Here's Why Some Shareholders May Not Be Too Generous With Biosino Bio-Technology and Science Incorporation's (HKG:8247) CEO Compensation This Year

Key Insights

- Biosino Bio-Technology and Science Incorporation's Annual General Meeting to take place on 30th of May

- Salary of CN¥1.53m is part of CEO Peng Chen's total remuneration

- The overall pay is 67% below the industry average

- Over the past three years, Biosino Bio-Technology and Science Incorporation's EPS fell by 110% and over the past three years, the total loss to shareholders 65%

Performance at Biosino Bio-Technology and Science Incorporation (HKG:8247) has not been particularly rosy recently and shareholders will likely be holding CEO Peng Chen and the board accountable for this. The next AGM coming up on 30th of May will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

View our latest analysis for Biosino Bio-Technology and Science Incorporation

How Does Total Compensation For Peng Chen Compare With Other Companies In The Industry?

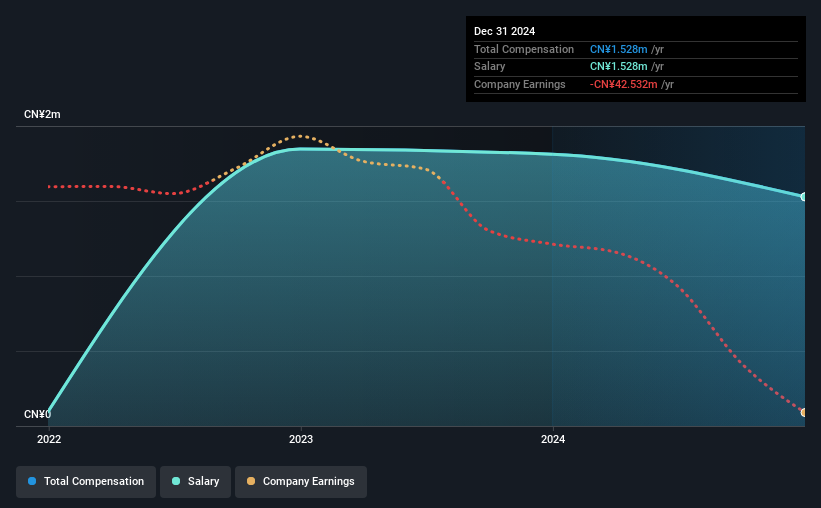

At the time of writing, our data shows that Biosino Bio-Technology and Science Incorporation has a market capitalization of HK$74m, and reported total annual CEO compensation of CN¥1.5m for the year to December 2024. That's a notable decrease of 16% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CN¥1.5m.

For comparison, other companies in the Hong Kong Biotechs industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥4.6m. In other words, Biosino Bio-Technology and Science Incorporation pays its CEO lower than the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥1.5m | CN¥1.8m | 100% |

| Other | - | - | - |

| Total Compensation | CN¥1.5m | CN¥1.8m | 100% |

Speaking on an industry level, nearly 52% of total compensation represents salary, while the remainder of 48% is other remuneration. Speaking on a company level, Biosino Bio-Technology and Science Incorporation prefers to tread along a traditional path, disbursing all compensation through a salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Biosino Bio-Technology and Science Incorporation's Growth Numbers

Over the last three years, Biosino Bio-Technology and Science Incorporation has shrunk its earnings per share by 110% per year. It saw its revenue drop 9.0% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Biosino Bio-Technology and Science Incorporation Been A Good Investment?

Few Biosino Bio-Technology and Science Incorporation shareholders would feel satisfied with the return of -65% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Biosino Bio-Technology and Science Incorporation rewards its CEO solely through a salary, ignoring non-salary benefits completely. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Biosino Bio-Technology and Science Incorporation that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Biosino Bio-Technology and Science Incorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8247

Biosino Bio-Technology and Science Incorporation

Manufactures, sells, and distributes in-vitro diagnostic reagents in Mainland China.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)