Uncovering Opportunities: 3 Penny Stocks With Market Caps Under US$500M

Reviewed by Simply Wall St

As global markets show signs of optimism with easing inflation and strong bank earnings propelling stocks higher, investors are increasingly looking for opportunities beyond the traditional large-cap stocks. Penny stocks, often representing smaller or newer companies, continue to capture attention due to their potential for significant growth. While the term may seem outdated, these investments remain relevant as they can offer value and opportunity when backed by robust financial health.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.69 | HK$42.48B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £150.76M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

Click here to see the full list of 5,711 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Uniphar (ISE:UPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Uniphar plc is a diversified healthcare services company operating in the Republic of Ireland, the United Kingdom, The Netherlands, and internationally with a market cap of €556.95 million.

Operations: The company's revenue is derived from three main segments: Pharma (€657.34 million), Medtech (€252.93 million), and Supply Chain & Retail (€1.77 billion).

Market Cap: €556.95M

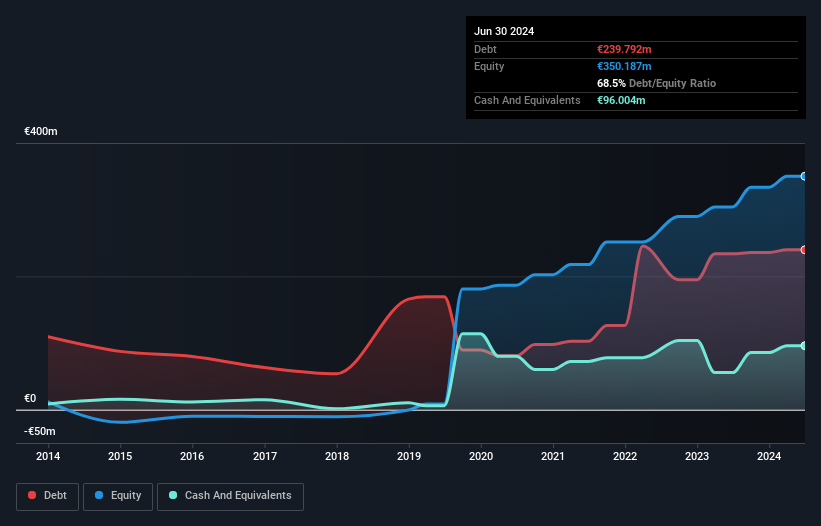

Uniphar, with a market cap of €556.95 million, operates across Pharma, Medtech, and Supply Chain & Retail segments. Despite its high net debt to equity ratio of 41.1%, its debt is well covered by operating cash flow (54.2%), and interest payments are adequately managed (3.4x EBIT coverage). The company has experienced earnings growth over the past five years at 17.2% annually but saw slower growth last year at 1.4%. Uniphar's recent expansion into cell and gene therapy programs highlights potential in the European pharmaceutical market despite challenges from higher US sales figures for new medicines launched between 2016-2021.

- Navigate through the intricacies of Uniphar with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Uniphar's future.

Greenland Hong Kong Holdings (SEHK:337)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Greenland Hong Kong Holdings Limited is an investment holding company involved in property development, property and hotel investment, and property management in China, with a market cap of HK$803.06 million.

Operations: The company's revenue segments include Sales of Properties generating CN¥21.82 billion, Property Management and Other Services contributing CN¥1.98 billion, Lease of Property at CN¥300.71 million, and Hotel and Related Services bringing in CN¥78.93 million.

Market Cap: HK$803.06M

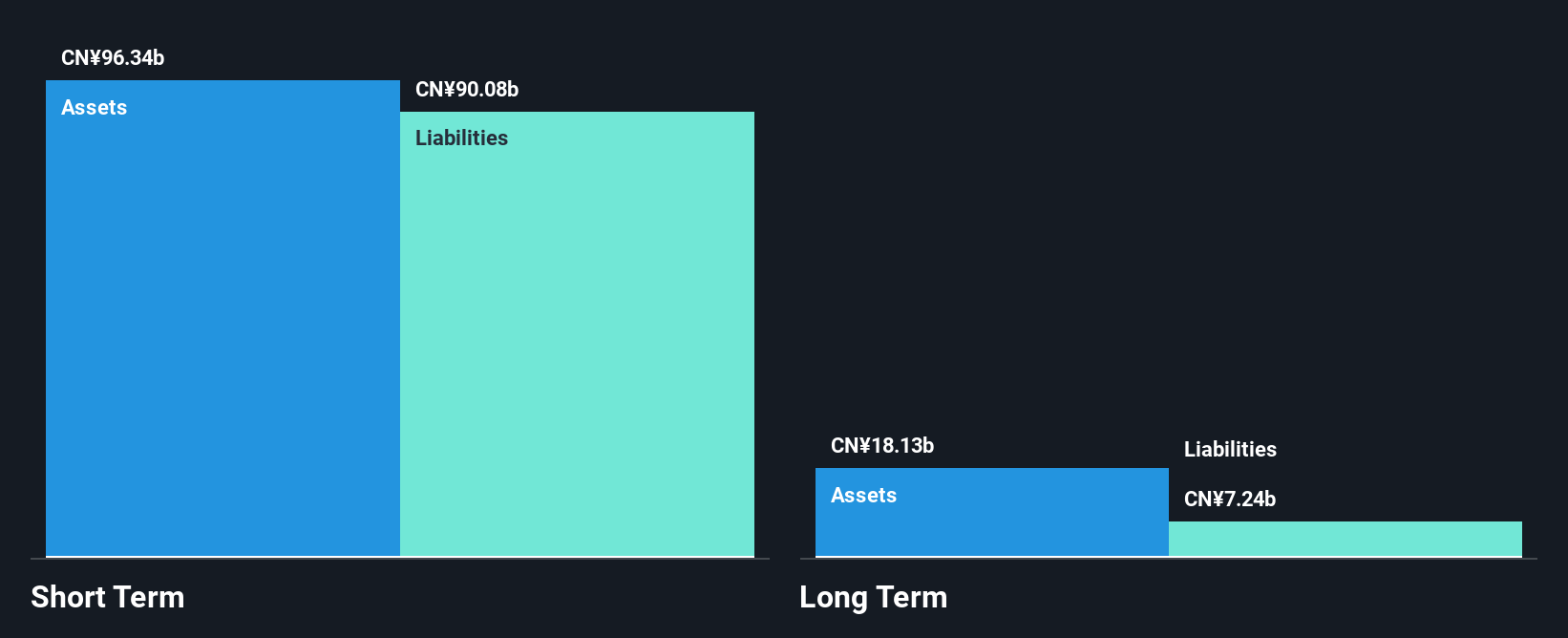

Greenland Hong Kong Holdings, with a market cap of HK$803.06 million, focuses on property development and management in China. Despite being unprofitable, it has substantial short-term assets (CN¥104.8 billion) that exceed both its long-term liabilities (CN¥5.2 billion) and short-term liabilities (CN¥99.9 billion). The company's debt to equity ratio has improved over five years from 123.8% to 76.1%, though the net debt to equity remains high at 70.9%. Recent sales reports indicate contracted sales of RMB 9,208 million for 2024, reflecting ongoing operational activity despite financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Greenland Hong Kong Holdings.

- Review our historical performance report to gain insights into Greenland Hong Kong Holdings' track record.

Greatview Aseptic Packaging (SEHK:468)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greatview Aseptic Packaging Company Limited is an investment holding company that offers packaging solutions for the liquid food industry in China and internationally, with a market cap of HK$3.71 billion.

Operations: The company generates revenue of CN¥3.55 billion from its Packaging & Containers segment.

Market Cap: HK$3.71B

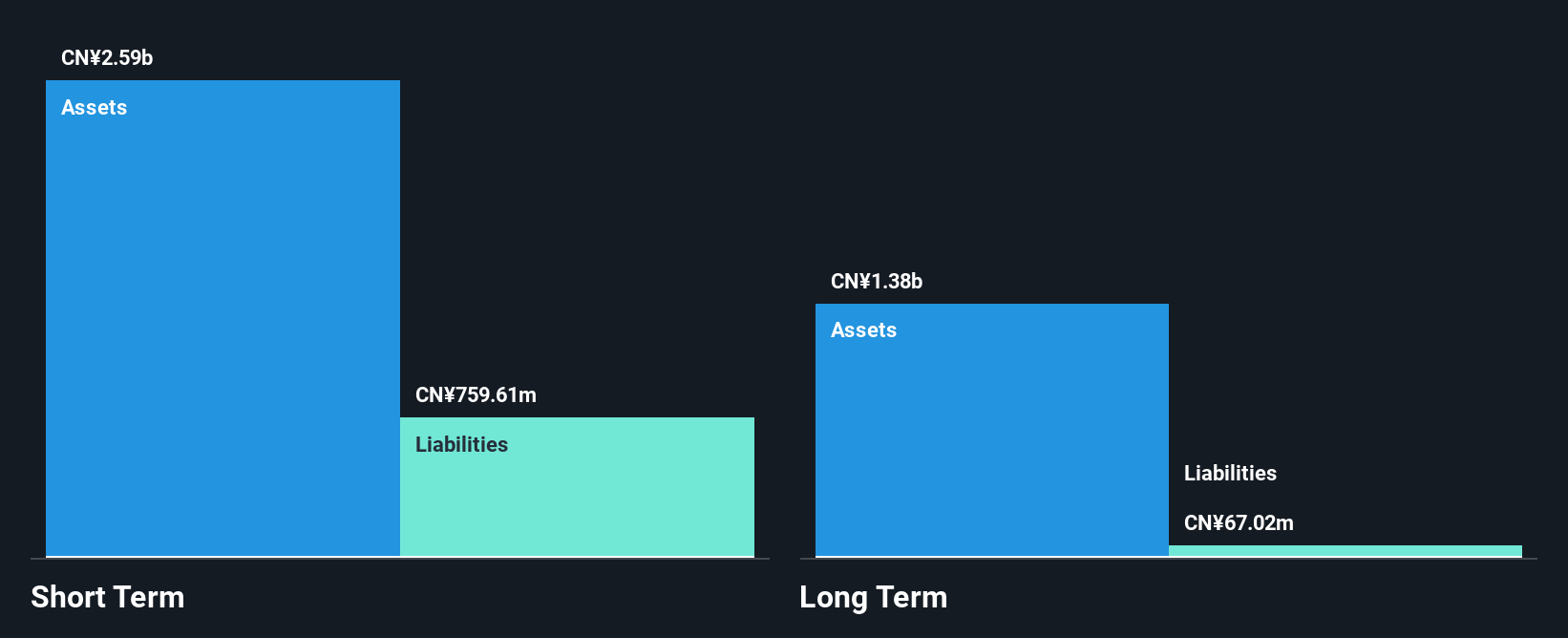

Greatview Aseptic Packaging, with a market cap of HK$3.71 billion, demonstrates financial stability through its strong asset position. The company's short-term assets (CN¥2.6 billion) comfortably cover both short-term (CN¥759.6 million) and long-term liabilities (CN¥67 million). It has more cash than debt, and its operating cash flow significantly covers its debt obligations. Despite a low return on equity at 8.3%, the company maintains high-quality earnings and improved profit margins from 5.3% to 7.3%. Recent auditor changes suggest governance adjustments, while earnings are forecasted to grow by 6.08% annually amidst stable volatility levels.

- Dive into the specifics of Greatview Aseptic Packaging here with our thorough balance sheet health report.

- Assess Greatview Aseptic Packaging's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Explore the 5,711 names from our Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:468

Greatview Aseptic Packaging

An investment holding company, provides packaging solutions to the liquid food industry in the People's Republic of China and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives