- Hong Kong

- /

- Real Estate

- /

- SEHK:754

Here's Why We Think Hopson Development Holdings (HKG:754) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Hopson Development Holdings (HKG:754), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Hopson Development Holdings

Hopson Development Holdings's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Hopson Development Holdings has managed to grow EPS by 28% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

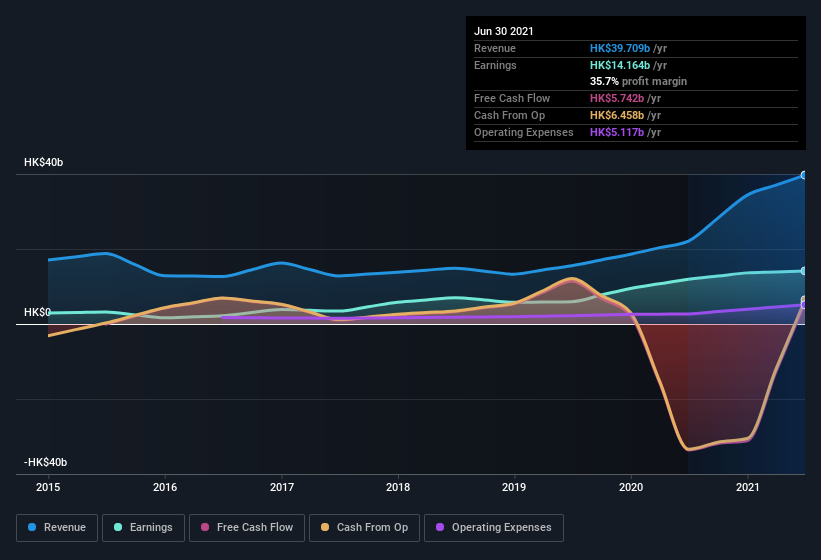

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Hopson Development Holdings shareholders can take confidence from the fact that EBIT margins are up from 46% to 50%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Hopson Development Holdings's balance sheet strength, before getting too excited.

Are Hopson Development Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One shining light for Hopson Development Holdings is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction Chairman of the Board Kut Yung Chu paid HK$8.5m, for stock at HK$16.95 per share. It doesn't get much better than that, in terms of large investments from insiders.

On top of the insider buying, we can also see that Hopson Development Holdings insiders own a large chunk of the company. In fact, they own 74% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. At the current share price, that insider holding is worth a whopping HK$28b. Now that's what I call some serious skin in the game!

Does Hopson Development Holdings Deserve A Spot On Your Watchlist?

You can't deny that Hopson Development Holdings has grown its earnings per share at a very impressive rate. That's attractive. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 4 warning signs for Hopson Development Holdings (1 can't be ignored!) that you need to take into consideration.

As a growth investor I do like to see insider buying. But Hopson Development Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hopson Development Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:754

Hopson Development Holdings

An investment holding company, primarily develops residential and commercial properties in China.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives