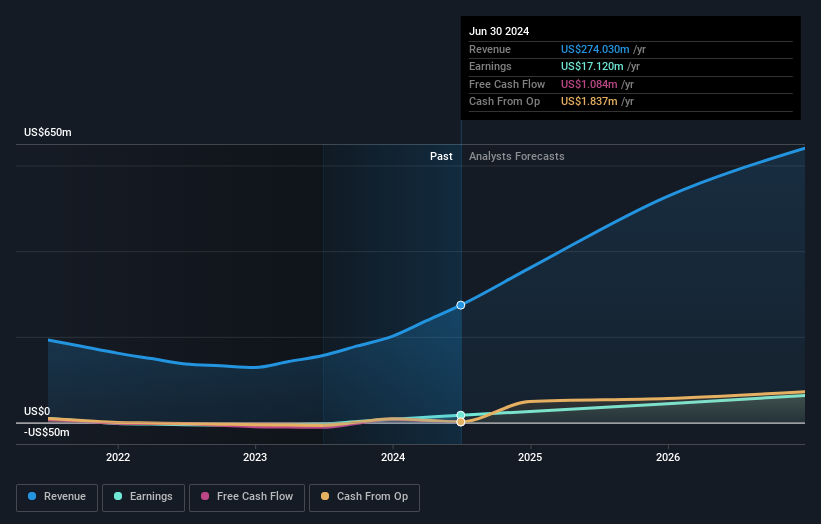

Operations: YesAsia Holdings Limited generates revenue primarily from the sale of fashion, lifestyle, and beauty products (HK$270.65 million) and entertainment products (HK$2.56 million). The company's market cap stands at HK$2.63 billion.

YesAsia Holdings has shown remarkable growth, with half-year sales reaching US$163.35 million, up from US$90.66 million last year. Net income surged to US$11.11 million compared to US$1.56 million previously, driven by increased beauty product sales on YesStyle Platforms and AsianBeautyWholesale expansion. The company repurchased shares in 2024 and declared a final dividend of HKD 5 cents per share for FY2023, reflecting strong financial health and commitment to shareholder returns.

- Click here to discover the nuances of YesAsia Holdings with our detailed analytical health report.

Explore historical data to track YesAsia Holdings' performance over time in our Past section.

Wanguo International Mining Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wanguo International Mining Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in the People’s Republic of China and Solomon Islands, with a market cap of HK$7.33 billion.

Operations: The company generates revenue primarily from its Yifeng Project (CN¥749.25 million) and Solomon Project (CN¥912.63 million).

Wanguo Gold Group, formerly Wanguo International Mining, reported a stellar year with earnings growth of 89.9%, far outpacing the industry average of 23.1%. The company also announced an interim dividend of HK$0.12 per share for the first half of 2024. Sales surged to CNY927.86 million from CNY581.19 million last year, and net income rose to CNY254.27 million from CNY147.11 million previously, highlighting strong operational performance and profitability improvements.

Turning Ideas Into Actions

- Gain an insight into the universe of 172 SEHK Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1931

IVD Medical Holding

An investment holding company, distributes In vitro diagnostic (IVD) products in Mainland China and internationally.

Solid track record with excellent balance sheet.