- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1280

China Qidian Guofeng Holdings Limited's (HKG:1280) 28% Price Boost Is Out Of Tune With Revenues

China Qidian Guofeng Holdings Limited (HKG:1280) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. The last 30 days bring the annual gain to a very sharp 41%.

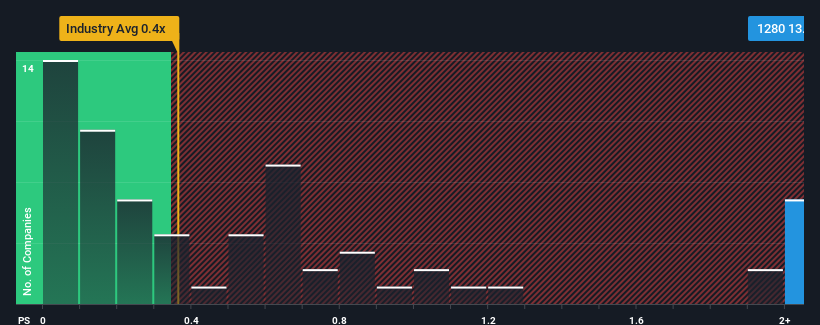

Following the firm bounce in price, you could be forgiven for thinking China Qidian Guofeng Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 13.1x, considering almost half the companies in Hong Kong's Specialty Retail industry have P/S ratios below 0.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for China Qidian Guofeng Holdings

How China Qidian Guofeng Holdings Has Been Performing

China Qidian Guofeng Holdings has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Qidian Guofeng Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, China Qidian Guofeng Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. Still, revenue has fallen 11% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

In contrast to the company, the rest of the industry is expected to grow by 32% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that China Qidian Guofeng Holdings' P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Shares in China Qidian Guofeng Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of China Qidian Guofeng Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

You always need to take note of risks, for example - China Qidian Guofeng Holdings has 2 warning signs we think you should be aware of.

If you're unsure about the strength of China Qidian Guofeng Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1280

China Qidian Guofeng Holdings

An investment holding company, engages in the retail of household appliances, mobile phones, computers, and imported and general merchandise in the People’s Republic of China.

Low risk with worrying balance sheet.

Market Insights

Community Narratives