- Hong Kong

- /

- Real Estate

- /

- SEHK:16

We Think The Compensation For Sun Hung Kai Properties Limited's (HKG:16) CEO Looks About Right

Key Insights

- Sun Hung Kai Properties' Annual General Meeting to take place on 6th of November

- Salary of HK$3.10m is part of CEO Raymond Kwok's total remuneration

- The total compensation is 72% less than the average for the industry

- Sun Hung Kai Properties' total shareholder return over the past three years was 28% while its EPS was down 9.0% over the past three years

Shareholders may be wondering what CEO Raymond Kwok plans to do to improve the less than great performance at Sun Hung Kai Properties Limited (HKG:16) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 6th of November. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. In our opinion, CEO compensation does not look excessive and we discuss why.

See our latest analysis for Sun Hung Kai Properties

Comparing Sun Hung Kai Properties Limited's CEO Compensation With The Industry

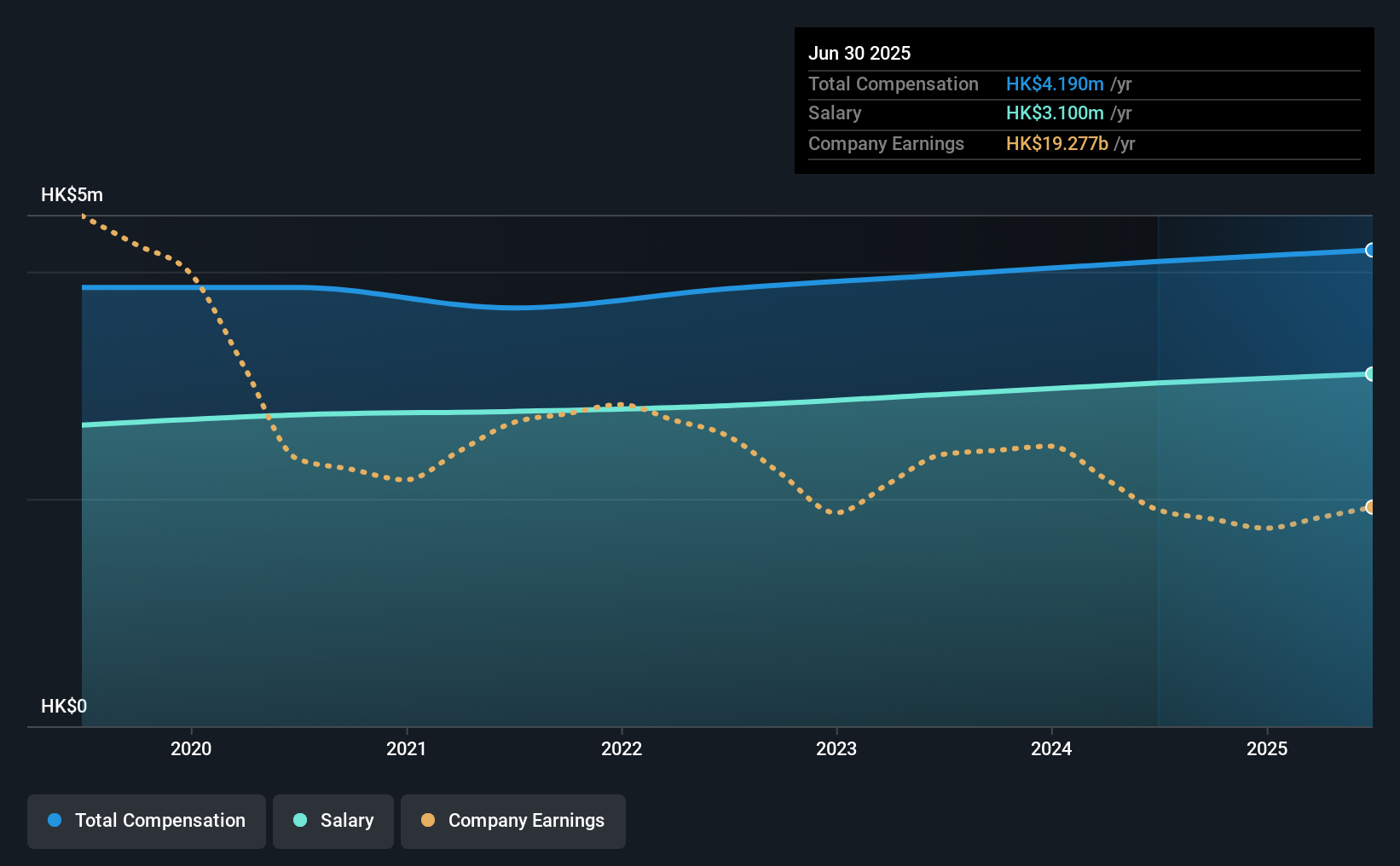

According to our data, Sun Hung Kai Properties Limited has a market capitalization of HK$274b, and paid its CEO total annual compensation worth HK$4.2m over the year to June 2025. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is HK$3.10m, represents most of the total compensation being paid.

For comparison, other companies in the Hong Kong Real Estate industry with market capitalizations above HK$62b, reported a median total CEO compensation of HK$15m. That is to say, Raymond Kwok is paid under the industry median. Moreover, Raymond Kwok also holds HK$6.3b worth of Sun Hung Kai Properties stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | HK$3.1m | HK$3.0m | 74% |

| Other | HK$1.1m | HK$1.1m | 26% |

| Total Compensation | HK$4.2m | HK$4.1m | 100% |

Speaking on an industry level, nearly 83% of total compensation represents salary, while the remainder of 17% is other remuneration. Sun Hung Kai Properties sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Sun Hung Kai Properties Limited's Growth

Over the last three years, Sun Hung Kai Properties Limited has shrunk its earnings per share by 9.0% per year. Its revenue is up 11% over the last year.

Overall this is not a very positive result for shareholders. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Sun Hung Kai Properties Limited Been A Good Investment?

With a total shareholder return of 28% over three years, Sun Hung Kai Properties Limited shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Sun Hung Kai Properties that investors should look into moving forward.

Important note: Sun Hung Kai Properties is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:16

Sun Hung Kai Properties

An investment holding company, develops and invests in properties for sale and rent in Hong Kong, Mainland China, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)