- Hong Kong

- /

- Real Estate

- /

- SEHK:35

Chairman & CEO of Far East Consortium International Tat Cheong Chiu Buys 9.5% More Shares

Far East Consortium International Limited (HKG:35) shareholders (or potential shareholders) will be happy to see that the Chairman & CEO, Tat Cheong Chiu, recently bought a whopping HK$154m worth of stock, at a price of HK$1.05. While that only increased their holding size by 9.5%, it is still a big swing by our standards.

See our latest analysis for Far East Consortium International

Far East Consortium International Insider Transactions Over The Last Year

In fact, the recent purchase by Tat Cheong Chiu was the biggest purchase of Far East Consortium International shares made by an insider individual in the last twelve months, according to our records. That implies that an insider found the current price of HK$1.16 per share to be enticing. That means they have been optimistic about the company in the past, though they may have changed their mind. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. The good news for Far East Consortium International share holders is that insiders were buying at near the current price.

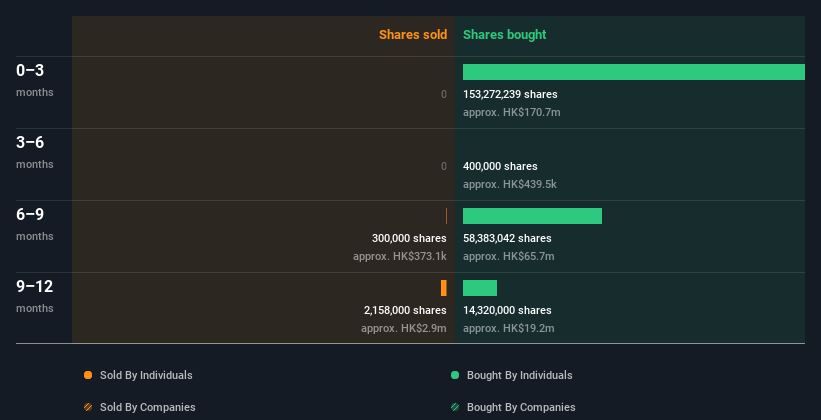

In the last twelve months insiders purchased 226.38m shares for HK$253m. But insiders sold 2.46m shares worth HK$3.3m. In total, Far East Consortium International insiders bought more than they sold over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership Of Far East Consortium International

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. It's great to see that Far East Consortium International insiders own 51% of the company, worth about HK$1.8b. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Far East Consortium International Tell Us?

It's certainly positive to see the recent insider purchases. And the longer term insider transactions also give us confidence. When combined with notable insider ownership, these factors suggest Far East Consortium International insiders are well aligned, and quite possibly think the share price is too low. One for the watchlist, at least! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For example, Far East Consortium International has 4 warning signs (and 1 which is significant) we think you should know about.

But note: Far East Consortium International may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:35

Far East Consortium International

An investment holding company, engages in the property development and investment activities in Australia, New Zealand, the Czech Republic, Hong Kong, Malaysia, the People’s Republic of China, Singapore, the United Kingdom, and the rest of Europe.

Undervalued with mediocre balance sheet.