As global markets react to rising U.S. Treasury yields, with the S&P 500 Index experiencing a decline after several weeks of gains, investors are closely monitoring economic indicators and central bank policies for signals on future market movements. In this environment of fluctuating interest rates and moderated inflation, identifying undervalued stocks can be a strategic move for those looking to capitalize on potential market inefficiencies, particularly when these stocks are estimated to be significantly below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 49.9% |

| Acerinox (BME:ACX) | €8.52 | €16.98 | 49.8% |

| Enento Group Oyj (HLSE:ENENTO) | €18.40 | €36.57 | 49.7% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.52 | CN¥22.89 | 49.7% |

| WEX (NYSE:WEX) | US$172.60 | US$343.98 | 49.8% |

| Semiconductor Manufacturing International (SEHK:981) | HK$27.05 | HK$53.78 | 49.7% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2706.00 | ¥5411.18 | 50% |

| Energy One (ASX:EOL) | A$5.53 | A$11.06 | 50% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.70 | 49.9% |

| Sinch (OM:SINCH) | SEK31.45 | SEK62.48 | 49.7% |

Let's review some notable picks from our screened stocks.

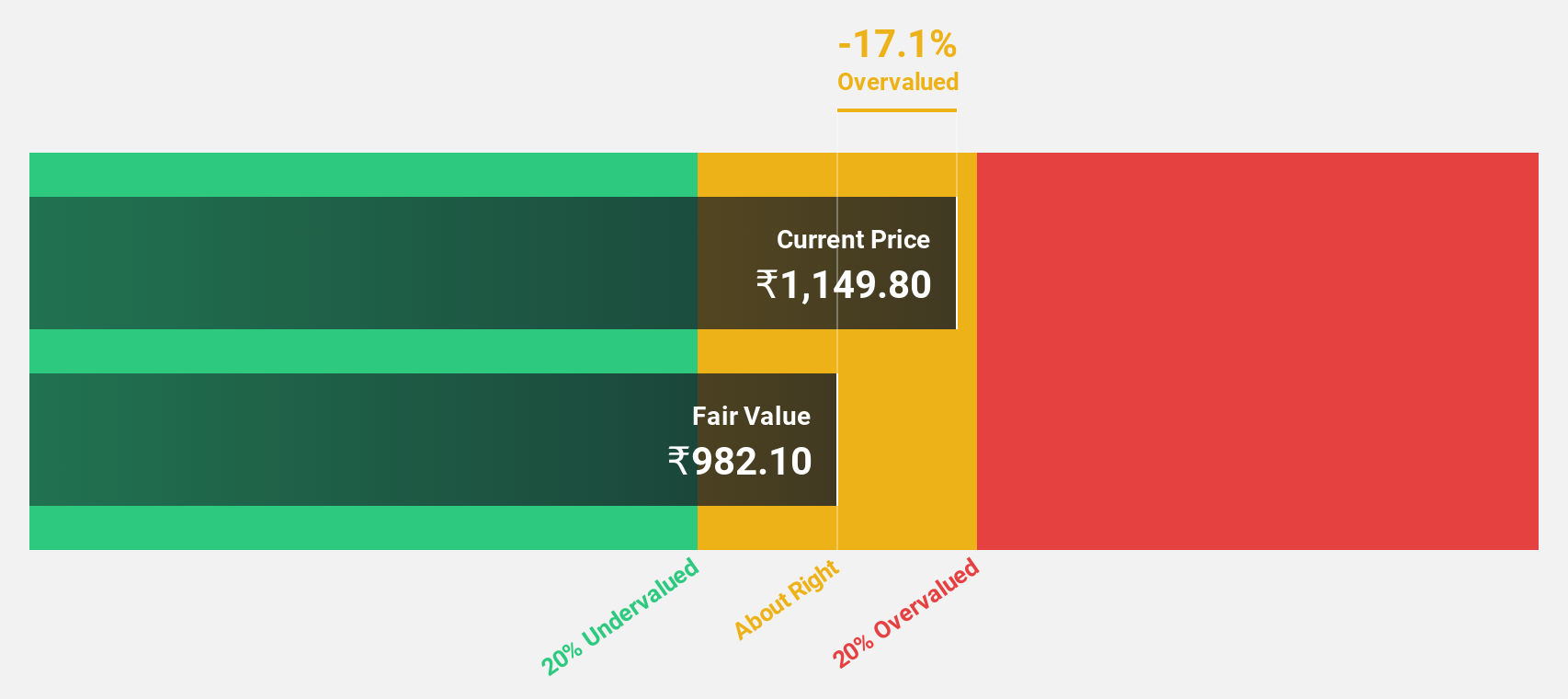

Kalpataru Projects International (NSEI:KPIL)

Overview: Kalpataru Projects International Limited offers engineering, procurement, and construction services across various sectors including power transmission, buildings and factories, water, railways, oil and gas, and urban infrastructure both in India and internationally with a market cap of ₹204.86 billion.

Operations: The company's revenue is primarily derived from its Engineering, Procurement and Construction (EPC) segment, which contributes ₹199.13 billion, alongside Development Projects accounting for ₹2.71 billion.

Estimated Discount To Fair Value: 30.1%

Kalpataru Projects International appears undervalued based on cash flows, trading at ₹1,274.15, which is over 30% below its estimated fair value of ₹1,823.92. The company reported strong earnings growth in the latest quarter with net income rising to INR 1.26 billion from INR 888.5 million year-on-year despite ongoing regulatory challenges that have not significantly impacted its financial position. Earnings are projected to grow significantly at 29.4% annually, outpacing the broader Indian market growth rate of 18%.

- Our earnings growth report unveils the potential for significant increases in Kalpataru Projects International's future results.

- Unlock comprehensive insights into our analysis of Kalpataru Projects International stock in this financial health report.

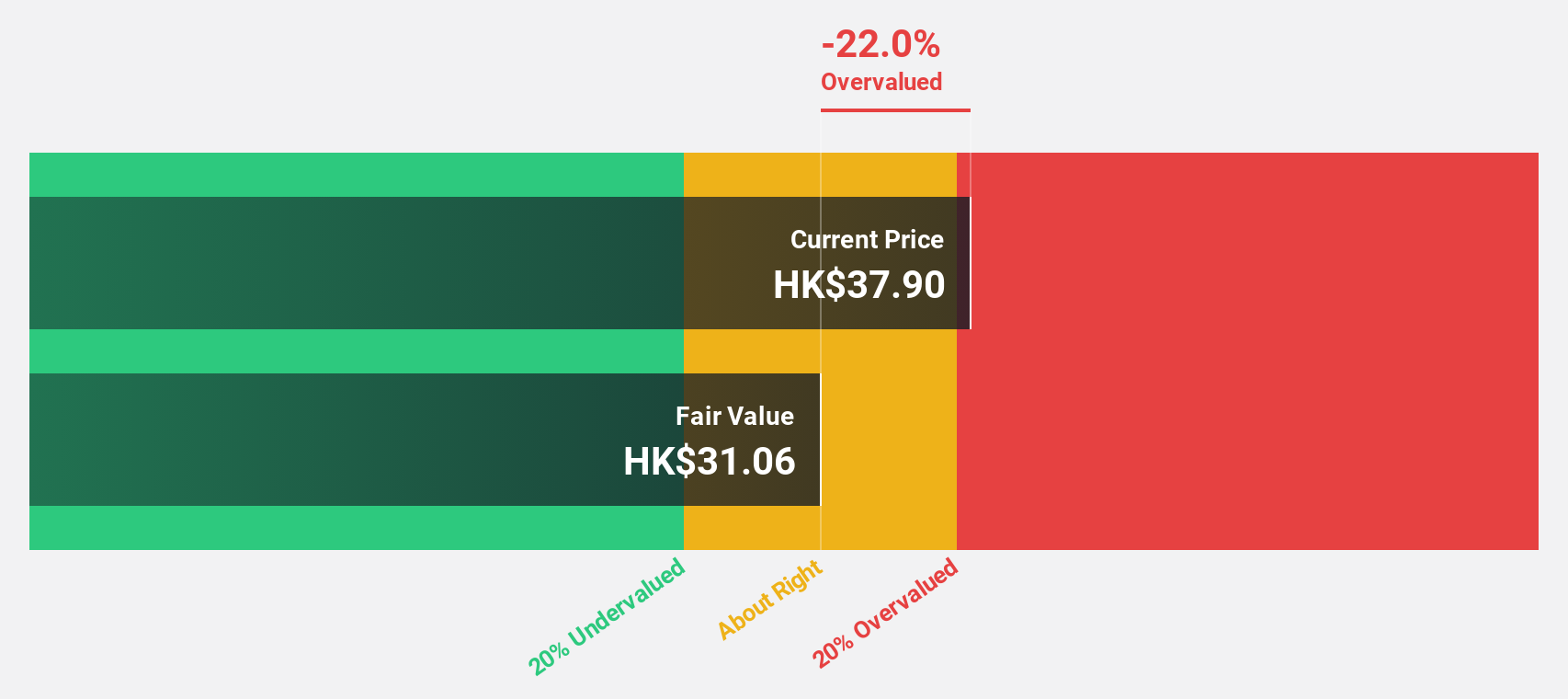

China Resources Mixc Lifestyle Services (SEHK:1209)

Overview: China Resources Mixc Lifestyle Services Limited is an investment holding company offering property management and commercial operational services in the People's Republic of China, with a market cap of HK$72.81 billion.

Operations: The company generates revenue from its property management business, totaling CN¥10.22 billion, and its commercial management business, amounting to CN¥5.71 billion.

Estimated Discount To Fair Value: 40.7%

China Resources Mixc Lifestyle Services is trading at HK$32.05, significantly below its estimated fair value of HK$54.08, indicating it may be undervalued based on cash flows. The company reported robust earnings growth with net income rising to CNY 1.91 billion from CNY 1.40 billion year-on-year and earnings per share increasing to CNY 0.836 from CNY 0.614. Earnings are forecasted to grow annually by 14.71%, surpassing the Hong Kong market rate of 12.4%.

- Our comprehensive growth report raises the possibility that China Resources Mixc Lifestyle Services is poised for substantial financial growth.

- Get an in-depth perspective on China Resources Mixc Lifestyle Services' balance sheet by reading our health report here.

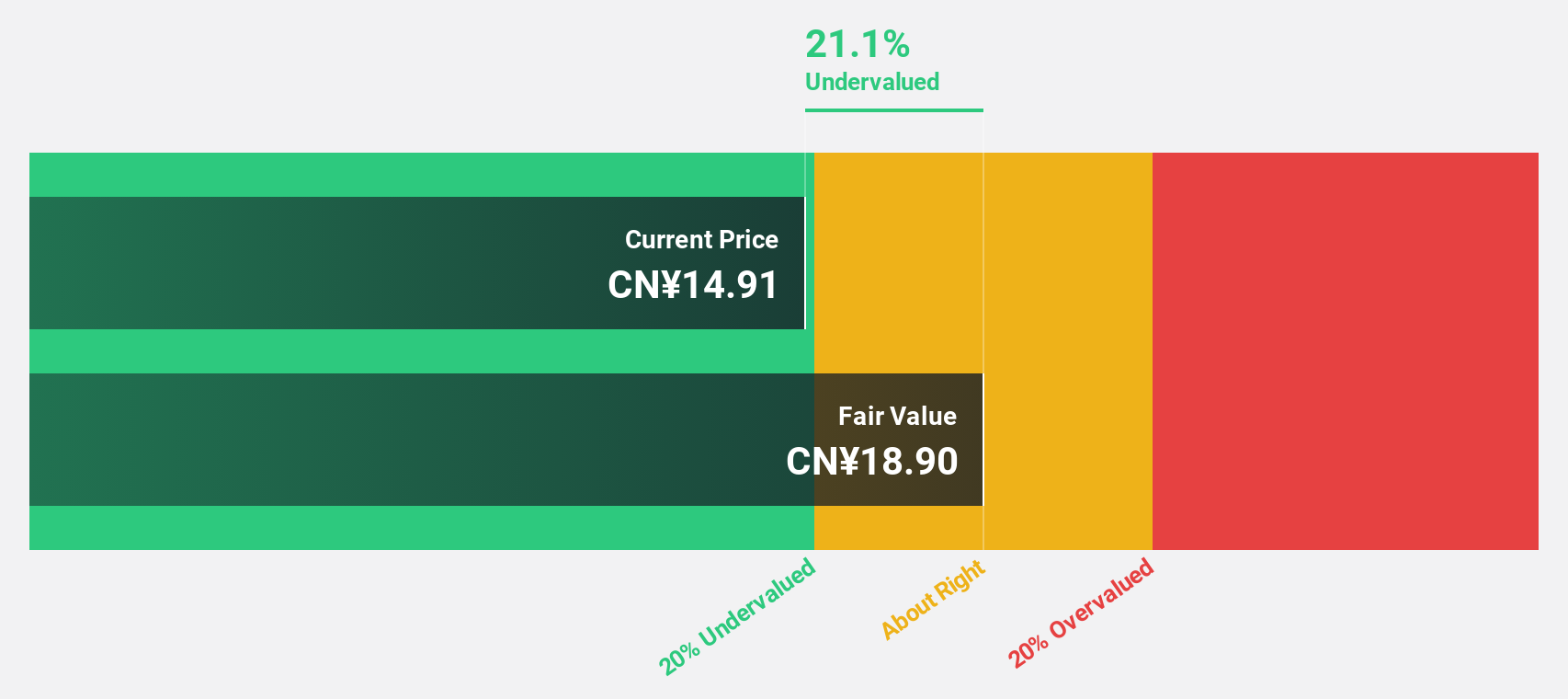

Venustech Group (SZSE:002439)

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥20.85 billion.

Operations: Venustech Group's revenue segments include network security products, trusted security management platforms, and specialized security services and solutions.

Estimated Discount To Fair Value: 15%

Venustech Group's stock is trading at CN¥17.73, below its fair value estimate of CN¥20.87, reflecting potential undervaluation based on cash flows. Despite a forecasted earnings growth of 37.33% annually, recent financials show challenges with a net loss of CN¥210.07 million for the nine months ending September 2024 compared to net income last year, and profit margins have decreased significantly from the previous year. Earnings are expected to outpace the broader Chinese market growth rate.

- In light of our recent growth report, it seems possible that Venustech Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Venustech Group's balance sheet health report.

Make It Happen

- Access the full spectrum of 958 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002439

Venustech Group

Provides network security products, trusted security management platforms, and specialized security services and solutions worldwide.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives