- Hong Kong

- /

- Real Estate

- /

- SEHK:1663

Here's Why We Think Sino Harbour Holdings Group (HKG:1663) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Sino Harbour Holdings Group (HKG:1663), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Sino Harbour Holdings Group

Sino Harbour Holdings Group's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that Sino Harbour Holdings Group's EPS went from CN¥0.023 to CN¥0.11 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

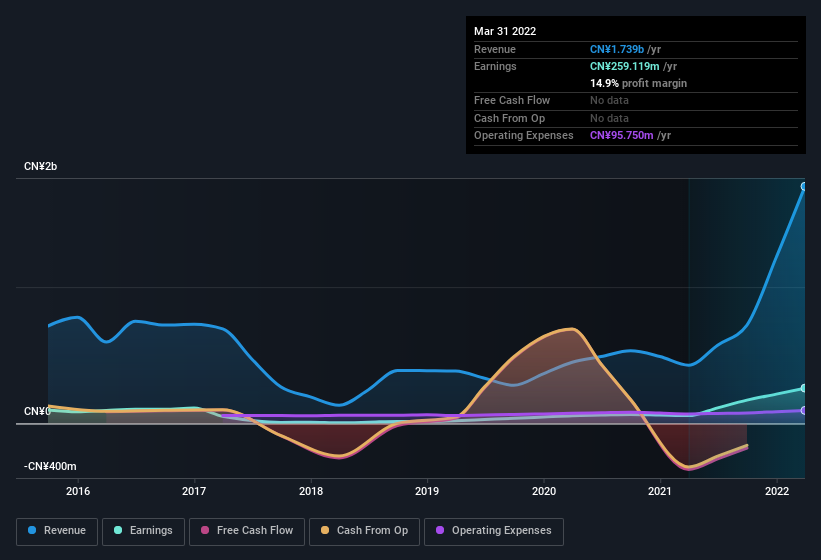

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Sino Harbour Holdings Group maintained stable EBIT margins over the last year, all while growing revenue 307% to CN¥1.7b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since Sino Harbour Holdings Group is no giant, with a market capitalisation of HK$458m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Sino Harbour Holdings Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While we did see insider selling of Sino Harbour Holdings Group stock in the last year, one single insider spent plenty more buying. Specifically the CEO, GM & Executive Chairman, Lam Ping Wong, spent CN¥2.3m, paying about CN¥0.15 per share. It's hard to ignore news like that.

It's commendable to see that insiders have been buying shares in Sino Harbour Holdings Group, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Sino Harbour Holdings Group with market caps under CN¥1.4b is about CN¥1.6m.

The Sino Harbour Holdings Group CEO received CN¥1.1m in compensation for the year ending March 2021. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Sino Harbour Holdings Group To Your Watchlist?

Sino Harbour Holdings Group's earnings per share growth have been climbing higher at an appreciable rate. The company can also boast of insider buying, and reasonable remuneration for the CEO. It could be that Sino Harbour Holdings Group is at an inflection point, given the EPS growth. For those attracted to fast growth, we'd suggest this stock merits monitoring. We should say that we've discovered 4 warning signs for Sino Harbour Holdings Group (1 is concerning!) that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, Sino Harbour Holdings Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1663

Sino Harbour Holdings Group

An investment holding company, engages in the development of properties in the People’s Republic of China.

Excellent balance sheet slight.

Market Insights

Community Narratives