- Hong Kong

- /

- Real Estate

- /

- SEHK:81

Do China Overseas Grand Oceans Group's (HKG:81) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in China Overseas Grand Oceans Group (HKG:81). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide China Overseas Grand Oceans Group with the means to add long-term value to shareholders.

See our latest analysis for China Overseas Grand Oceans Group

How Fast Is China Overseas Grand Oceans Group Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that China Overseas Grand Oceans Group's EPS has grown 33% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

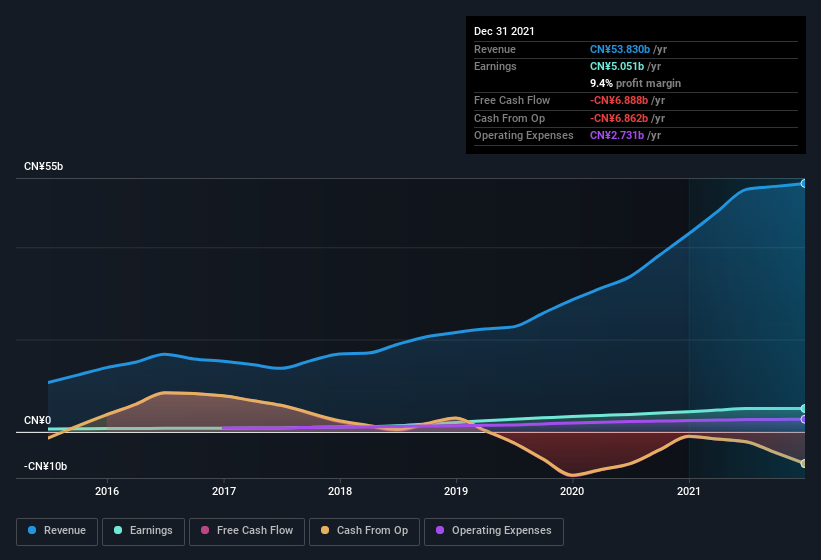

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While China Overseas Grand Oceans Group did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of China Overseas Grand Oceans Group's forecast profits?

Are China Overseas Grand Oceans Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First and foremost; there we saw no insiders sell China Overseas Grand Oceans Group shares in the last year. Even better, though, is that the Executive Chairman of the Board, Yong Zhuang, bought a whopping CN¥1.9m worth of shares, paying about CN¥3.83 per share, on average. Big buys like that may signal an opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that China Overseas Grand Oceans Group insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at CN¥1.6b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is China Overseas Grand Oceans Group Worth Keeping An Eye On?

You can't deny that China Overseas Grand Oceans Group has grown its earnings per share at a very impressive rate. That's attractive. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. Astute investors will want to keep this stock on watch. We should say that we've discovered 4 warning signs for China Overseas Grand Oceans Group (2 are concerning!) that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, China Overseas Grand Oceans Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:81

China Overseas Grand Oceans Group

An investment holding company, invests in, develops, and leases real estate properties in the People’s Republic of China and Hong Kong.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives