- Hong Kong

- /

- Real Estate

- /

- SEHK:9983

After Leaping 29% Central China New Life Limited (HKG:9983) Shares Are Not Flying Under The Radar

Central China New Life Limited (HKG:9983) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 43% over that time.

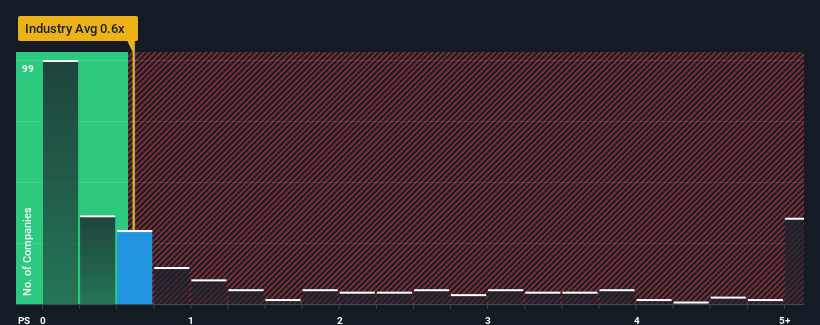

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Central China New Life's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Hong Kong is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Central China New Life

How Central China New Life Has Been Performing

While the industry has experienced revenue growth lately, Central China New Life's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Central China New Life will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Central China New Life?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Central China New Life's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 9.6% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.2% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 5.7% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 5.7% per annum, which is not materially different.

With this in mind, it makes sense that Central China New Life's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Central China New Life's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Central China New Life maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Central China New Life you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9983

Central China New Life

An investment holding company, provides property management and value-added services in the People’s Republic of China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives