David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies China Asia Valley Group Limited (HKG:63) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for China Asia Valley Group

What Is China Asia Valley Group's Debt?

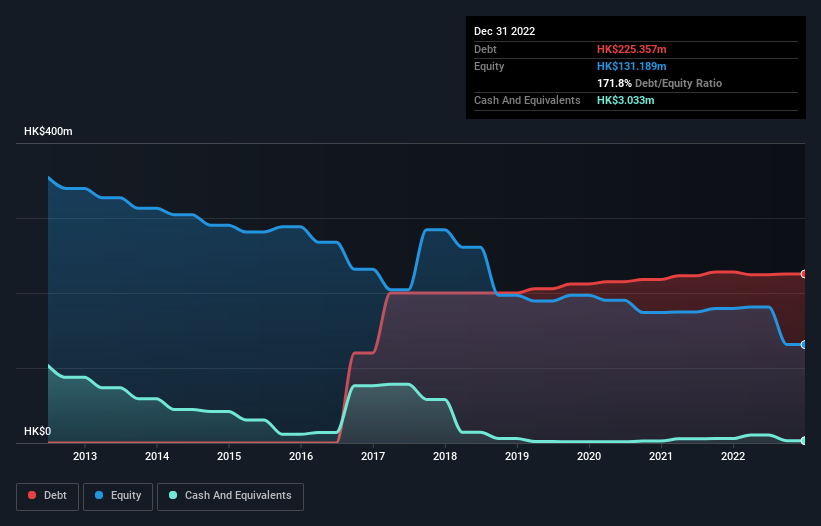

As you can see below, China Asia Valley Group had HK$225.4m of debt, at December 2022, which is about the same as the year before. You can click the chart for greater detail. Net debt is about the same, since the it doesn't have much cash.

A Look At China Asia Valley Group's Liabilities

Zooming in on the latest balance sheet data, we can see that China Asia Valley Group had liabilities of HK$240.9m due within 12 months and no liabilities due beyond that. Offsetting this, it had HK$3.03m in cash and HK$5.16m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$232.7m.

This is a mountain of leverage relative to its market capitalization of HK$372.1m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

China Asia Valley Group shareholders face the double whammy of a high net debt to EBITDA ratio (49.6), and fairly weak interest coverage, since EBIT is just 0.87 times the interest expense. The debt burden here is substantial. The good news is that China Asia Valley Group grew its EBIT a smooth 35% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. There's no doubt that we learn most about debt from the balance sheet. But it is China Asia Valley Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last two years, China Asia Valley Group actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

China Asia Valley Group's interest cover was a real negative on this analysis, as was its net debt to EBITDA. But its conversion of EBIT to free cash flow was significantly redeeming. When we consider all the factors mentioned above, we do feel a bit cautious about China Asia Valley Group's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for China Asia Valley Group (of which 2 are a bit unpleasant!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:63

China Asia Valley Group

An investment holding company, engages in property management business in Hong Kong and the People’s Republic of China.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives