- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:9911

SEHK Growth Companies With High Insider Ownership Expecting Up To 32% Revenue Growth

Reviewed by Simply Wall St

In the midst of global market volatility and economic uncertainties, the Hong Kong stock market has shown resilience with selective growth opportunities. Investors are increasingly focusing on companies with strong insider ownership, as this often signals confidence in the firm's future prospects. When evaluating stocks, particularly in today's fluctuating environment, high insider ownership can be a key indicator of alignment between management and shareholder interests. This article will explore three growth companies listed on SEHK that exhibit significant insider ownership and are poised for up to 32% revenue growth.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Akeso (SEHK:9926) | 20.5% | 54.7% |

| Fenbi (SEHK:2469) | 31.2% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 78.9% |

| DPC Dash (SEHK:1405) | 38.2% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 28.6% | 93.4% |

| Lianlian DigiTech (SEHK:2598) | 19.7% | 92.3% |

Let's review some notable picks from our screened stocks.

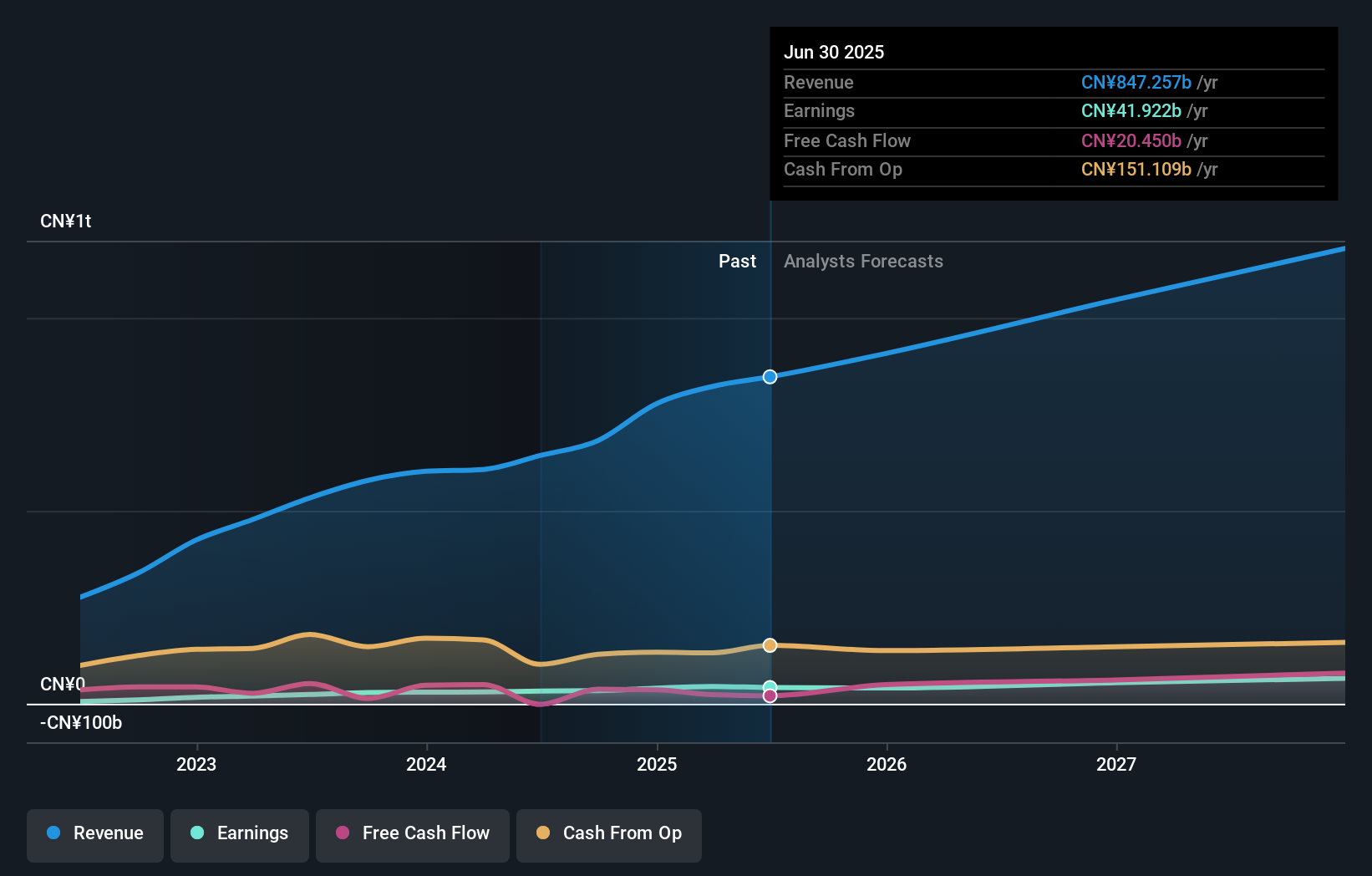

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, with a market cap of HK$753.40 billion, operates in the automobiles and batteries business across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Operations: BYD generates revenue primarily from Automobiles and Related Products at CN¥507.52 billion, and Mobile Handset Components, Assembly Service, and Other Products at CN¥154.49 billion.

Insider Ownership: 30.1%

Revenue Growth Forecast: 14.0% p.a.

BYD has demonstrated significant growth, with recent unaudited sales for August 2024 showing a notable increase to 373,083 units from 274,386 units a year ago. The company also reported half-year earnings of CNY 13.63 billion, up from CNY 10.95 billion last year. Insider ownership remains high, indicating strong confidence in the company's future prospects. Additionally, BYD's strategic partnership with Uber aims to deploy 100,000 electric vehicles globally, enhancing its market presence and growth potential further.

- Click to explore a detailed breakdown of our findings in BYD's earnings growth report.

- The valuation report we've compiled suggests that BYD's current price could be inflated.

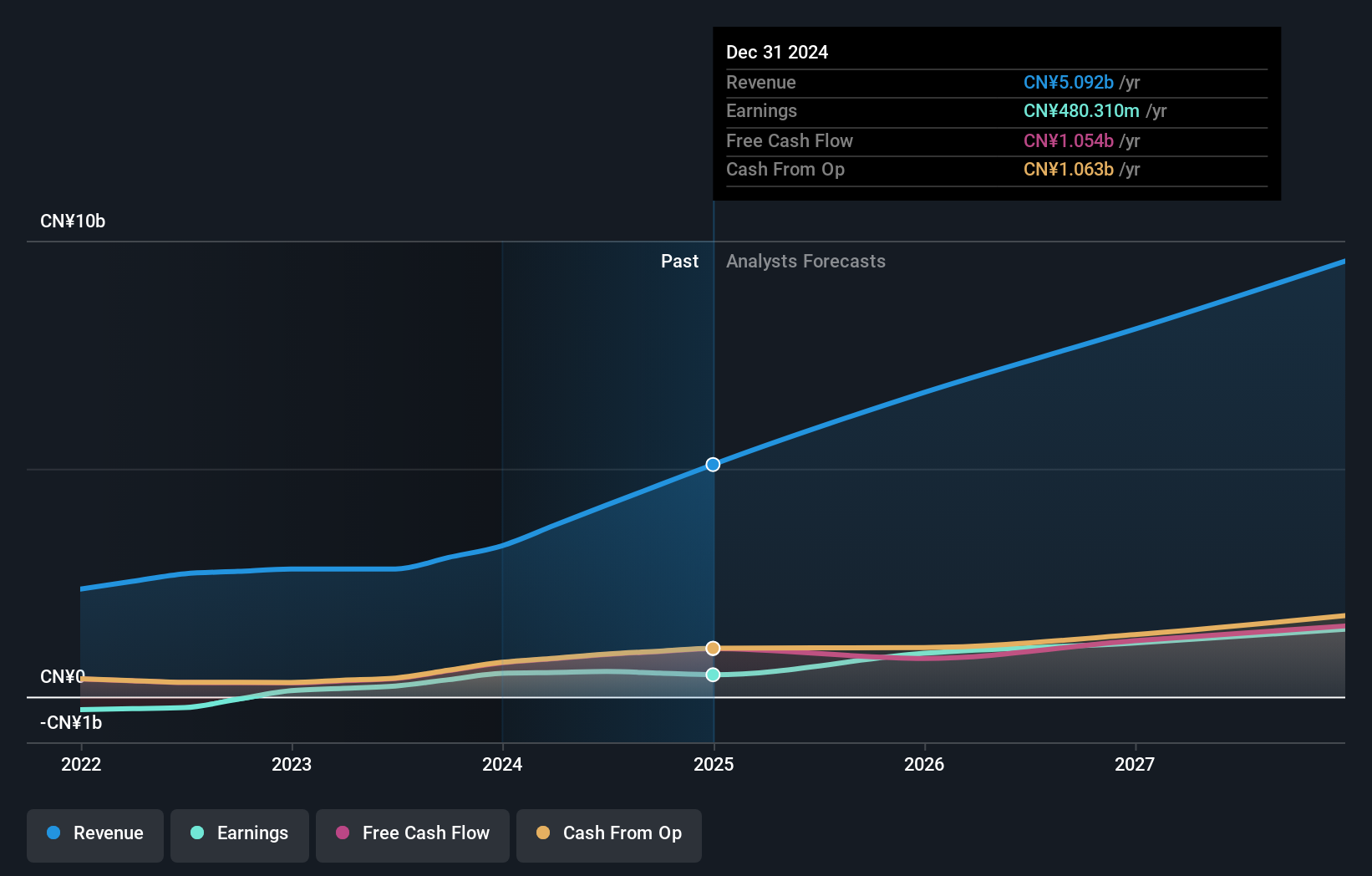

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Newborn Town Inc., an investment holding company with a market cap of HK$2.95 billion, operates in the social networking business worldwide.

Operations: The company's revenue segments include CN¥3.80 billion from the Social Networking Business and CN¥406.28 million from Innovative Business.

Insider Ownership: 35.3%

Revenue Growth Forecast: 12.6% p.a.

Newborn Town's revenue is forecast to grow at 12.6% per year, outpacing the Hong Kong market's 7.3%. Recent earnings for the half-year ended June 30, 2024, showed sales of CNY 2.27 billion and net income of CNY 224.68 million, both up from last year. The company's high insider ownership indicates strong internal confidence. Additionally, Newborn Town appointed Mr. LI Yongjie as COO to drive strategic initiatives and improve performance further.

- Navigate through the intricacies of Newborn Town with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Newborn Town is trading behind its estimated value.

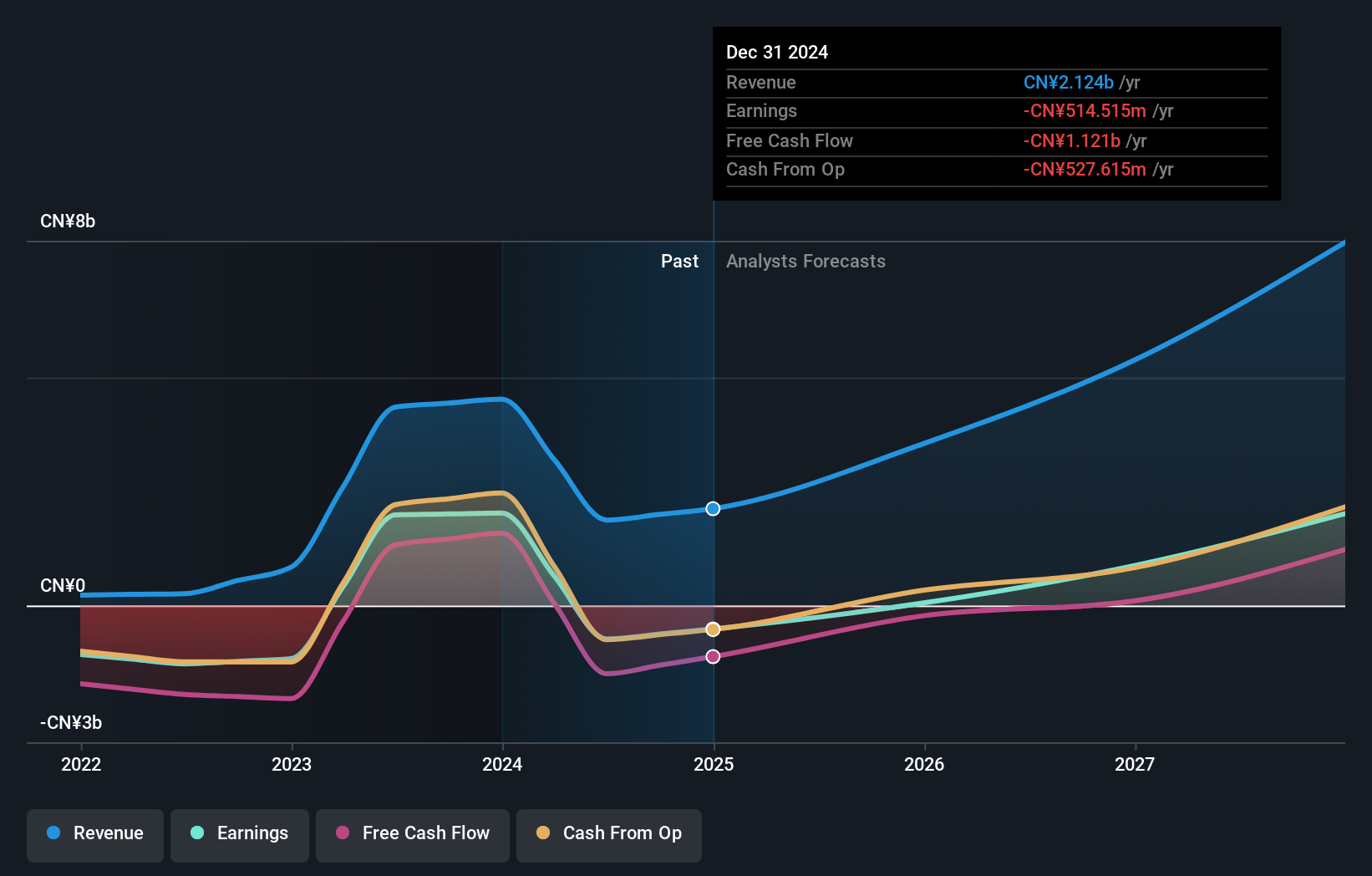

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc., a biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs with a market cap of HK$50.22 billion.

Operations: The company's revenue from the research, development, production, and sale of biopharmaceutical products is CN¥1.87 billion.

Insider Ownership: 20.5%

Revenue Growth Forecast: 32.9% p.a.

Akeso is forecast to grow earnings by 54.67% annually and become profitable within three years, outpacing the market. Despite recent shareholder dilution and a significant revenue drop to CNY 1.02 billion for H1 2024, the company's innovative drug ivonescimab has shown superior efficacy in clinical trials, enhancing its growth prospects. High insider ownership reflects strong internal confidence in Akeso's strategic direction and potential for substantial future growth.

- Get an in-depth perspective on Akeso's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Akeso's shares may be trading at a premium.

Key Takeaways

- Navigate through the entire inventory of 47 Fast Growing SEHK Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Newborn Town might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9911

Newborn Town

An investment holding company, engages in the social networking business worldwide.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives