- Hong Kong

- /

- Real Estate

- /

- SEHK:191

The Lai Sun Garment (International) (HKG:191) Share Price Is Up 59% And Shareholders Are Holding On

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, long term Lai Sun Garment (International) Limited (HKG:191) shareholders have enjoyed a 59% share price rise over the last half decade, well in excess of the market return of around 45% (not including dividends).

View our latest analysis for Lai Sun Garment (International)

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Lai Sun Garment (International)'s earnings per share are down 5.8% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

In contrast revenue growth of 24% per year is probably viewed as evidence that Lai Sun Garment (International) is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

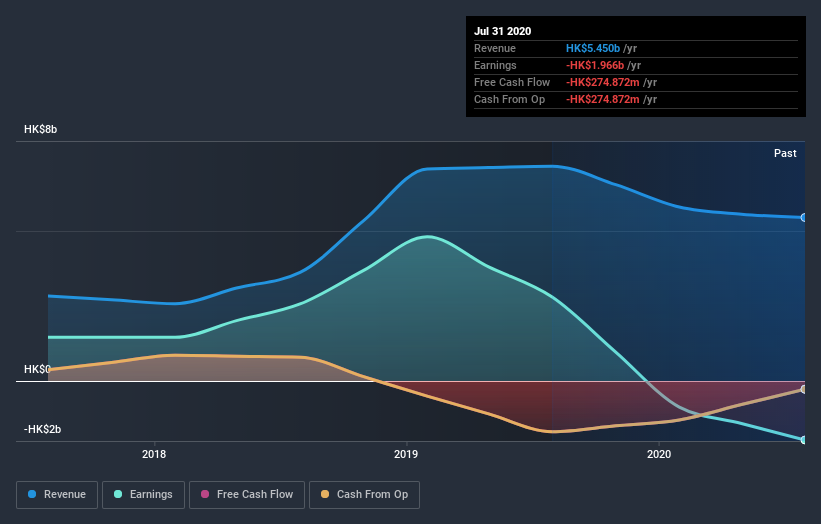

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Lai Sun Garment (International)'s financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Lai Sun Garment (International)'s total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Lai Sun Garment (International)'s TSR of 63% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

Investors in Lai Sun Garment (International) had a tough year, with a total loss of 34%, against a market gain of about 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Lai Sun Garment (International) has 2 warning signs we think you should be aware of.

Of course Lai Sun Garment (International) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Lai Sun Garment (International), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Lai Sun Garment (International), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:191

Lai Sun Garment (International)

An investment holding company, invests in and develops properties in Hong Kong, Mainland China, Macau, the United Kingdom, Vietnam, and internationally.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives