- Hong Kong

- /

- Real Estate

- /

- SEHK:51

Some Harbour Centre Development Limited (HKG:51) Shareholders Look For Exit As Shares Take 27% Pounding

Harbour Centre Development Limited (HKG:51) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 34% share price drop.

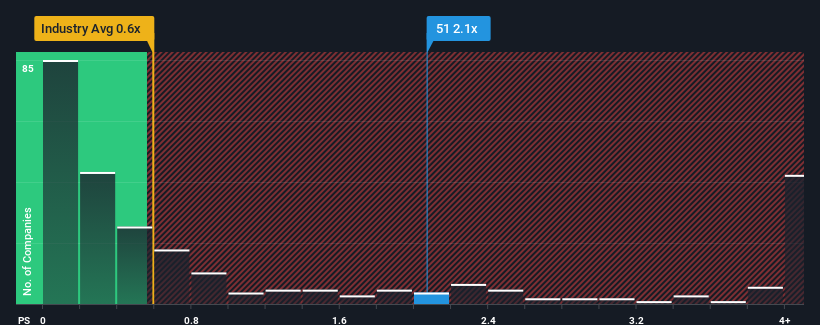

Even after such a large drop in price, when almost half of the companies in Hong Kong's Real Estate industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider Harbour Centre Development as a stock probably not worth researching with its 2.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

We check all companies for important risks. See what we found for Harbour Centre Development in our free report.See our latest analysis for Harbour Centre Development

What Does Harbour Centre Development's Recent Performance Look Like?

For example, consider that Harbour Centre Development's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Harbour Centre Development, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Harbour Centre Development?

In order to justify its P/S ratio, Harbour Centre Development would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. The last three years don't look nice either as the company has shrunk revenue by 70% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 6.8% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Harbour Centre Development's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Harbour Centre Development's P/S

Harbour Centre Development's P/S remain high even after its stock plunged. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Harbour Centre Development currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Harbour Centre Development with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Harbour Centre Development, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Harbour Centre Development, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harbour Centre Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:51

Harbour Centre Development

An investment holding company, engages in the hotel ownership, and property investment and development activities in Hong Kong, Mainland China, and internationally.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives