China Merchants Commercial Real Estate Investment Trust's(HKG:1503) Share Price Is Down 24% Over The Past Year.

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the China Merchants Commercial Real Estate Investment Trust (HKG:1503) share price is down 24% in the last year. That falls noticeably short of the market return of around 22%. China Merchants Commercial Real Estate Investment Trust may have better days ahead, of course; we've only looked at a one year period. It's down 1.6% in the last seven days.

Check out our latest analysis for China Merchants Commercial Real Estate Investment Trust

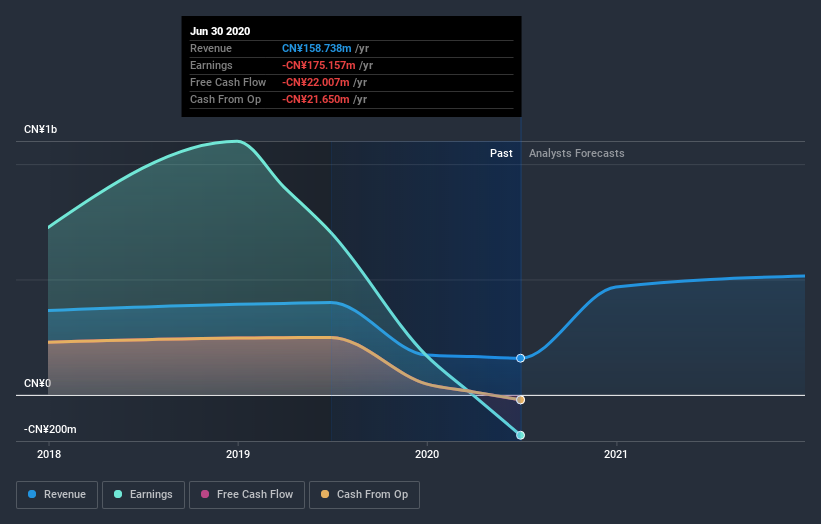

Because China Merchants Commercial Real Estate Investment Trust made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In just one year China Merchants Commercial Real Estate Investment Trust saw its revenue fall by 60%. If you think that's a particularly bad result, you're statistically on the money Meanwhile, the share price dropped by 24%. It's always work digging deeper, but we'd probably need to see a strong balance sheet and bottom line improvements to get interested in this one.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at China Merchants Commercial Real Estate Investment Trust's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for China Merchants Commercial Real Estate Investment Trust the TSR over the last year was -21%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Given that the market gained 22% in the last year, China Merchants Commercial Real Estate Investment Trust shareholders might be miffed that they lost 21% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 2.9%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand China Merchants Commercial Real Estate Investment Trust better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for China Merchants Commercial Real Estate Investment Trust you should be aware of, and 2 of them are a bit concerning.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading China Merchants Commercial Real Estate Investment Trust or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1503

China Merchants Commercial Real Estate Investment Trust

China Merchants Commercial REIT is a Hong Kong collective investment scheme authorised under section 104 of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) and its units are listed on the Main Board of the Stock Exchange of Hong Kong Limited (the “HKSE”).

Good value average dividend payer.

Market Insights

Community Narratives