Undervalued Small Caps With Insider Buying To Explore In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate cuts from the ECB and SNB, and expectations of a similar move by the Fed, small-cap stocks have faced challenges, with the Russell 2000 Index underperforming against larger indices like the S&P 500. Amidst this backdrop of fluctuating economic indicators and market sentiment, identifying promising small-cap stocks requires careful consideration of factors such as financial health, growth potential, and insider activity.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 25.1x | 0.8x | 26.88% | ★★★★★☆ |

| Maharashtra Seamless | 11.2x | 1.9x | 29.57% | ★★★★★☆ |

| Avia Avian | 13.8x | 3.2x | 25.49% | ★★★★★☆ |

| ABG Sundal Collier Holding | 12.3x | 2.1x | 40.83% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 48.92% | ★★★★☆☆ |

| Gooch & Housego | 41.2x | 1.0x | 31.99% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 14.6x | 1.7x | -45.96% | ★★★☆☆☆ |

| Kambi Group | 16.3x | 1.5x | 40.68% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| THG | NA | 0.4x | -1066.40% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

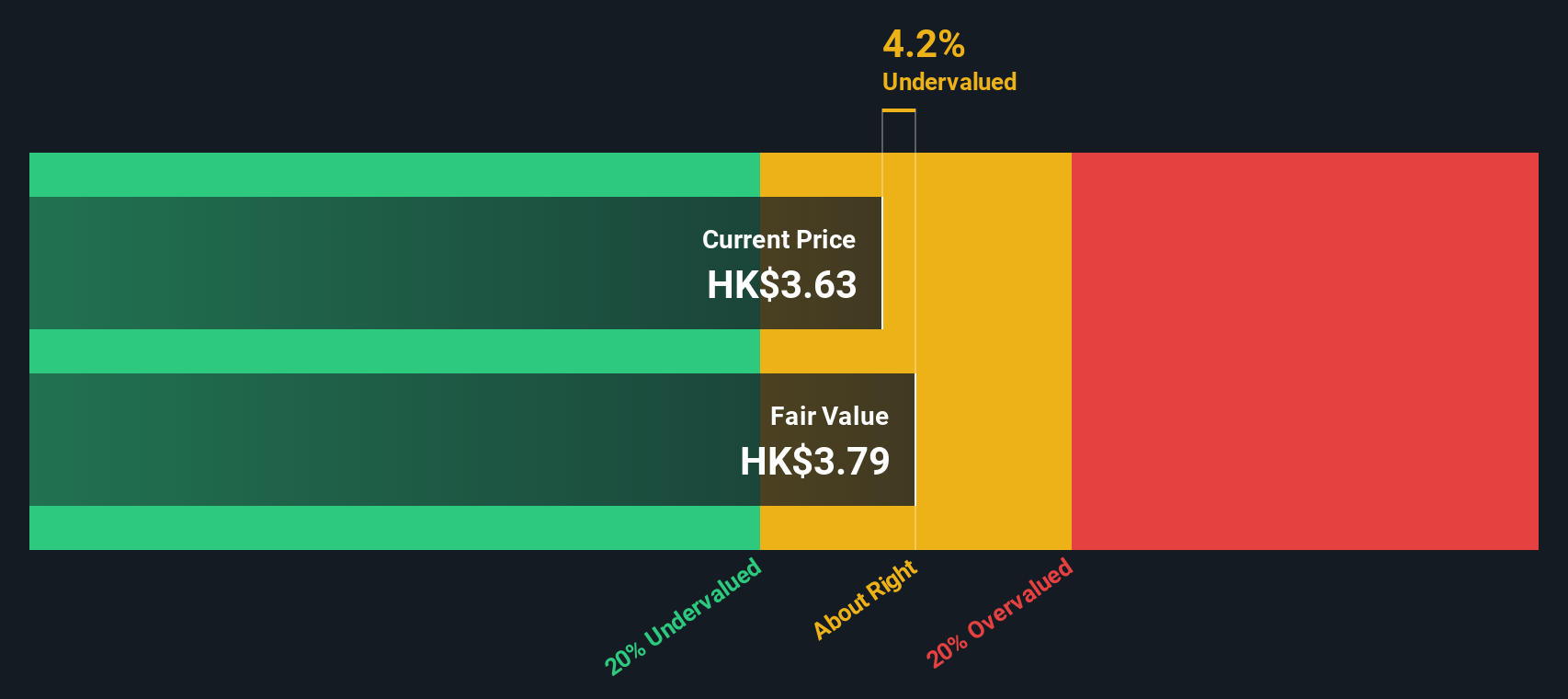

Eagle Nice (International) Holdings (SEHK:2368)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Eagle Nice (International) Holdings is engaged in the manufacturing and sale of sportswear and apparel, with a market capitalization of HK$1.94 billion.

Operations: The company's revenue streams are primarily driven by its operations in the Chinese Mainland, contributing significantly to its total revenue of HK$4.54 billion as of 2024-09-30. Over recent periods, the gross profit margin has shown a decline from 20.06% in 2020-12-31 to 16.31% in 2024-09-30, indicating changes in cost structures or pricing strategies. Operating expenses have increased alongside revenue growth, affecting overall profitability and net income margins which have decreased from a peak of 10.65% in late 2017 to around 4.80% by late 2024.

PE: 10.6x

Eagle Nice, a smaller company in the market, shows potential despite some challenges. Insider confidence is evident with share purchases over the past year. The company's earnings quality remains high, although profit margins have decreased from 7% to 4.8%. Sales increased to HK$2.98 billion for the half-year ending September 2024, yet net income fell to HK$183 million from HK$229 million a year ago. Debt coverage by operating cash flow needs improvement, but strategic moves and insider confidence may support future growth prospects.

- Get an in-depth perspective on Eagle Nice (International) Holdings' performance by reading our valuation report here.

Understand Eagle Nice (International) Holdings' track record by examining our Past report.

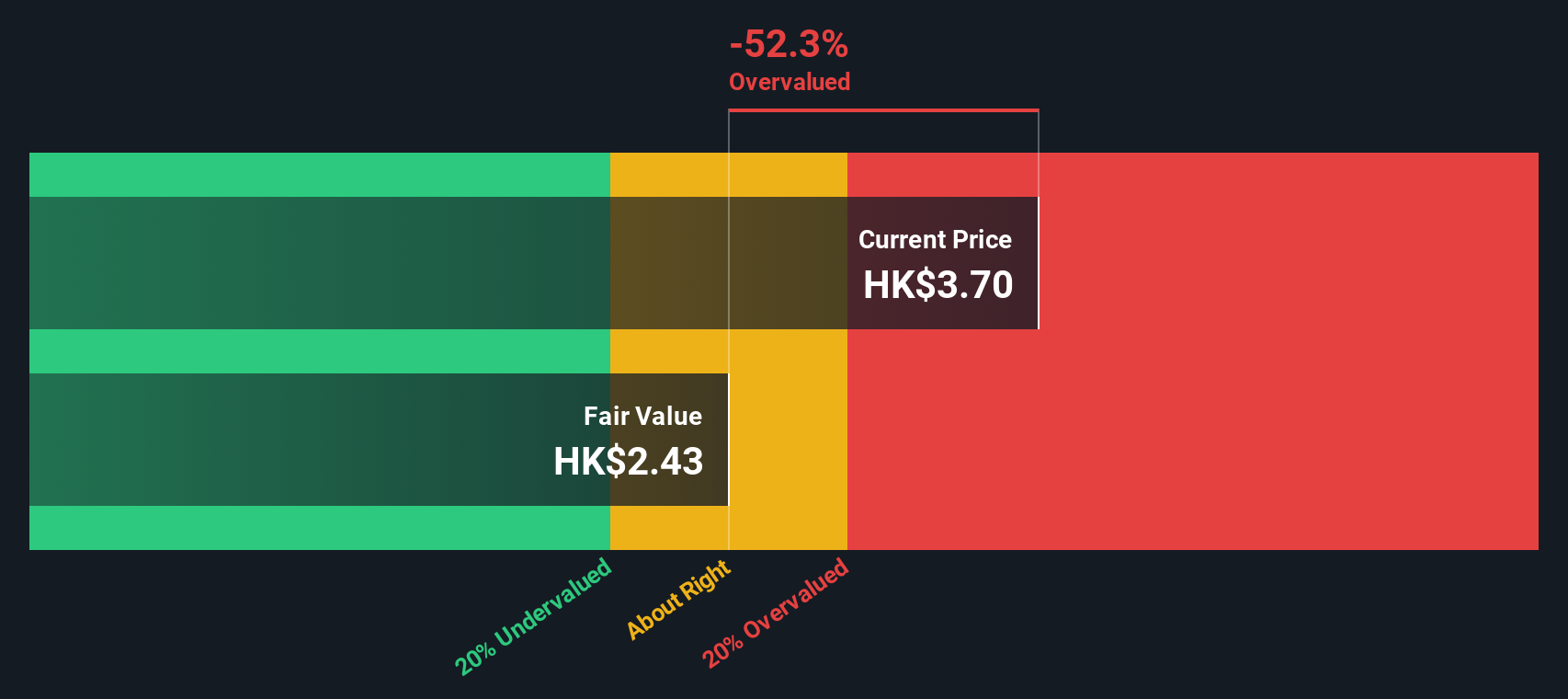

NagaCorp (SEHK:3918)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NagaCorp operates primarily in the casino and hotel entertainment industry, with a focus on integrated gaming resorts, and has a market capitalization of approximately $1.88 billion.

Operations: The company's primary revenue stream is from casino operations, with additional contributions from hotel and entertainment operations. Over the observed periods, the gross profit margin has shown a notable increase, reaching as high as 86.81%. Operating expenses have been a significant part of the cost structure, with general and administrative expenses consistently contributing to these costs.

PE: 17.2x

NagaCorp, a small cap entity, recently experienced significant board changes with Monica Lam transitioning from company secretary to non-executive director. Despite lower profit margins at 17.7% compared to last year's 30%, earnings are projected to grow by 42.41% annually. The company's funding relies entirely on external borrowing, posing higher risk without customer deposits. Insider confidence is evident through recent share purchases, suggesting potential value recognition within the company amidst these strategic adjustments.

- Click here to discover the nuances of NagaCorp with our detailed analytical valuation report.

Gain insights into NagaCorp's historical performance by reviewing our past performance report.

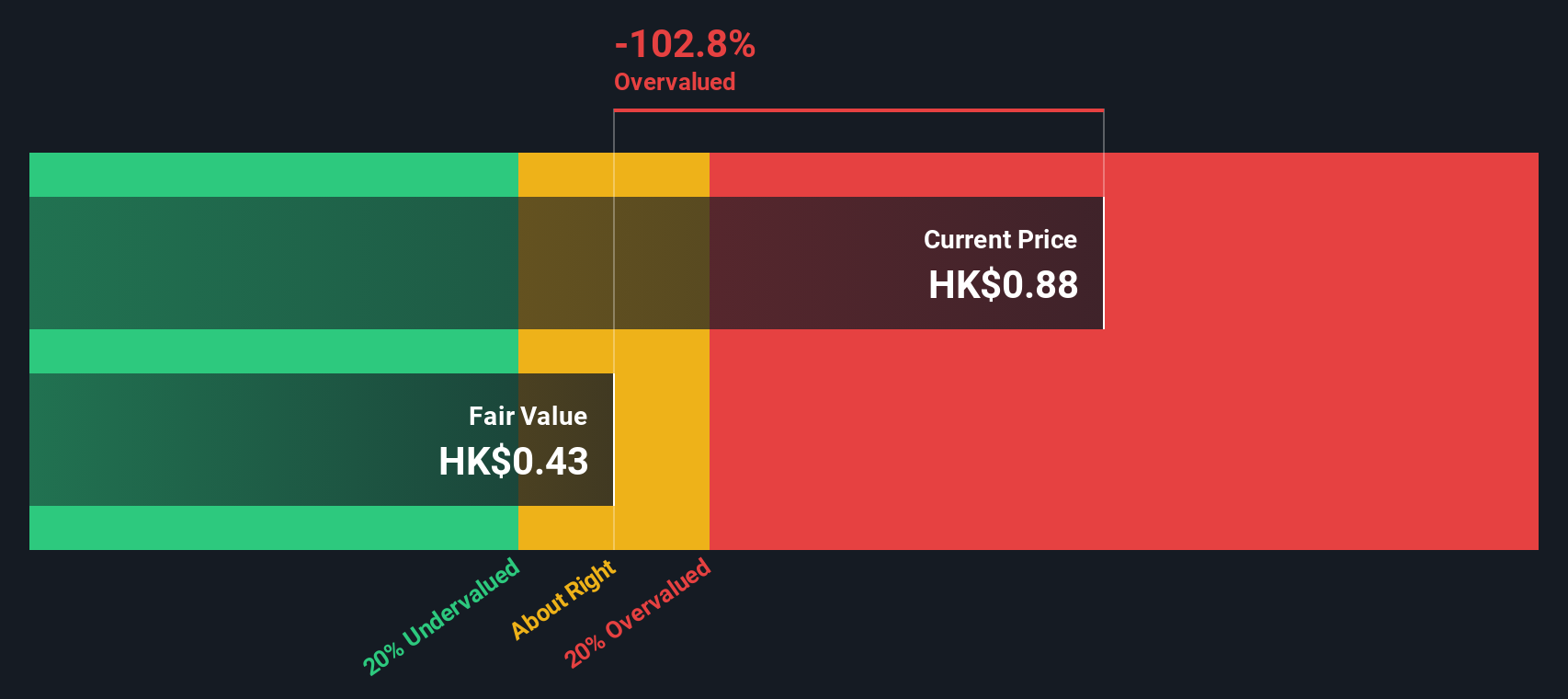

CK Life Sciences Int'l. (Holdings) (SEHK:775)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CK Life Sciences Int'l. (Holdings) operates in the agriculture-related sector and other segments, with a focus on health and environmental sustainability, and has a market capitalization of approximately HK$3.36 billion.

Operations: The primary revenue stream for CK Life Sciences Int'l. (Holdings) comes from agriculture-related activities, contributing significantly to its overall earnings. Over the analyzed periods, the gross profit margin has shown a varied trend, reaching 30.95% in recent quarters. The company faces substantial cost of goods sold and operating expenses that influence its profitability metrics.

PE: -208.6x

CK Life Sciences Int'l. (Holdings) shows potential as an undervalued stock with insider confidence indicated by Lance Richard Lee Yuen's purchase of 2.1 million shares, valued at approximately HK$969,365, reflecting a significant increase in their holdings by over 1250%. Despite the company's reliance on higher-risk external borrowing and declining earnings over the past five years, recent leadership changes could drive strategic shifts. The healthcare-focused firm may benefit from Yuen's extensive experience in multinational environments.

Make It Happen

- Dive into all 185 of the Undervalued Small Caps With Insider Buying we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagle Nice (International) Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2368

Eagle Nice (International) Holdings

An investment holding company, manufactures and trades in sportswear and garments in Mainland China, the United States, Europe, Japan, and internationally.

Average dividend payer slight.