Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that China Dili Group (HKG:1387) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for China Dili Group

What Is China Dili Group's Net Debt?

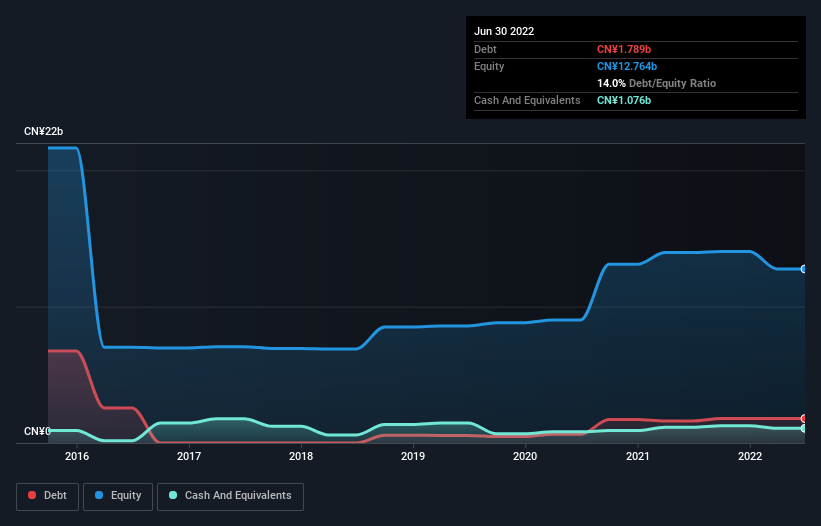

As you can see below, at the end of June 2022, China Dili Group had CN¥1.79b of debt, up from CN¥1.62b a year ago. Click the image for more detail. However, it does have CN¥1.08b in cash offsetting this, leading to net debt of about CN¥712.9m.

How Strong Is China Dili Group's Balance Sheet?

According to the last reported balance sheet, China Dili Group had liabilities of CN¥1.41b due within 12 months, and liabilities of CN¥3.89b due beyond 12 months. Offsetting these obligations, it had cash of CN¥1.08b as well as receivables valued at CN¥1.62b due within 12 months. So its liabilities total CN¥2.60b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because China Dili Group is worth CN¥7.33b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

China Dili Group has net debt worth 1.5 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 5.4 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Shareholders should be aware that China Dili Group's EBIT was down 40% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since China Dili Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, China Dili Group recorded free cash flow of 39% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

We'd go so far as to say China Dili Group's EBIT growth rate was disappointing. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making China Dili Group stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. While China Dili Group didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away. Click here to see if its earnings are heading in the right direction, over the medium term.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1387

China Dili Group

An investment holding company, engages in the operating, leasing, and managing agriculture wholesale markets in the People’s Republic of China.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives