CK Life Sciences Int'l., (Holdings) Inc.'s (HKG:775) Share Price Boosted 34% But Its Business Prospects Need A Lift Too

CK Life Sciences Int'l., (Holdings) Inc. (HKG:775) shareholders have had their patience rewarded with a 34% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

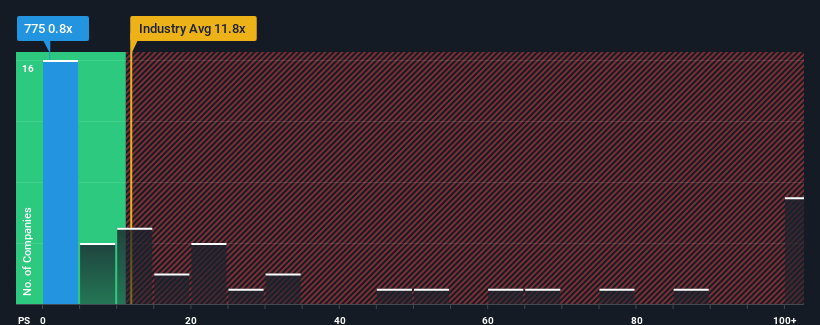

Even after such a large jump in price, CK Life Sciences Int'l. (Holdings)'s price-to-sales (or "P/S") ratio of 0.8x might still make it look like a strong buy right now compared to the wider Biotechs industry in Hong Kong, where around half of the companies have P/S ratios above 11.8x and even P/S above 56x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CK Life Sciences Int'l. (Holdings)

What Does CK Life Sciences Int'l. (Holdings)'s Recent Performance Look Like?

For example, consider that CK Life Sciences Int'l. (Holdings)'s financial performance has been pretty ordinary lately as revenue growth is non-existent. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. Those who are bullish on CK Life Sciences Int'l. (Holdings) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CK Life Sciences Int'l. (Holdings) will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, CK Life Sciences Int'l. (Holdings) would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Likewise, not much has changed from three years ago as revenue have been stuck during that whole time. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

This is in contrast to the rest of the industry, which is expected to grow by 83% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why CK Life Sciences Int'l. (Holdings)'s P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From CK Life Sciences Int'l. (Holdings)'s P/S?

Even after such a strong price move, CK Life Sciences Int'l. (Holdings)'s P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

In line with expectations, CK Life Sciences Int'l. (Holdings) maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - CK Life Sciences Int'l. (Holdings) has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:775

CK Life Sciences Int'l. (Holdings)

An investment holding company, researches, develops, manufactures, commercializes, and sells health and agriculture-related products in the Asia Pacific and North America.

Slightly overvalued very low.

Similar Companies

Market Insights

Community Narratives