While it’s been a great week for Midland Holdings Limited (HKG:1200) shareholders after stock gained 11%, they should consider it with a grain of salt. Although prices were relatively low, insiders chose to sell HK$3.8m worth of stock in the past 12 months. This could be a sign of impending weakness.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

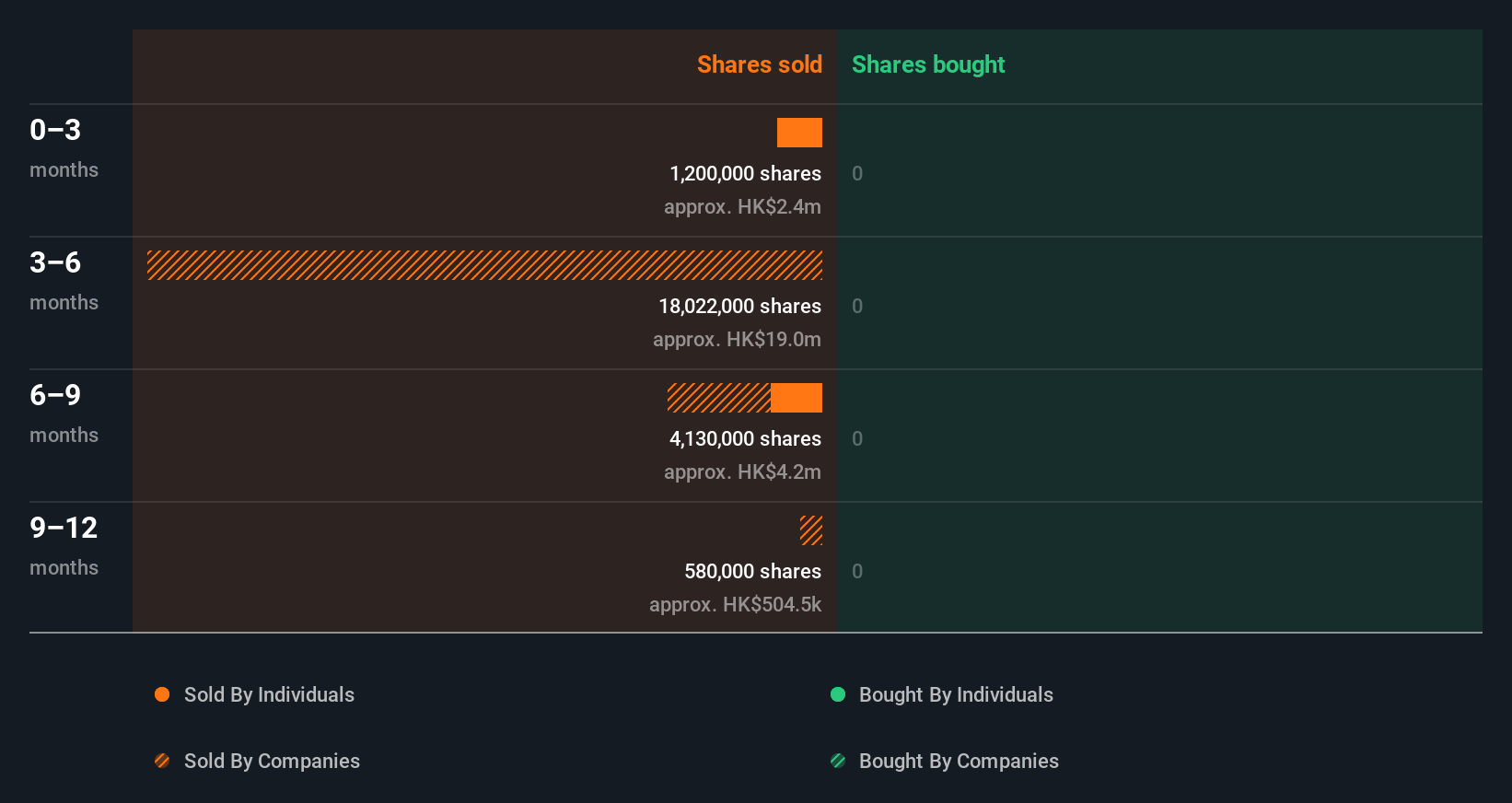

Midland Holdings Insider Transactions Over The Last Year

The insider, Yuen Hing Lam, made the biggest insider sale in the last 12 months. That single transaction was for HK$1.5m worth of shares at a price of HK$2.20 each. That means that even when the share price was slightly below the current price of HK$2.22, an insider wanted to cash in some shares. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. We note that the biggest single sale was only 4.7% of Yuen Hing Lam's holding. Yuen Hing Lam was the only individual insider to sell over the last year.

Yuen Hing Lam ditched 2.57m shares over the year. The average price per share was HK$1.48. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

See our latest analysis for Midland Holdings

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Midland Holdings Insiders Are Selling The Stock

Over the last three months, we've seen significant insider selling at Midland Holdings. In total, insider Yuen Hing Lam dumped HK$2.5m worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the insiders think that the shares are a bargain.

Insider Ownership Of Midland Holdings

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Midland Holdings insiders own 42% of the company, worth about HK$668m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Midland Holdings Tell Us?

An insider hasn't bought Midland Holdings stock in the last three months, but there was some selling. Looking to the last twelve months, our data doesn't show any insider buying. On the plus side, Midland Holdings makes money, and is growing profits. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Every company has risks, and we've spotted 1 warning sign for Midland Holdings you should know about.

Of course Midland Holdings may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1200

Midland Holdings

An investment holding company, provides property agency services in Hong Kong, Macau, and Mainland China.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>