- Hong Kong

- /

- Real Estate

- /

- SEHK:3883

China Aoyuan Group's (HKG:3883) Dividend Will Be Increased To HK$0.92

China Aoyuan Group Limited (HKG:3883) will increase its dividend on the 16th of July to HK$0.92. This makes the dividend yield 10%, which is above the industry average.

See our latest analysis for China Aoyuan Group

China Aoyuan Group's Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, China Aoyuan Group was earning enough to cover the dividend, but free cash flows weren't positive. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

Over the next year, EPS is forecast to expand by 9.8%. If the dividend continues on this path, the payout ratio could be 52% by next year, which we think can be pretty sustainable going forward.

China Aoyuan Group Has A Solid Track Record

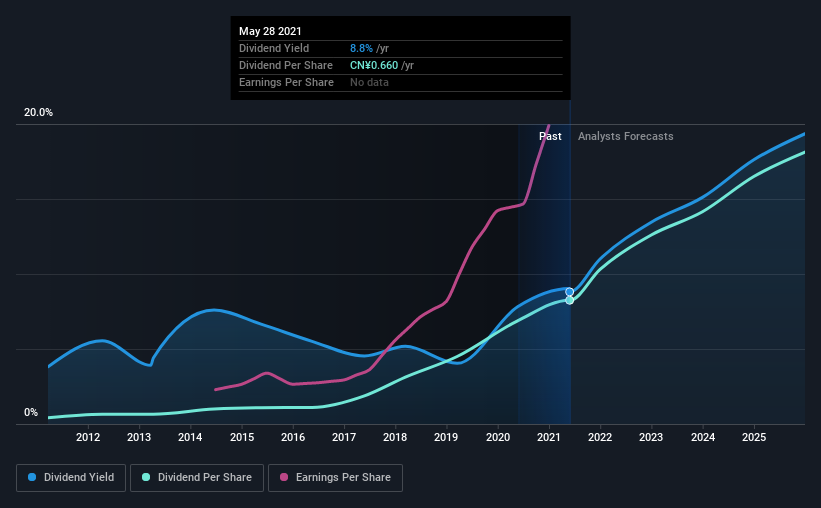

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The first annual payment during the last 10 years was CN¥0.033 in 2011, and the most recent fiscal year payment was CN¥0.66. This implies that the company grew its distributions at a yearly rate of about 35% over that duration. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. We are encouraged to see that China Aoyuan Group has grown earnings per share at 50% per year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While China Aoyuan Group is earning enough to cover the dividend, we are generally unimpressed with its future prospects. We don't think China Aoyuan Group is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 2 warning signs for China Aoyuan Group that investors need to be conscious of moving forward. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3883

China Aoyuan Group

Engages in the development and sale of properties in Mainland China and Canada.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives