InnoCare Pharma (SEHK:9969) Achieves Key Milestone with ICP-488 Phase II Success in Psoriasis Treatment

Reviewed by Simply Wall St

InnoCare Pharma (SEHK:9969) is making notable strides with its recent phase II clinical trial success of ICP-488 for psoriasis, highlighting its potential to capture a significant market share in China's high-demand oral medication sector. The company's projected revenue growth and innovative product development, such as the EcoSmart line, underscore its strategic focus on addressing unmet medical needs. Readers should expect a discussion on how InnoCare navigates these opportunities and challenges to enhance its market position and future profitability.

Click here and access our complete analysis report to understand the dynamics of InnoCare Pharma.

Unique Capabilities Enhancing InnoCare Pharma's Market Position

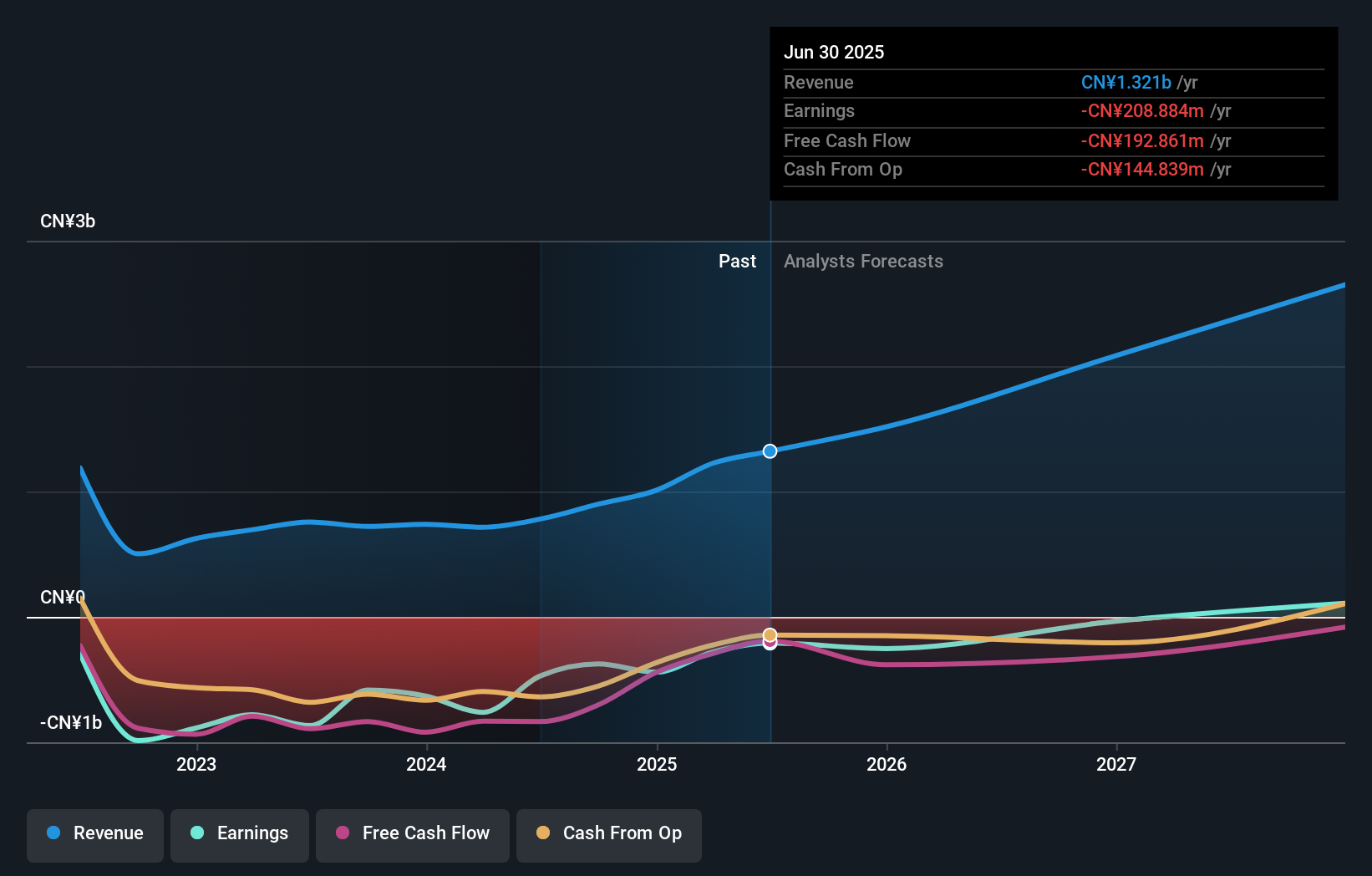

InnoCare Pharma's revenue is projected to grow at an impressive 26.4% per year, significantly outpacing the Hong Kong market average of 7.7%. This growth is supported by strong demand for its core product lines, as highlighted by a 15% year-over-year revenue increase. The company's innovative product development, such as the EcoSmart line, has captured a substantial share of the sustainable market, reflecting its commitment to addressing unmet medical needs. Additionally, InnoCare's management team, with an average tenure of 3.2 years, brings valuable experience that aligns with its strategic goals. The company is trading at 73.2% below its estimated fair value, which, despite being considered expensive based on its Price-To-Sales Ratio, indicates potential for future market positioning improvements.

See what the latest analyst reports say about InnoCare Pharma's future prospects and potential market movements.Internal Limitations Hindering InnoCare Pharma's Growth

Currently, InnoCare faces financial challenges, being unprofitable and forecasted to remain so for the next three years. This is compounded by a negative Return on Equity of -6.98%, which complicates comparisons of past earnings growth. Operational inefficiencies, particularly in supply chain management, have also led to increased costs, pressuring margins. The company's valuation, considered expensive compared to industry peers despite trading below its estimated fair value, highlights these financial hurdles.

To dive deeper into how InnoCare Pharma's valuation metrics are shaping its market position, check out our detailed analysis of InnoCare Pharma's Valuation.Growth Avenues Awaiting InnoCare Pharma

InnoCare's strategic initiatives, including the successful phase II clinical trials of ICP-488 for psoriasis, present significant growth opportunities. This product's promising results could enhance the company's market position, especially given the high demand for new oral medications in China. Additionally, the approval of ICP-248 for AML trials underscores potential expansion into new therapeutic areas, offering avenues for future profitability.

Key Risks and Challenges That Could Impact InnoCare Pharma's Success

Economic headwinds and intense market competition pose significant threats to InnoCare's growth trajectory. The company's ability to innovate continuously is critical to maintaining its market share amidst regulatory challenges. Analysts' uncertainty regarding target prices further indicates potential volatility in market expectations, necessitating strategic adaptability to sustain growth.

To gain deeper insights into InnoCare Pharma's historical performance, explore our detailed analysis of past performance. Explore the current health of InnoCare Pharma and how it reflects on its financial stability and growth potential.Conclusion

InnoCare Pharma's impressive projected revenue growth of 26.4% annually, driven by strong demand for its core products and innovative developments like the EcoSmart line, underscores its potential to significantly enhance its market position. However, the company faces notable financial challenges, including unprofitability and a negative Return on Equity, which are exacerbated by operational inefficiencies and high costs. These issues contribute to its expensive Price-To-Sales Ratio compared to peers, despite trading 73.2% below its estimated fair value, indicating room for market positioning improvement if these hurdles are addressed. Strategic initiatives, such as the promising ICP-488 and ICP-248 trials, offer growth avenues, but the company must navigate economic headwinds and market competition while maintaining innovation to sustain its trajectory and achieve future profitability.

Summing It All Up

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:9969

InnoCare Pharma

A biopharmaceutical company, engages in discovering, developing, and commercializing drugs for the treatment of cancer and autoimmune diseases in China.

Excellent balance sheet and fair value.