Kerry Properties Limited's (HKG:683) investors are due to receive a payment of HK$0.95 per share on 7th of June. Based on this payment, the dividend yield on the company's stock will be 18%, which is an attractive boost to shareholder returns.

Check out our latest analysis for Kerry Properties

Kerry Properties Is Paying Out More Than It Is Earning

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Kerry Properties was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to fall by 53.3% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 116%, which could put the dividend under pressure if earnings don't start to improve.

Kerry Properties Has A Solid Track Record

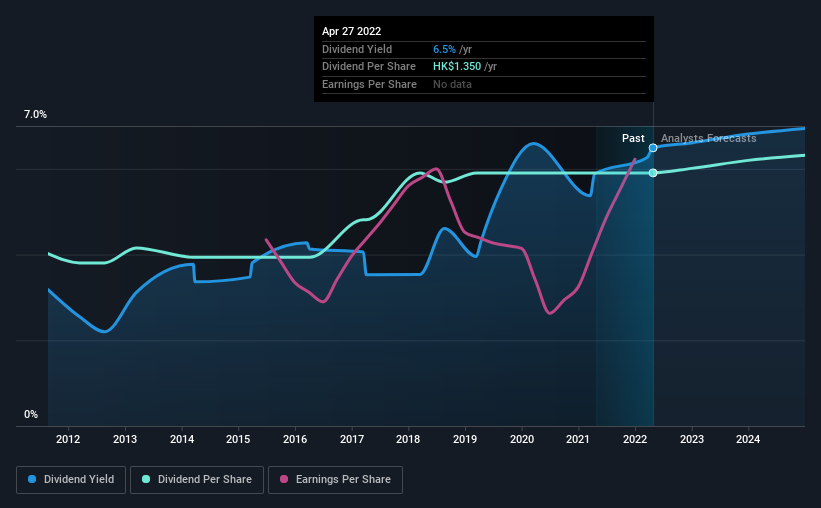

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2012, the first annual payment was HK$0.92, compared to the most recent full-year payment of HK$1.35. This implies that the company grew its distributions at a yearly rate of about 3.9% over that duration. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

Kerry Properties Could Grow Its Dividend

Investors could be attracted to the stock based on the quality of its payment history. Kerry Properties has seen EPS rising for the last five years, at 9.5% per annum. With a decent amount of growth and a low payout ratio, we think this bodes well for Kerry Properties' prospects of growing its dividend payments in the future.

Kerry Properties Looks Like A Great Dividend Stock

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. The earnings easily cover the company's distributions, and the company is generating plenty of cash. If earnings do fall over the next 12 months, the dividend could be buffeted a little bit, but we don't think it should cause too much of a problem in the long term. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 2 warning signs for Kerry Properties (1 is a bit unpleasant!) that you should be aware of before investing. Is Kerry Properties not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kerry Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:683

Kerry Properties

An investment holding company, engages in the development, investment, management, and trading of properties in Hong Kong, Mainland China, and the Asia Pacific region.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)