- Hong Kong

- /

- Real Estate

- /

- SEHK:817

China Jinmao Holdings Group Limited's (HKG:817) CEO Compensation Is Looking A Bit Stretched At The Moment

In the past three years, the share price of China Jinmao Holdings Group Limited (HKG:817) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also poor, despite revenues growing. Shareholders will have a chance to take their concerns to the board at the next AGM on 08 June 2021 and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

Check out our latest analysis for China Jinmao Holdings Group

How Does Total Compensation For Congrui Li Compare With Other Companies In The Industry?

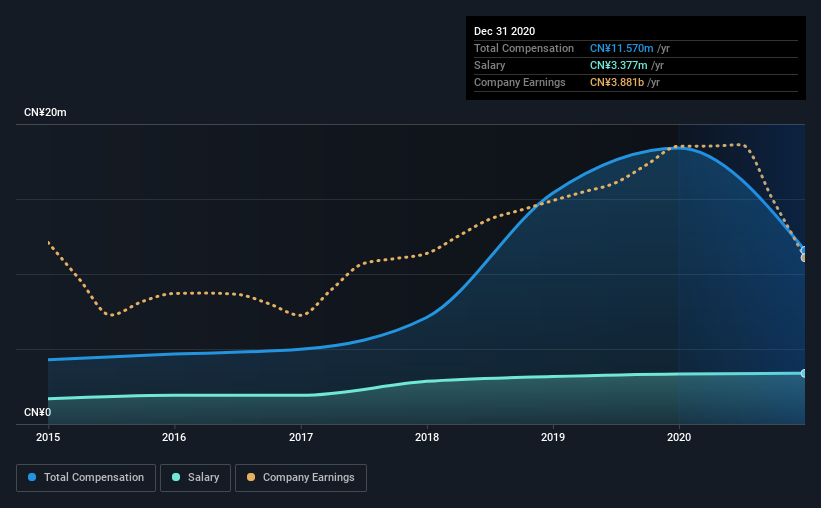

Our data indicates that China Jinmao Holdings Group Limited has a market capitalization of HK$39b, and total annual CEO compensation was reported as CN¥12m for the year to December 2020. We note that's a decrease of 37% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CN¥3.4m.

On comparing similar companies from the same industry with market caps ranging from HK$31b to HK$93b, we found that the median CEO total compensation was CN¥5.1m. Accordingly, our analysis reveals that China Jinmao Holdings Group Limited pays Congrui Li north of the industry median. Moreover, Congrui Li also holds HK$9.2m worth of China Jinmao Holdings Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥3.4m | CN¥3.3m | 29% |

| Other | CN¥8.2m | CN¥15m | 71% |

| Total Compensation | CN¥12m | CN¥18m | 100% |

Talking in terms of the industry, salary represented approximately 70% of total compensation out of all the companies we analyzed, while other remuneration made up 30% of the pie. It's interesting to note that China Jinmao Holdings Group allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at China Jinmao Holdings Group Limited's Growth Numbers

China Jinmao Holdings Group Limited has reduced its earnings per share by 5.1% a year over the last three years. It achieved revenue growth of 39% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has China Jinmao Holdings Group Limited Been A Good Investment?

Given the total shareholder loss of 21% over three years, many shareholders in China Jinmao Holdings Group Limited are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 4 warning signs for China Jinmao Holdings Group that investors should look into moving forward.

Important note: China Jinmao Holdings Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:817

Undervalued with moderate growth potential.

Market Insights

Community Narratives