- Hong Kong

- /

- Real Estate

- /

- SEHK:3380

We Think Shareholders May Want To Consider A Review Of Logan Group Company Limited's (HKG:3380) CEO Compensation Package

Key Insights

- Logan Group's Annual General Meeting to take place on 14th of June

- CEO Zhuobin Lai's total compensation includes salary of CN¥3.60m

- Total compensation is similar to the industry average

- Over the past three years, Logan Group's EPS fell by 107% and over the past three years, the total loss to shareholders 94%

The results at Logan Group Company Limited (HKG:3380) have been quite disappointing recently and CEO Zhuobin Lai bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 14th of June. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for Logan Group

How Does Total Compensation For Zhuobin Lai Compare With Other Companies In The Industry?

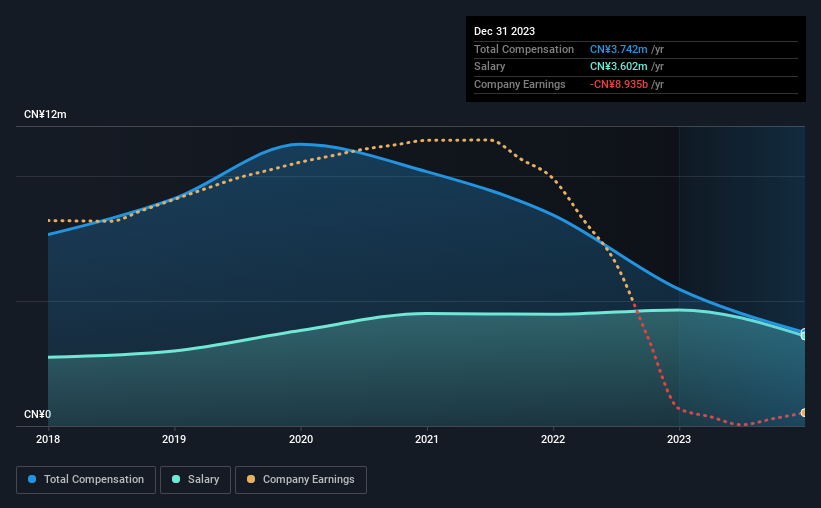

According to our data, Logan Group Company Limited has a market capitalization of HK$3.6b, and paid its CEO total annual compensation worth CN¥3.7m over the year to December 2023. Notably, that's a decrease of 32% over the year before. In particular, the salary of CN¥3.60m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Hong Kong Real Estate industry with market capitalizations ranging from HK$1.6b to HK$6.2b, the reported median CEO total compensation was CN¥3.5m. This suggests that Logan Group remunerates its CEO largely in line with the industry average. What's more, Zhuobin Lai holds HK$1.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥3.6m | CN¥4.6m | 96% |

| Other | CN¥140k | CN¥828k | 4% |

| Total Compensation | CN¥3.7m | CN¥5.5m | 100% |

On an industry level, around 77% of total compensation represents salary and 23% is other remuneration. Logan Group pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Logan Group Company Limited's Growth

Logan Group Company Limited has reduced its earnings per share by 107% a year over the last three years. In the last year, its revenue is up 13%.

Overall this is not a very positive result for shareholders. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Logan Group Company Limited Been A Good Investment?

Few Logan Group Company Limited shareholders would feel satisfied with the return of -94% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Zhuobin receives almost all of their compensation through a salary. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 2 warning signs for Logan Group that investors should be aware of in a dynamic business environment.

Important note: Logan Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3380

Logan Group

An investment holding company, engages in property development and operation in the People’s Republic of China.

Imperfect balance sheet with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion