The Hong Kong market has been experiencing some turbulence, with the Hang Seng Index recently giving up 0.43%, reflecting broader concerns about economic stability and inflation trends in China. Amid these fluctuations, growth companies with high insider ownership can offer a compelling investment case, as significant insider stakes often signal confidence in the company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Akeso (SEHK:9926) | 20.5% | 54.7% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| RemeGen (SEHK:9995) | 16.1% | 52.2% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.7% | 78.9% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| DPC Dash (SEHK:1405) | 38.2% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

Let's uncover some gems from our specialized screener.

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, with a market cap of HK$770.06 billion, operates in the automobiles and batteries sectors across China, Hong Kong, Macau, Taiwan, and internationally.

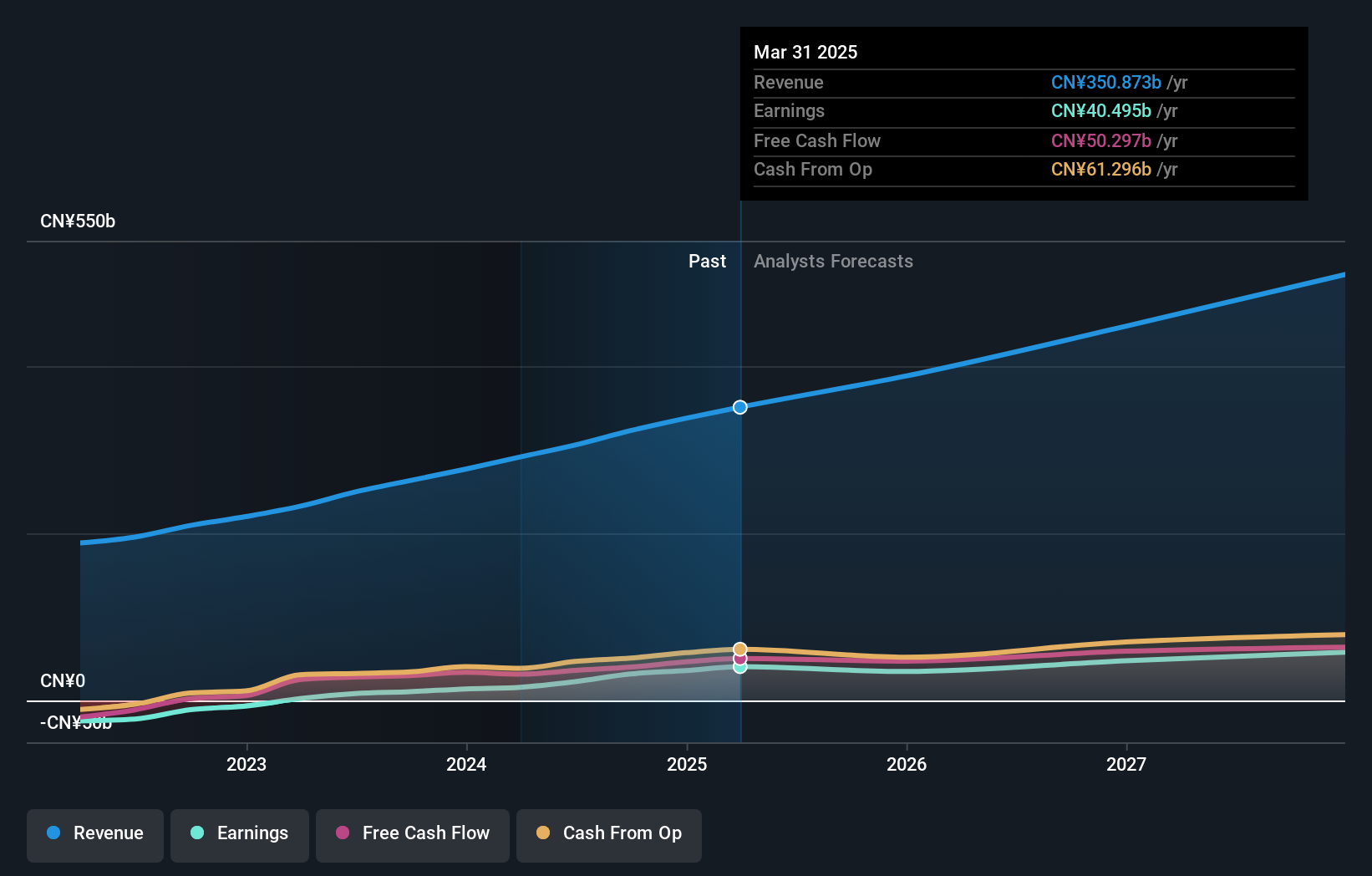

Operations: The company's revenue segments include CN¥507.52 billion from Automobiles and Related Products and Other Products, and CN¥154.49 billion from Mobile Handset Components, Assembly Service, and Other Products.

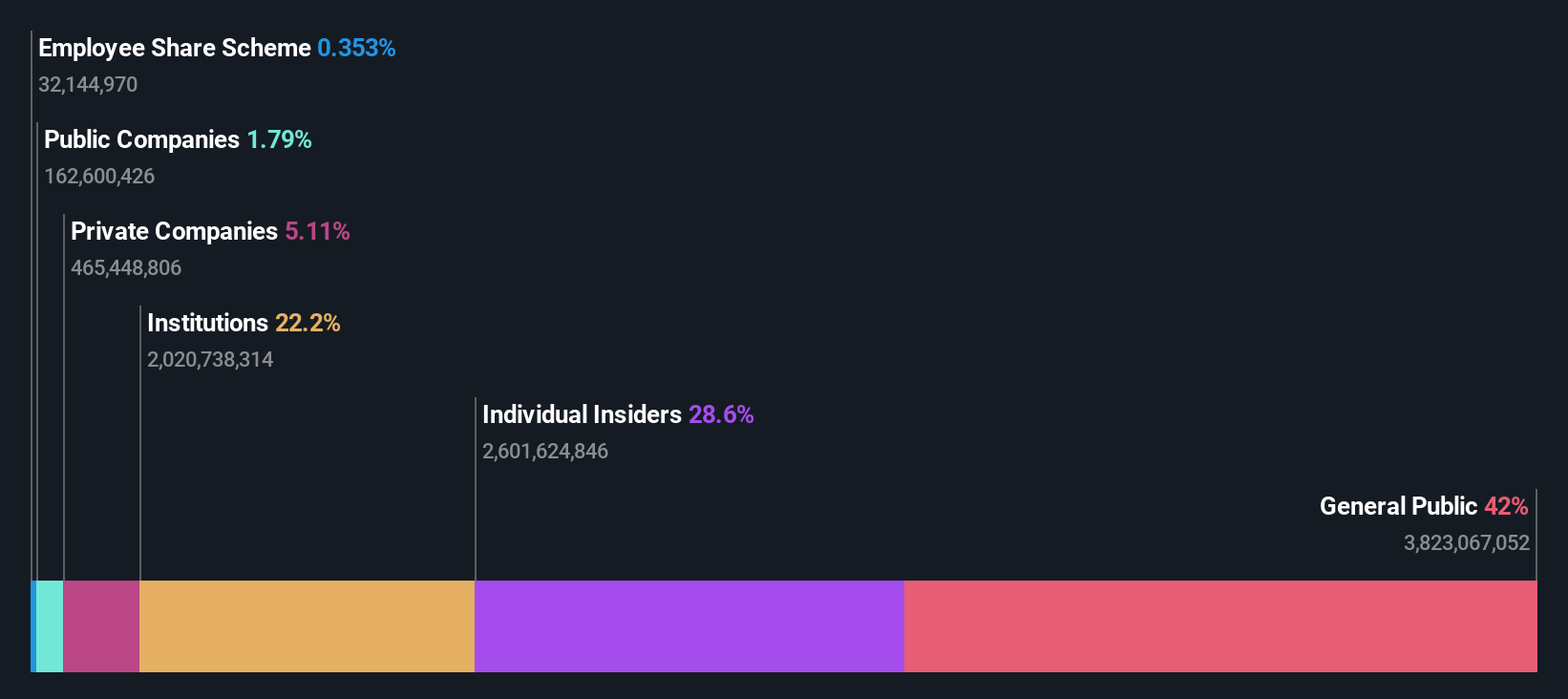

Insider Ownership: 30.1%

BYD has demonstrated robust growth, with earnings growing 36.2% over the past year and forecasted to grow at 15.22% annually, outpacing the Hong Kong market's average. The company reported significant increases in both sales and production volumes for August 2024 compared to last year, alongside a strategic partnership with Uber to expand its electric vehicle footprint globally. Despite trading below fair value estimates, BYD's high insider ownership underscores confidence in its long-term potential.

- Get an in-depth perspective on BYD's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that BYD's current price could be inflated.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan operates as a technology retail company in the People's Republic of China with a market cap of HK$766.11 billion.

Operations: The company's revenue segments include New Initiatives generating CN¥77.56 billion and Core Local Commerce contributing CN¥228.13 billion.

Insider Ownership: 11.6%

Meituan's earnings are projected to grow at 25.8% annually, significantly outpacing the Hong Kong market average. Recent financial results show a strong performance with net income doubling to CNY 16.72 billion for H1 2024. The company has completed substantial share buybacks totaling HKD 7.17 billion, reflecting confidence in its future growth prospects despite trading below fair value estimates and having low insider buying activity recently.

- Click here to discover the nuances of Meituan with our detailed analytical future growth report.

- Our expertly prepared valuation report Meituan implies its share price may be lower than expected.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc., a biopharmaceutical company with a market cap of HK$61.99 billion, focuses on researching, developing, manufacturing, and commercializing antibody drugs.

Operations: The company generates CN¥1.87 billion from the research, development, production, and sale of biopharmaceutical products.

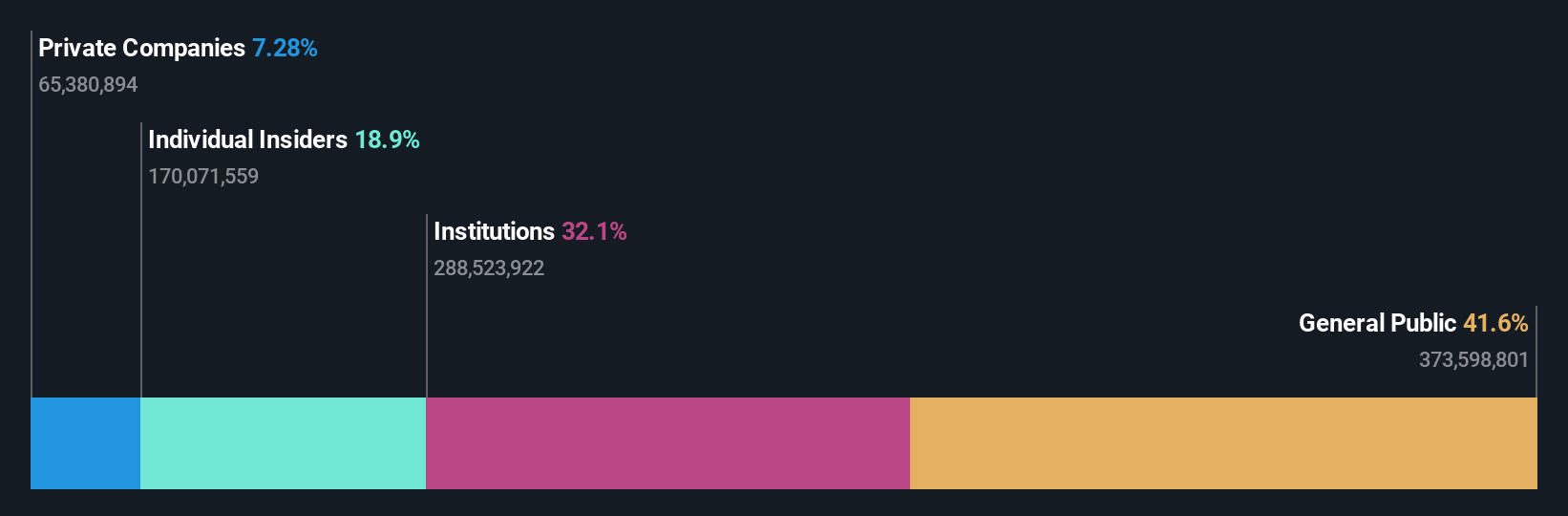

Insider Ownership: 20.5%

Akeso's recent presentations at the 2024 European Society for Medical Oncology Conference highlighted promising phase 2 results for ivonescimab in treating triple-negative breast cancer and metastatic colorectal cancer, demonstrating high efficacy and manageable safety profiles. Despite a significant revenue drop to CNY 1.02 billion for H1 2024 and a net loss of CNY 238.59 million, Akeso's strong insider ownership underscores confidence in its innovative pipeline, including its PD-1/VEGF bispecific antibody therapies.

- Click here and access our complete growth analysis report to understand the dynamics of Akeso.

- In light of our recent valuation report, it seems possible that Akeso is trading beyond its estimated value.

Make It Happen

- Unlock more gems! Our Fast Growing SEHK Companies With High Insider Ownership screener has unearthed 43 more companies for you to explore.Click here to unveil our expertly curated list of 46 Fast Growing SEHK Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs.

Exceptional growth potential with adequate balance sheet.