- China

- /

- Semiconductors

- /

- SHSE:600770

3 Penny Stocks With Market Caps Higher Than US$500M To Watch

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by rising inflation and near-record highs in major U.S. stock indexes, investors are exploring diverse opportunities beyond the traditional large-cap stocks. Penny stocks, despite their somewhat outdated moniker, remain an intriguing investment area for those interested in smaller or newer companies that may offer unexpected value. In this article, we explore three penny stocks that exhibit strong financial foundations and potential for stability and growth amidst current market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.66B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £329.61M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.95 | HK$45.35B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.38 | £336.16M | ★★★★☆☆ |

Click here to see the full list of 5,687 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Sunac Services Holdings (SEHK:1516)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sunac Services Holdings Limited is an investment holding company that offers property development, cultural tourism city construction and operation, and property management services in the People’s Republic of China, with a market cap of HK$5.01 billion.

Operations: The company's revenue is primarily derived from Property Management and Operational Services (CN¥6.38 billion), Community Living Services (CN¥440.70 million), and Value-Added Services to Non-Property Owners (CN¥271.82 million).

Market Cap: HK$5.01B

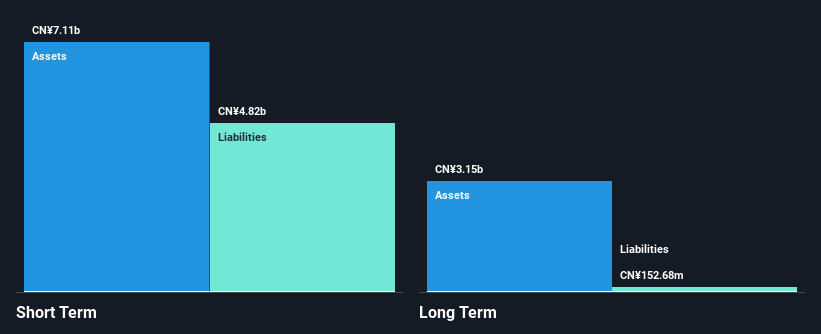

Sunac Services Holdings Limited, with a market cap of HK$5.01 billion, faces challenges as it remains unprofitable with a negative return on equity of -23.01% and increasing losses over the past five years. Despite these setbacks, its revenue streams from Property Management and Operational Services (CN¥6.38 billion) provide some stability. The company is debt-free, which reduces financial risk, and its short-term assets significantly exceed liabilities (CN¥7.1 billion vs CN¥4.8 billion). A recent shareholder meeting addressed entering into a new Property Management Services Framework Agreement to potentially enhance future growth prospects.

- Click here and access our complete financial health analysis report to understand the dynamics of Sunac Services Holdings.

- Gain insights into Sunac Services Holdings' future direction by reviewing our growth report.

Jiumaojiu International Holdings (SEHK:9922)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiumaojiu International Holdings Limited operates Chinese cuisine restaurant brands across several countries, including China, Singapore, Canada, Malaysia, Thailand, and the United States, with a market cap of HK$4.14 billion.

Operations: The company's revenue segments include Tai Er with CN¥4.54 billion, Jiu Mao Jiu at CN¥603.83 million, and Song Hot Pot generating CN¥885.66 million.

Market Cap: HK$4.14B

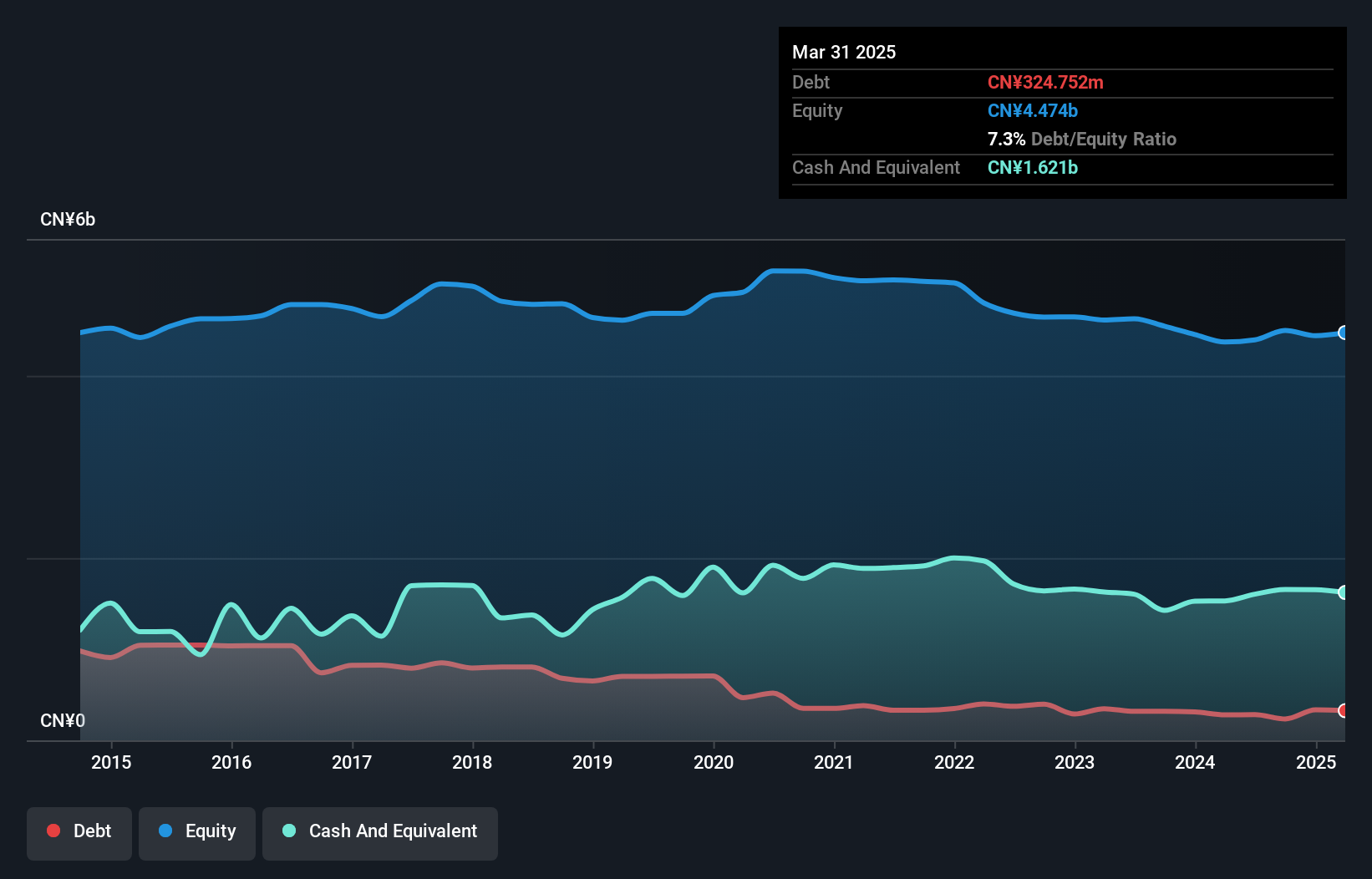

Jiumaojiu International Holdings, with a market cap of HK$4.14 billion, shows promising financial health for investors interested in smaller stocks. The company has demonstrated robust earnings growth of 42% over the past year, outpacing the hospitality industry average. Its interest payments are well covered by EBIT at 13.5 times, and it holds more cash than total debt. However, its return on equity is relatively low at 9.8%. Despite a less experienced management team with an average tenure of 1.3 years, Jiumaojiu's short-term assets comfortably cover both short and long-term liabilities, indicating solid liquidity management.

- Take a closer look at Jiumaojiu International Holdings' potential here in our financial health report.

- Learn about Jiumaojiu International Holdings' future growth trajectory here.

Jiangsu ZongyiLTD (SHSE:600770)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangsu Zongyi Co., LTD operates in the clean energy, advanced technology, and integrated finance sectors with a market capitalization of CN¥5.82 billion.

Operations: No specific revenue segments are reported for Jiangsu Zongyi Co., LTD.

Market Cap: CN¥5.82B

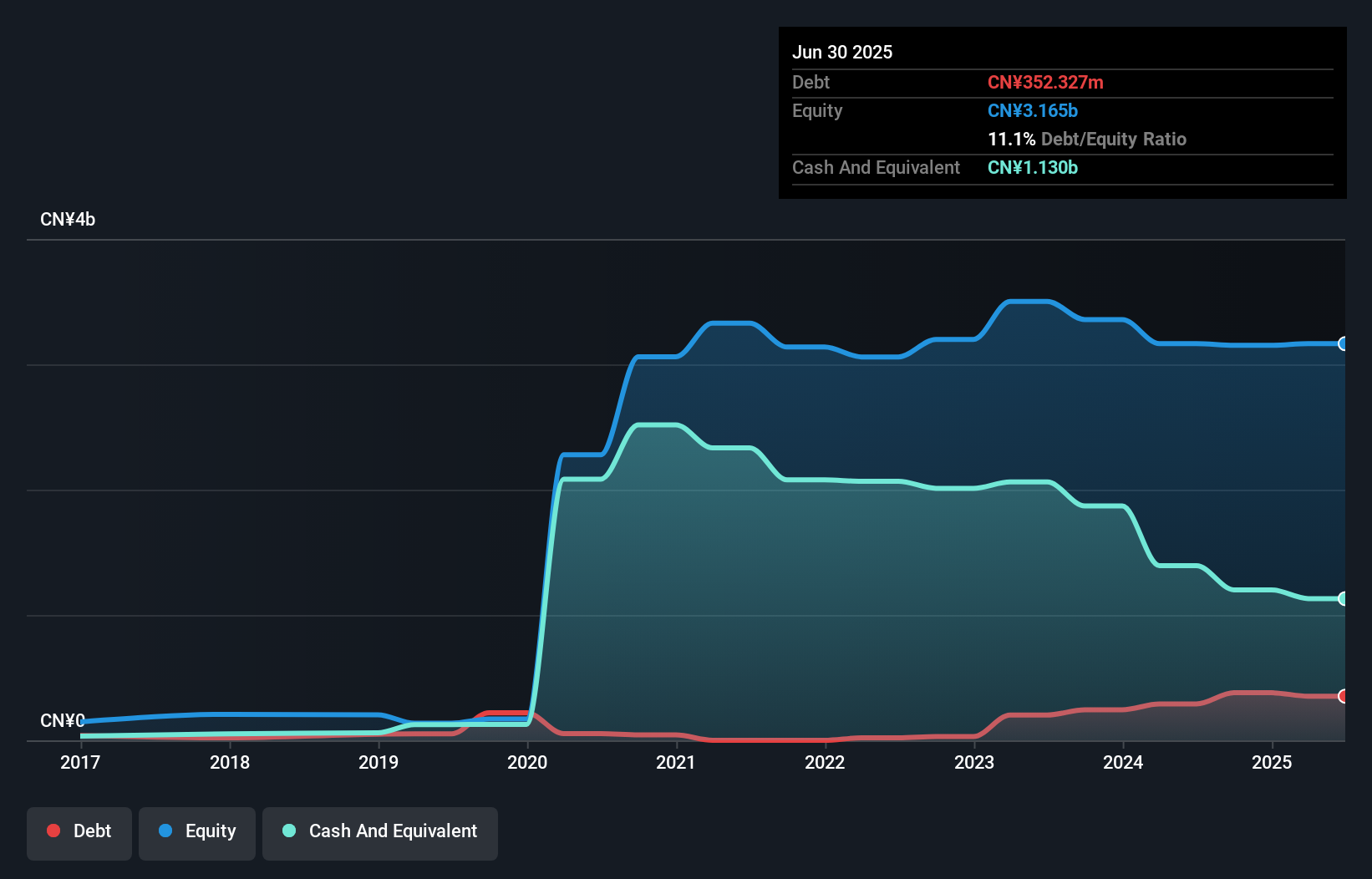

Jiangsu Zongyi Co., LTD, with a market cap of CN¥5.82 billion, has recently achieved profitability, marking a significant milestone. The company's short-term assets of CN¥1.9 billion comfortably exceed both its short and long-term liabilities, highlighting strong liquidity management. Despite a low return on equity at -0.7%, the debt level is well-managed with cash exceeding total debt and operating cash flow covering 44.5% of the debt. However, recent financial results were influenced by a large one-off gain of CN¥32.9 million, which may not reflect ongoing operational performance accurately.

- Dive into the specifics of Jiangsu ZongyiLTD here with our thorough balance sheet health report.

- Evaluate Jiangsu ZongyiLTD's historical performance by accessing our past performance report.

Key Takeaways

- Investigate our full lineup of 5,687 Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600770

Jiangsu ZongyiLTD

Engages in the clean energy, advanced technology, and integrated finance businesses.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives