This article will reflect on the compensation paid to Zuric Chan who has served as CEO of Chinney Investments, Limited (HKG:216) since 2018. This analysis will also assess whether Chinney Investments pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Chinney Investments

Comparing Chinney Investments, Limited's CEO Compensation With the industry

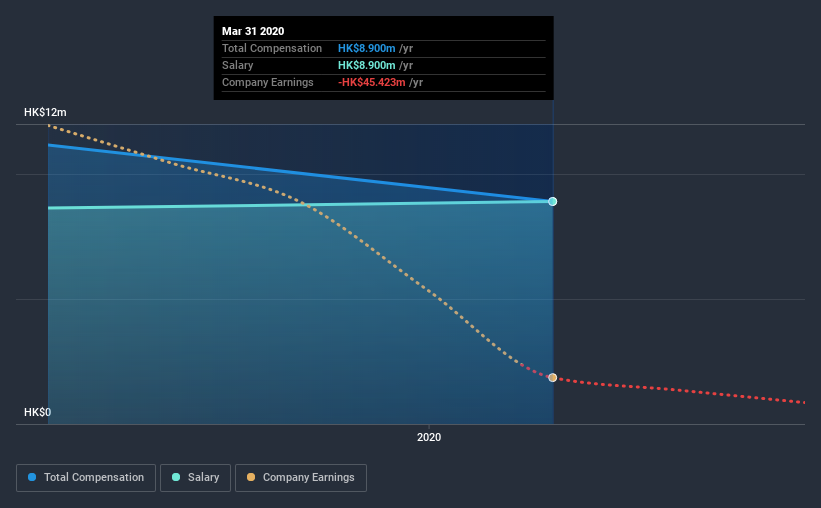

At the time of writing, our data shows that Chinney Investments, Limited has a market capitalization of HK$937m, and reported total annual CEO compensation of HK$8.9m for the year to March 2020. Notably, that's a decrease of 20% over the year before. It is worth noting that the CEO compensation consists entirely of the salary, worth HK$8.9m.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.8m. Accordingly, our analysis reveals that Chinney Investments, Limited pays Zuric Chan north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$8.9m | HK$8.6m | 100% |

| Other | - | HK$2.5m | - |

| Total Compensation | HK$8.9m | HK$11m | 100% |

On an industry level, roughly 70% of total compensation represents salary and 30% is other remuneration. On a company level, Chinney Investments prefers to reward its CEO through a salary, opting not to pay Zuric Chan through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Chinney Investments, Limited's Growth Numbers

Over the last three years, Chinney Investments, Limited has shrunk its earnings per share by 88% per year. In the last year, its revenue is up 52%.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Chinney Investments, Limited Been A Good Investment?

Given the total shareholder loss of 50% over three years, many shareholders in Chinney Investments, Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

Chinney Investments rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we touched on above, Chinney Investments, Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. It concerns us that EPS growth for the company is negative, while share price gains did not materialize over the last three years. In contrast, revenue growth for the company has been showing a positive trend. Most would consider it prudent for the company to hold off any CEO pay rise until performance improves.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for Chinney Investments you should be aware of, and 2 of them are a bit concerning.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Chinney Investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:216

Chinney Investments

An investment holding company, primarily engages in the property development and investment activities in Hong Kong, Japan, and Mainland China.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives