- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1231

3 Promising Penny Stocks With At Least US$100M Market Cap

Reviewed by Simply Wall St

As global markets show signs of optimism with cooling inflation and robust bank earnings in the U.S., investors are exploring diverse opportunities across different sectors. Penny stocks, a term rooted in earlier market days, represent smaller or less-established companies that can offer significant value. By focusing on those with strong financials and clear growth potential, investors can uncover promising opportunities within this often-overlooked segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$41.79B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £150.76M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,713 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Newton Resources (SEHK:1231)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Newton Resources Ltd is an investment holding company involved in the sourcing and supply of iron ores and other commodities both in Mainland China and internationally, with a market capitalization of HK$1.24 billion.

Operations: The company generates revenue of $485.41 million from its resources business segment.

Market Cap: HK$1.24B

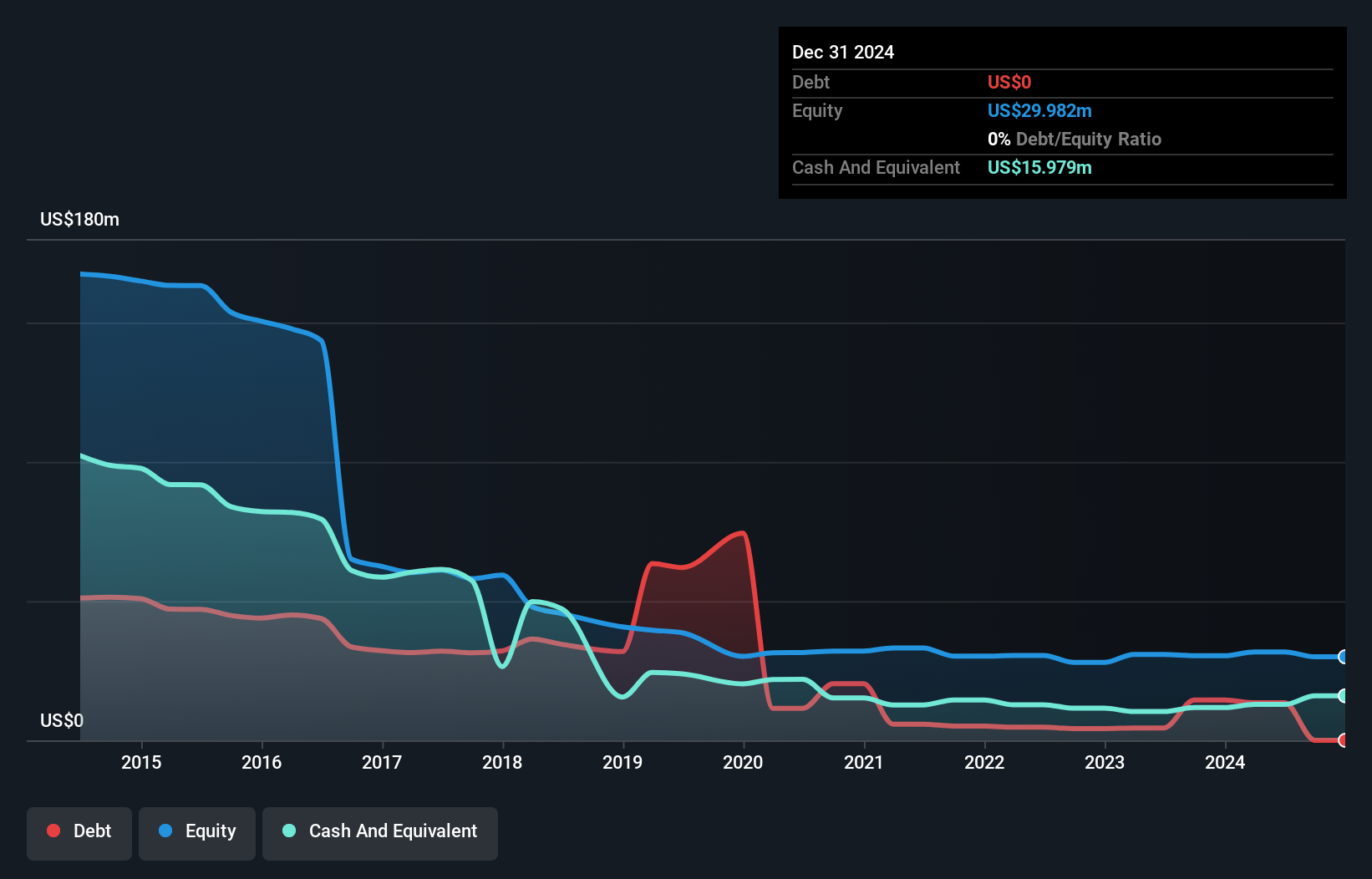

Newton Resources Ltd. has faced recent challenges, expecting a net loss of US$1 million for 2024, primarily due to decreased iron ore supply and demand. Despite this setback, the company has shown resilience with a significant reduction in its debt-to-equity ratio from 160.5% to 42.5% over five years and satisfactory net debt levels at 2%. Its earnings growth of 103% last year outpaced industry averages, although operating cash flow remains negative. Short-term assets cover liabilities well, but return on equity is low at 2.9%. The board's experience may support future strategic adjustments amidst current volatility.

- Get an in-depth perspective on Newton Resources' performance by reading our balance sheet health report here.

- Learn about Newton Resources' historical performance here.

North East Rubber (SET:NER)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: North East Rubber Public Company Limited manufactures and sells rubber products in Thailand with a market cap of THB9.24 billion.

Operations: The company generates revenue of THB25.15 billion from its segments, including Rubber Smoked Sheets, Skim Block Rubbers, and other rubber products.

Market Cap: THB9.24B

North East Rubber, with a market cap of THB9.24 billion, has shown robust financial performance despite some challenges. The company reported increased revenues and net income for the third quarter of 2024, indicating solid growth momentum. However, its debt is not well covered by operating cash flow, which could be a concern for potential investors. The company's high return on equity is skewed by significant debt levels, yet it maintains strong short-term asset coverage over liabilities. Recent fixed-income offerings aim to bolster financial stability further while analysts anticipate continued earnings growth above industry averages.

- Jump into the full analysis health report here for a deeper understanding of North East Rubber.

- Gain insights into North East Rubber's outlook and expected performance with our report on the company's earnings estimates.

Discount Investment (TASE:DISI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Discount Investment Corporation Ltd. is a holding company that invests in various sectors both in Israel and internationally, with a market cap of ₪605.29 million.

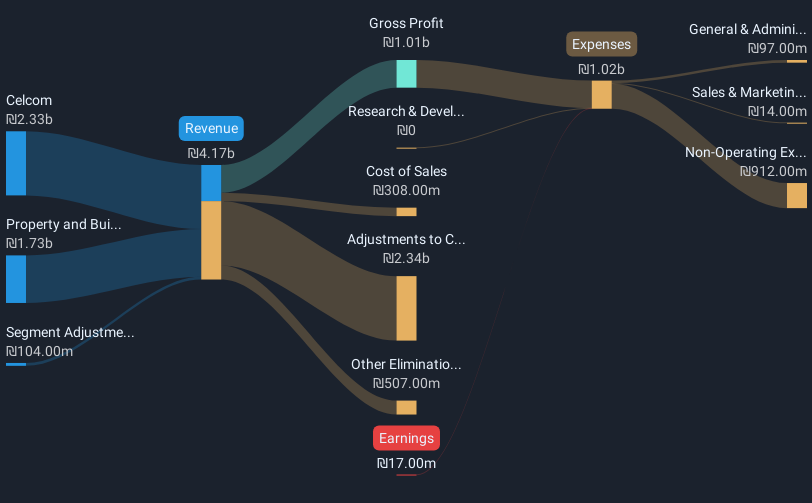

Operations: The company generates revenue from its segments, including Celcom with ₪2.33 billion and Property and Building with ₪1.73 billion.

Market Cap: ₪605.29M

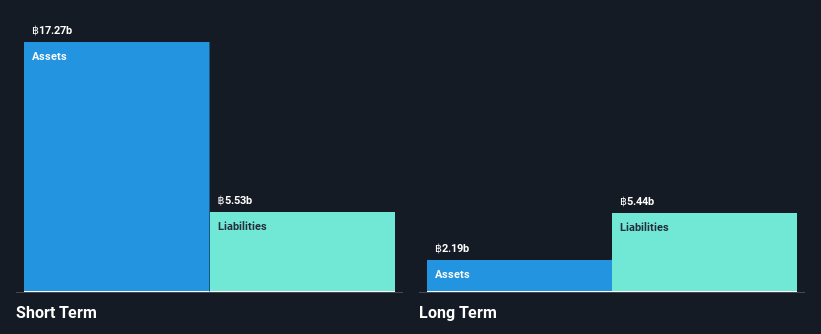

Discount Investment Corporation Ltd., with a market cap of ₪605.29 million, has shown progress in reducing its net loss from ILS 364 million to ILS 109 million year-over-year for the third quarter of 2024. Despite being unprofitable, the company has a positive free cash flow and sufficient cash runway for over three years. Its short-term assets of ₪5.9 billion cover short-term liabilities but not long-term liabilities totaling ₪13.1 billion, indicating potential financial strain if debt levels remain high. The board's average tenure is experienced at 3.4 years, providing some stability amidst ongoing financial challenges.

- Unlock comprehensive insights into our analysis of Discount Investment stock in this financial health report.

- Review our historical performance report to gain insights into Discount Investment's track record.

Where To Now?

- Dive into all 5,713 of the Penny Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newton Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1231

Newton Resources

An investment holding company, engages in identification and exploration of sourcing and supply of iron ores and other commodities in Mainland China and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives