- Hong Kong

- /

- Life Sciences

- /

- SEHK:8225

If You Had Bought China Health Group (HKG:8225) Stock A Year Ago, You Could Pocket A 546% Gain Today

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. While not every stock performs well, when investors win, they can win big. For example, the China Health Group Inc. (HKG:8225) share price is up a whopping 546% in the last year, a handsome return in a single year. In more good news, the share price has risen -1.9% in thirty days. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report. Also impressive, the stock is up 128% over three years, making long term shareholders happy, too.

It really delights us to see such great share price performance for investors.

See our latest analysis for China Health Group

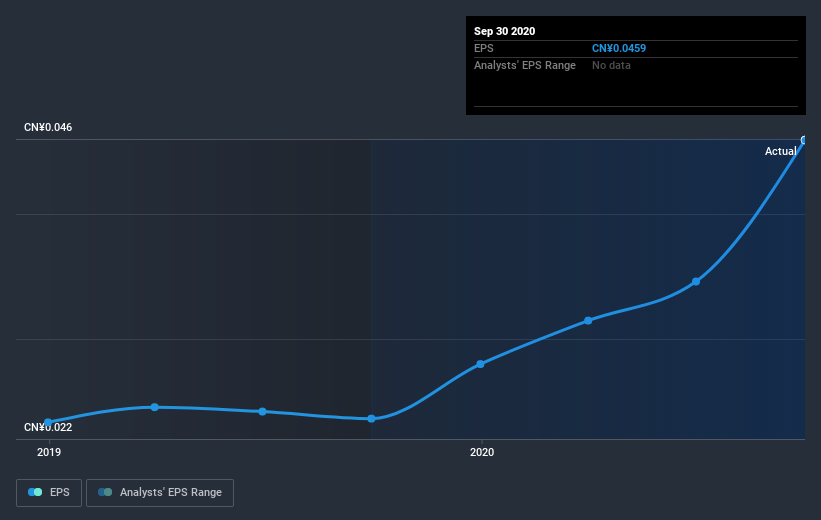

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year China Health Group grew its earnings per share (EPS) by 94%. The share price gain of 546% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on China Health Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that China Health Group has rewarded shareholders with a total shareholder return of 546% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 17% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - China Health Group has 2 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade China Health Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:8225

China Health Group

An investment holding company, provides research and development services of drugs, bio drugs, natural drugs, and synthetic drugs in the People’s Republic of China.

Flawless balance sheet slight.