- Hong Kong

- /

- Real Estate

- /

- SEHK:688

Does China Overseas Land & Investment (HKG:688) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like China Overseas Land & Investment (HKG:688), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for China Overseas Land & Investment

How Fast Is China Overseas Land & Investment Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years China Overseas Land & Investment grew its EPS by 7.3% per year. While that sort of growth rate isn't amazing, it does show the business is growing.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the one hand, China Overseas Land & Investment's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

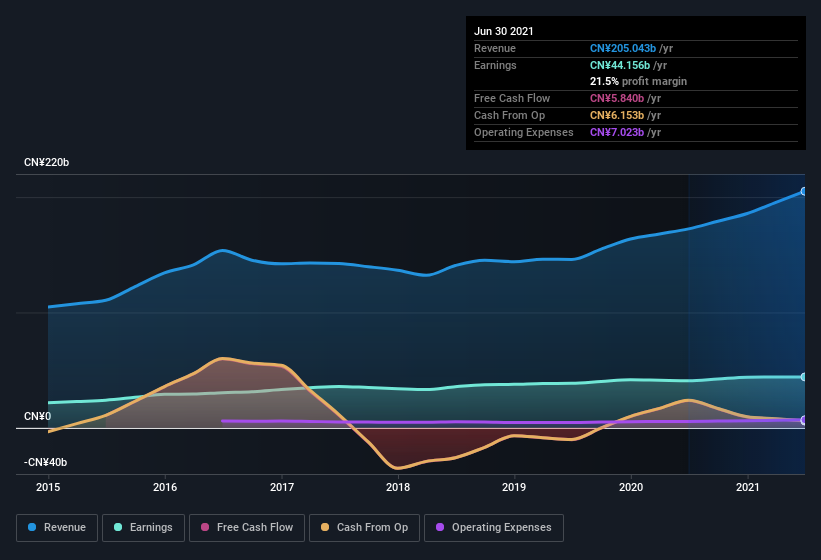

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of China Overseas Land & Investment's forecast profits?

Are China Overseas Land & Investment Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it China Overseas Land & Investment shareholders can gain quiet confidence from the fact that insiders shelled out CN¥4.3m to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Independent Non Executive Director, Man-Bun Li, who made the biggest single acquisition, paying HK$1.7m for shares at about HK$17.44 each.

Along with the insider buying, another encouraging sign for China Overseas Land & Investment is that insiders, as a group, have a considerable shareholding. Indeed, they hold CN¥107m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.05% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add China Overseas Land & Investment To Your Watchlist?

One important encouraging feature of China Overseas Land & Investment is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for China Overseas Land & Investment that you should be aware of.

As a growth investor I do like to see insider buying. But China Overseas Land & Investment isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:688

China Overseas Land & Investment

An investment holding company, engages in the property development and investment, and other operations in the People’s Republic of China and the United Kingdom.

Undervalued with excellent balance sheet.