- Hong Kong

- /

- Real Estate

- /

- SEHK:101

Here's Why Hang Lung Properties (HKG:101) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Hang Lung Properties (HKG:101). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hang Lung Properties with the means to add long-term value to shareholders.

See our latest analysis for Hang Lung Properties

Hang Lung Properties' Improving Profits

In the last three years Hang Lung Properties' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Hang Lung Properties boosted its trailing twelve month EPS from HK$0.80 to HK$0.95, in the last year. There's little doubt shareholders would be happy with that 20% gain.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Hang Lung Properties may have maintained EBIT margins over the last year, revenue has fallen. Suffice it to say that is not a great sign of growth.

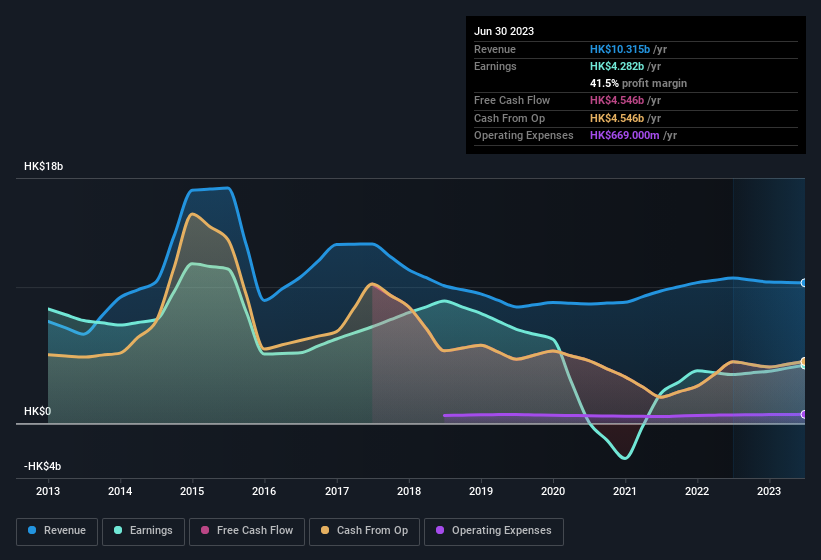

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Hang Lung Properties?

Are Hang Lung Properties Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no Hang Lung Properties insiders reported share sales in the last twelve months. Even better, though, is that the CEO & Executive Director, Wai Pak Lo, bought a whopping HK$1.8m worth of shares, paying about HK$10.03 per share, on average. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

On top of the insider buying, it's good to see that Hang Lung Properties insiders have a valuable investment in the business. As a matter of fact, their holding is valued at HK$270m. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Hang Lung Properties To Your Watchlist?

One important encouraging feature of Hang Lung Properties is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Of course, just because Hang Lung Properties is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Hang Lung Properties is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hang Lung Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:101

Hang Lung Properties

An investment holding company, engages in the property investment, development, and management activities in Hong Kong and Mainland China.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives