Grown Up Group Investment Holdings Among 3 Intriguing Penny Stocks

Reviewed by Simply Wall St

As global markets respond to political shifts and economic policies, investors are witnessing a rally in major U.S. indices, with small-cap stocks showing significant movement. In this context, penny stocks—though an outdated term—remain an intriguing area for investment due to their potential for growth in smaller or newer companies. When these stocks are supported by strong financial health, they can offer unique opportunities that larger firms might overlook.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR349.03M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$526.87M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.46 | MYR2.46B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$139.45M | ★★★★☆☆ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.295 | £864.67M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.93 | MYR2.04B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

Click here to see the full list of 5,751 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Grown Up Group Investment Holdings (SEHK:1842)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Grown Up Group Investment Holdings Limited operates in the design, development, manufacture, trading, and sale of bags and luggage products and accessories across various international markets including Hong Kong, Europe, North America, China, and Asia-Pacific with a market cap of HK$105.60 million.

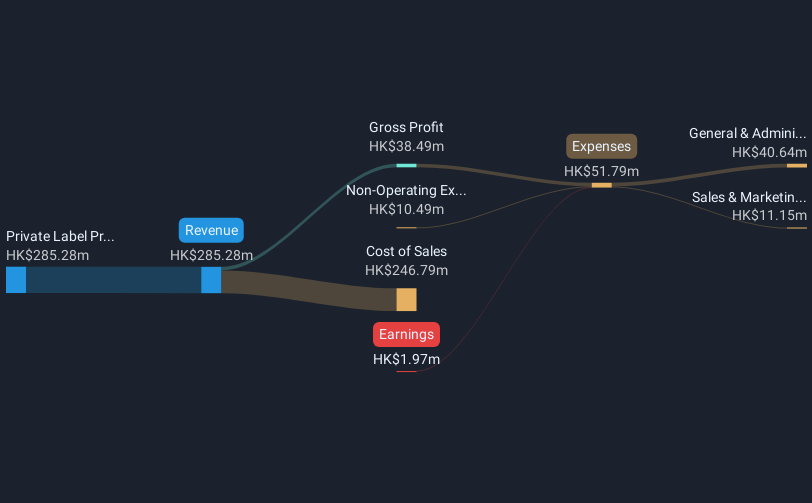

Operations: The company generates revenue from its Private Label Products segment, amounting to HK$285.28 million.

Market Cap: HK$105.6M

Grown Up Group Investment Holdings Limited is navigating challenges typical of smaller-cap stocks, with a market cap of HK$105.60 million and revenue from its Private Label Products segment at HK$285.28 million. The company remains unprofitable but has reduced losses over the past five years by 29.6% annually, indicating some progress in financial management despite negative operating cash flow and high share price volatility. Recent changes include a new auditor appointment after Grant Thornton Hong Kong Limited resigned due to fee disagreements, highlighting ongoing cost management efforts amidst operational scale considerations. Short-term assets exceed both short- and long-term liabilities, providing some financial stability.

- Dive into the specifics of Grown Up Group Investment Holdings here with our thorough balance sheet health report.

- Gain insights into Grown Up Group Investment Holdings' past trends and performance with our report on the company's historical track record.

Kintor Pharmaceutical (SEHK:9939)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kintor Pharmaceutical Limited is a clinical-stage biotechnology company focused on researching, developing, and commercializing therapeutic drugs for dermatology and tumor indications in China, with a market cap of HK$476.26 million.

Operations: Kintor Pharmaceutical Limited has not reported any revenue segments.

Market Cap: HK$476.26M

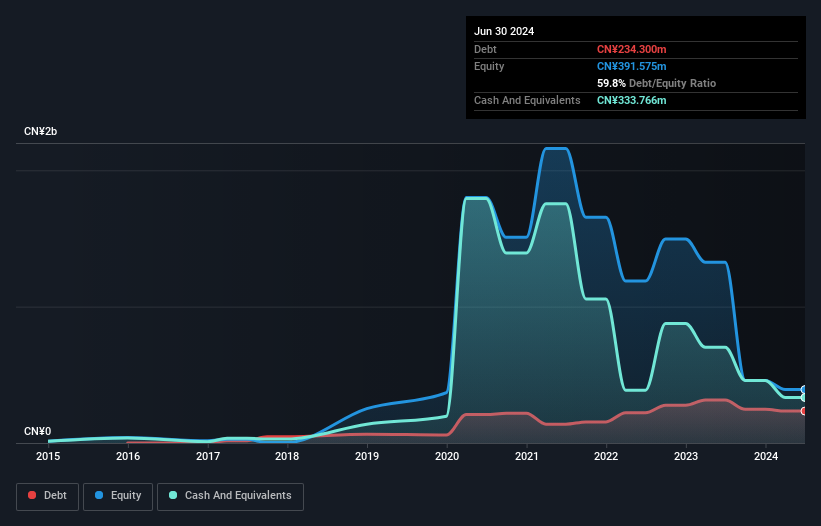

Kintor Pharmaceutical Limited is a clinical-stage biotechnology company with a market cap of HK$476.26 million, currently pre-revenue and unprofitable. Despite this, it has promising developments in its pipeline. The recent approval of KT-939 as an International Nomenclature Cosmetic Ingredient highlights its potential in the cosmetic sector, particularly for skin pigmentation issues. Additionally, Kintor's KX-826 tincture for androgenetic alopecia is advancing through pivotal clinical trials in China, showing encouraging safety and efficacy results. Financially, the company maintains more cash than debt and has sufficient short-term assets to cover liabilities but faces challenges with profitability and cash runway constraints if growth continues at historical rates.

- Click here and access our complete financial health analysis report to understand the dynamics of Kintor Pharmaceutical.

- Evaluate Kintor Pharmaceutical's historical performance by accessing our past performance report.

Hong Leong Finance (SGX:S41)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Leong Finance Limited is a financial services company serving consumer and SME markets in Singapore, with a market cap of SGD1.09 billion.

Operations: The company's revenue from its Financing Business segment is SGD227.13 million.

Market Cap: SGD1.09B

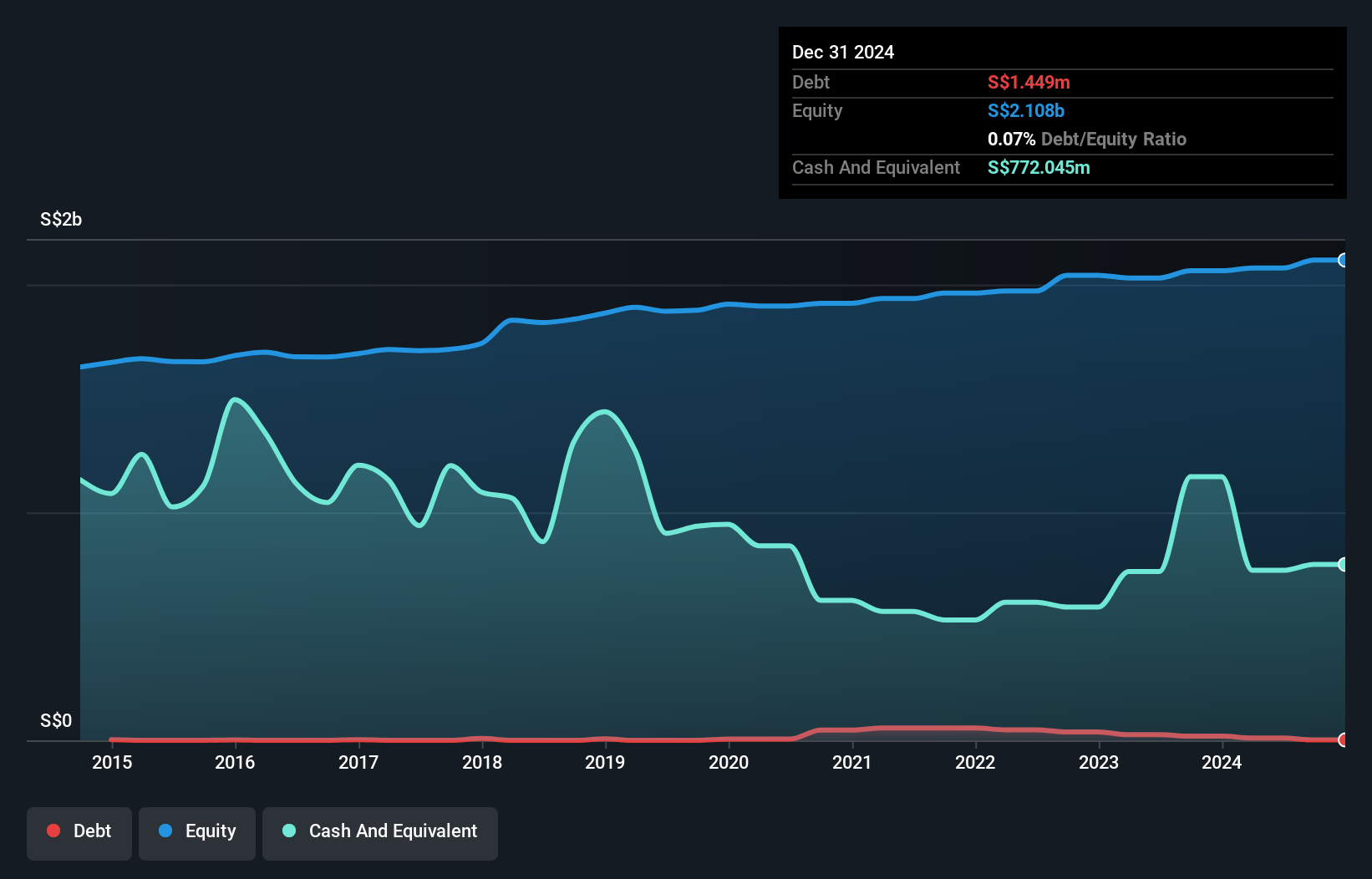

Hong Leong Finance, with a market cap of SGD1.09 billion, operates in Singapore's consumer and SME finance sectors. Despite stable weekly volatility at 1%, the company faced negative earnings growth of -24.9% over the past year, contrasting with industry averages. Its Price-To-Earnings ratio of 11.1x suggests a valuation slightly below the SG market average. The management team is experienced, averaging 8.1 years in tenure, and funding primarily comes from low-risk customer deposits (98%). However, net profit margins have decreased from last year to 43.8%. The company's loans to deposits ratio remains appropriate at 95%.

- Click here to discover the nuances of Hong Leong Finance with our detailed analytical financial health report.

- Learn about Hong Leong Finance's historical performance here.

Turning Ideas Into Actions

- Reveal the 5,751 hidden gems among our Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Grown Up Group Investment Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1842

Grown Up Group Investment Holdings

Engages in the design, development, manufacture, trading and sale of bags and luggage products and accessories in Hong Kong, Europe, North America, the People’s Republic of China, Asia-Pacific, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives