As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, investors are increasingly exploring diverse opportunities in Asia. Penny stocks, often representing smaller or newer companies, remain an intriguing area despite the term's somewhat outdated connotations. By focusing on those with robust financials and potential for growth, investors can uncover hidden value in these less prominent yet promising companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.94 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.42 | HK$878.3M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.59 | HK$2.15B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.30 | SGD526.88M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.78 | THB2.87B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.097 | SGD50.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.40 | SGD13.38B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.09 | HK$3.15B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.98 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.80 | THB9.7B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 957 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

K. Wah International Holdings (SEHK:173)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: K. Wah International Holdings Limited is an investment holding company focused on property development and investment in Hong Kong and Mainland China, with a market capitalization of approximately HK$6.87 billion.

Operations: The company's revenue is primarily derived from property development in Mainland China (HK$5.91 billion) and Hong Kong (HK$410.53 million), along with property investment generating HK$623.61 million.

Market Cap: HK$6.87B

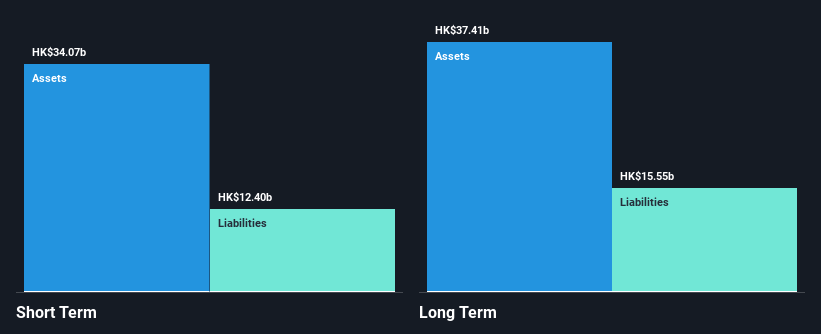

K. Wah International Holdings, with a market cap of HK$6.87 billion, recently joined the S&P Global BMI Index but faces challenges such as declining earnings and reduced profit margins from 11.2% to 4.2%. Despite trading at a significant discount to estimated fair value and having stable weekly volatility, its earnings are forecasted to decline by an average of 17.2% annually over the next three years. The company maintains a satisfactory net debt-to-equity ratio of 11.1%, with short-term assets exceeding both short- and long-term liabilities, but it has an unstable dividend track record and inexperienced management team tenure averaging only 0.6 years.

- Dive into the specifics of K. Wah International Holdings here with our thorough balance sheet health report.

- Understand K. Wah International Holdings' earnings outlook by examining our growth report.

SSY Group (SEHK:2005)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SSY Group Limited is an investment holding company that engages in the research, development, manufacture, trading, and sale of pharmaceutical products to hospitals and distributors both in China and internationally, with a market capitalization of approximately HK$8.65 billion.

Operations: The company's revenue primarily comes from its Intravenous Infusion Solution and Others segment, generating HK$4.39 billion, followed by Medical Materials at HK$375.23 million.

Market Cap: HK$8.65B

SSY Group Limited, with a market cap of HK$8.65 billion, has recently secured multiple approvals from China's National Medical Products Administration for various pharmaceutical products, including Ambroxol Hydrochloride and Morinidazole. Despite these developments, the company faces challenges such as declining earnings and profit margins dropping from 21.1% to 14.4%. While trading significantly below estimated fair value and having stable weekly volatility, its Return on Equity is low at 8.8%. The company's short-term assets exceed both short- and long-term liabilities, but its debt is not well covered by operating cash flow.

- Take a closer look at SSY Group's potential here in our financial health report.

- Explore SSY Group's analyst forecasts in our growth report.

Zhejiang CONBA PharmaceuticalLtd (SHSE:600572)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang CONBA Pharmaceutical Co., Ltd. focuses on the research, development, production, and sales of pharmaceuticals and health products in mainland China with a market cap of CN¥10.88 billion.

Operations: The company's revenue is primarily generated from its operations in China, totaling CN¥6.43 billion.

Market Cap: CN¥10.88B

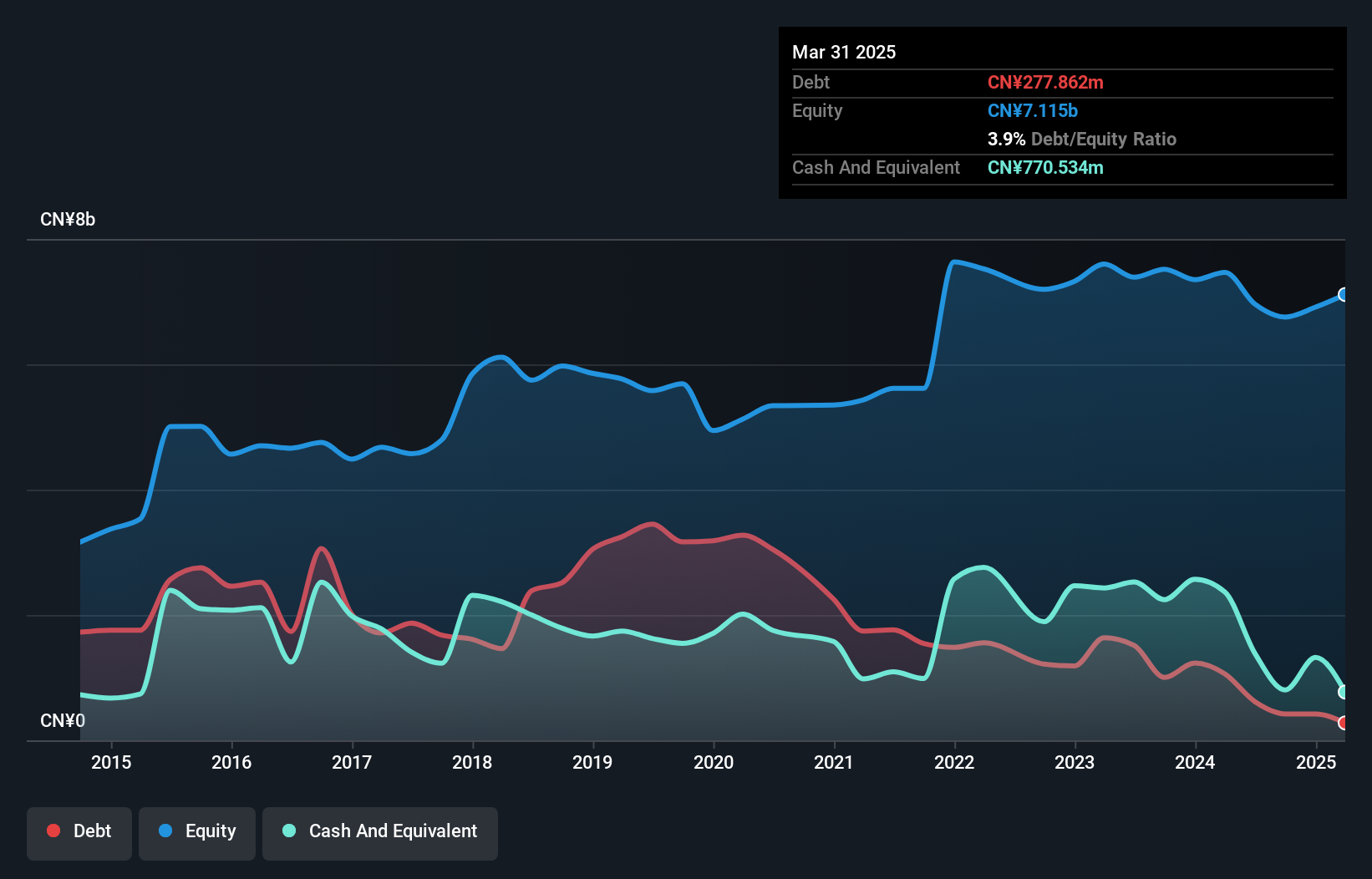

Zhejiang CONBA Pharmaceutical Co., Ltd. has a market cap of CN¥10.88 billion and reported half-year revenue of CN¥3.36 billion, slightly down from the previous year. The company has successfully reduced its debt to equity ratio from 57% to 4.3% over five years and now holds more cash than total debt, indicating strong financial management. Its short-term assets significantly exceed liabilities, both short- and long-term, providing a solid liquidity position. While earnings grew by 29.8% last year, driven partly by a large one-off gain of CN¥156 million, the board's average tenure is relatively inexperienced at 1.8 years.

- Get an in-depth perspective on Zhejiang CONBA PharmaceuticalLtd's performance by reading our balance sheet health report here.

- Gain insights into Zhejiang CONBA PharmaceuticalLtd's historical outcomes by reviewing our past performance report.

Where To Now?

- Jump into our full catalog of 957 Asian Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2005

SSY Group

An investment holding company, researches, develops, manufactures, trades in, and sells various pharmaceutical products to hospitals and distributors in the People’s Republic of China and internationally.

Undervalued with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)