- Hong Kong

- /

- Retail REITs

- /

- SEHK:823

Will Link REIT’s Interim Leadership Reshape Its Strategic Direction and Stability Narrative (SEHK:823)?

Reviewed by Sasha Jovanovic

- Link Asset Management Limited recently announced the past retirement of long-serving Group CEO Mr. George Kwok Lung HONGCHOY, effective by December 31, 2025, and the establishment of an interim leadership structure involving Group CIO John Russell Saunders and Group CFO NG Kok Siong.

- This executive transition marks a major governance development for Link Real Estate Investment Trust, highlighting management succession and continuity as they introduce new board and committee compositions for 2026.

- We'll examine how the transition to interim leadership shapes Link REIT's investment narrative, especially regarding management stability and future strategy.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Link Real Estate Investment Trust Investment Narrative Recap

To be a shareholder in Link Real Estate Investment Trust, you need to believe in its ability to deliver resilient earnings by diversifying across APAC markets and strengthening its investment management capabilities. The recent CEO retirement and shift to interim leadership are unlikely to meaningfully alter the most immediate catalyst, portfolio expansion across Asia-Pacific, but they could add boardroom risk, given the already high turnover and short average board tenure.

One of the more relevant recent announcements is the upcoming change in auditor from PricewaterhouseCoopers to KPMG, set for later this year. This move comes during a time of heightened governance change and may have implications for investor confidence, especially as new leadership prepares to steer Link REIT through a period of rapid portfolio and operational adjustments.

In contrast, investors should be aware that underlying board inexperience and leadership transition could become more significant if...

Read the full narrative on Link Real Estate Investment Trust (it's free!)

Link Real Estate Investment Trust is projected to reach HK$15.5 billion in revenue and HK$11.2 billion in earnings by 2028. This outlook assumes annual revenue growth of 5.2% and represents an earnings increase of HK$13.5 billion from current earnings of HK$-2.3 billion.

Uncover how Link Real Estate Investment Trust's forecasts yield a HK$43.72 fair value, a 8% upside to its current price.

Exploring Other Perspectives

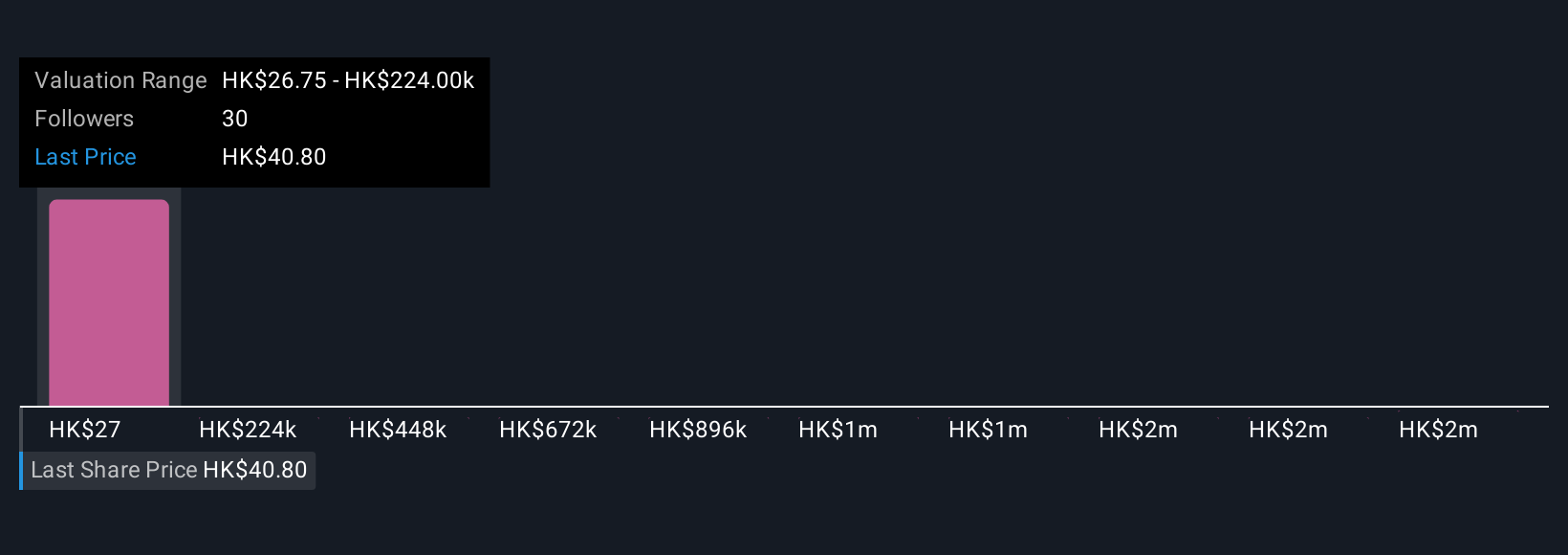

Simply Wall St Community members have shared nine unique fair value estimates for Link REIT, ranging from HK$26.75 to an outlier above HK$2,239,714. Within this broad spectrum, the ongoing management transition means many see governance stability as key to Link's future performance. Diverse viewpoints await your review and comparison.

Explore 9 other fair value estimates on Link Real Estate Investment Trust - why the stock might be worth 34% less than the current price!

Build Your Own Link Real Estate Investment Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Link Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Link Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Link Real Estate Investment Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:823

Link Real Estate Investment Trust

Link Real Estate Investment Trust (Link REIT) is the largest REIT in Asia by many measures including asset value.

Established dividend payer with moderate growth potential.

Market Insights

Community Narratives