- Hong Kong

- /

- Real Estate

- /

- SEHK:884

Here's Why I Think CIFI Holdings (Group) (HKG:884) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like CIFI Holdings (Group) (HKG:884), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for CIFI Holdings (Group)

CIFI Holdings (Group)'s Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years CIFI Holdings (Group) grew its EPS by 7.1% per year. While that sort of growth rate isn't amazing, it does show the business is growing.

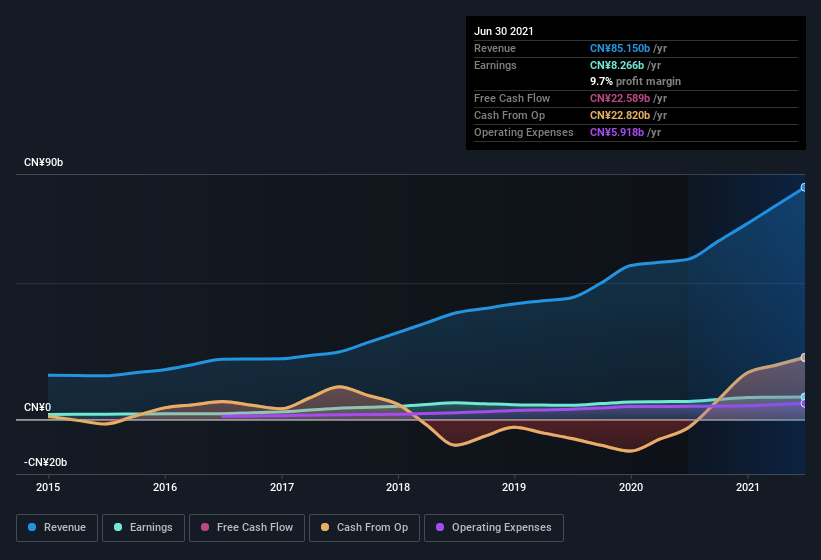

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While CIFI Holdings (Group) did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of CIFI Holdings (Group)'s forecast profits?

Are CIFI Holdings (Group) Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that CIFI Holdings (Group) insiders spent a whopping CN¥55m on stock in just one year, and I didn't see any selling. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. It is also worth noting that it was Executive Vice Chairman of the Board Wei Lin who made the biggest single purchase, worth HK$10m, paying HK$5.20 per share.

On top of the insider buying, it's good to see that CIFI Holdings (Group) insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth CN¥4.3b. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Does CIFI Holdings (Group) Deserve A Spot On Your Watchlist?

One positive for CIFI Holdings (Group) is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Before you take the next step you should know about the 3 warning signs for CIFI Holdings (Group) (1 makes us a bit uncomfortable!) that we have uncovered.

As a growth investor I do like to see insider buying. But CIFI Holdings (Group) isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:884

CIFI Holdings (Group)

Engages in the property development and investment business in the People’s Republic of China.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives