Ascentage Pharma Group International's (HKG:6855) Shares Climb 29% But Its Business Is Yet to Catch Up

Ascentage Pharma Group International (HKG:6855) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 25% in the last year.

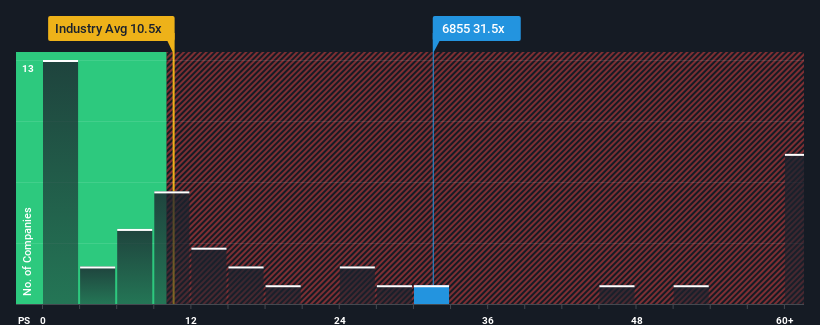

Since its price has surged higher, Ascentage Pharma Group International may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 31.5x, since almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios under 10.5x and even P/S lower than 2x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Ascentage Pharma Group International

What Does Ascentage Pharma Group International's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Ascentage Pharma Group International has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ascentage Pharma Group International will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Ascentage Pharma Group International would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.9% last year. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 38% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 54% each year, which is noticeably more attractive.

With this information, we find it concerning that Ascentage Pharma Group International is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Ascentage Pharma Group International's P/S?

The strong share price surge has lead to Ascentage Pharma Group International's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Ascentage Pharma Group International, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you take the next step, you should know about the 2 warning signs for Ascentage Pharma Group International that we have uncovered.

If these risks are making you reconsider your opinion on Ascentage Pharma Group International, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6855

Ascentage Pharma Group International

A clinical-stage biotechnology company, develops therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives