- Hong Kong

- /

- Real Estate

- /

- SEHK:6093

Why We Think Hevol Services Group Co. Limited's (HKG:6093) CEO Compensation Is Not Excessive At All

Key Insights

- Hevol Services Group to hold its Annual General Meeting on 31st of May

- CEO Wenhao Wang's total compensation includes salary of CN¥928.0k

- The total compensation is 36% less than the average for the industry

- Hevol Services Group's three-year loss to shareholders was 58% while its EPS grew by 2.9% over the past three years

Performance at Hevol Services Group Co. Limited (HKG:6093) has been rather uninspiring recently and shareholders may be wondering how CEO Wenhao Wang plans to fix this. At the next AGM coming up on 31st of May, they can influence managerial decision making through voting on resolutions, including executive remuneration. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

See our latest analysis for Hevol Services Group

Comparing Hevol Services Group Co. Limited's CEO Compensation With The Industry

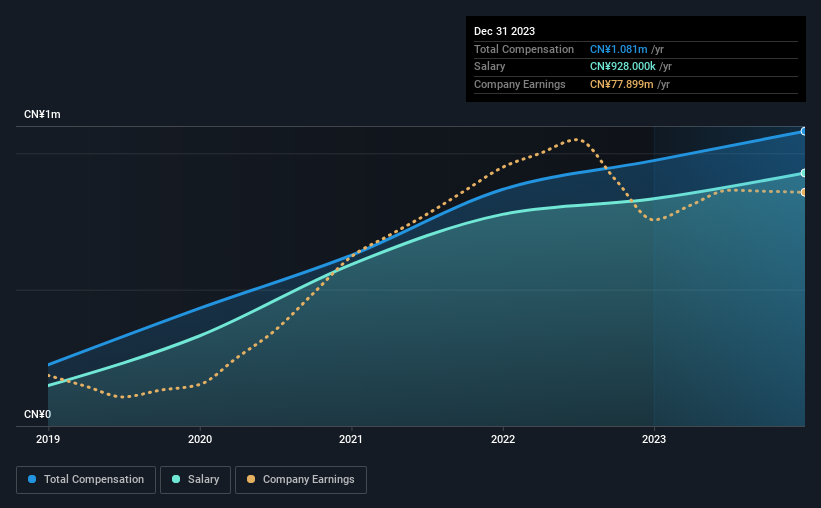

According to our data, Hevol Services Group Co. Limited has a market capitalization of HK$840m, and paid its CEO total annual compensation worth CN¥1.1m over the year to December 2023. We note that's an increase of 11% above last year. Notably, the salary which is CN¥928.0k, represents most of the total compensation being paid.

In comparison with other companies in the Hong Kong Real Estate industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥1.7m. Accordingly, Hevol Services Group pays its CEO under the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥928k | CN¥833k | 86% |

| Other | CN¥153k | CN¥140k | 14% |

| Total Compensation | CN¥1.1m | CN¥973k | 100% |

On an industry level, around 77% of total compensation represents salary and 23% is other remuneration. Hevol Services Group pays out 86% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Hevol Services Group Co. Limited's Growth Numbers

Over the past three years, Hevol Services Group Co. Limited has seen its earnings per share (EPS) grow by 2.9% per year. It achieved revenue growth of 26% over the last year.

We like the look of the strong year-on-year improvement in revenue. Combined with modest EPS growth, we get a good impression of the company. We wouldn't say this is necessarily top notch growth, but it is certainly promising. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Hevol Services Group Co. Limited Been A Good Investment?

The return of -58% over three years would not have pleased Hevol Services Group Co. Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The loss to shareholders over the past three years is certainly concerning. The lacklustre earnings growth perhaps may have something to do with the downward trend in the share price. In the upcoming AGM, shareholders will get the opportunity to discuss these concerns with the board and assess if the board's plan is likely to improve company performance.

Shareholders may want to check for free if Hevol Services Group insiders are buying or selling shares.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Hevol Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6093

Hevol Services Group

An investment holding company, engages in the provision of property management and related value-added services in the People’s Republic of China.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives