Should You Be Adding CanSino Biologics (HKG:6185) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like CanSino Biologics (HKG:6185). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide CanSino Biologics with the means to add long-term value to shareholders.

View our latest analysis for CanSino Biologics

CanSino Biologics' Improving Profits

CanSino Biologics has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. CanSino Biologics' EPS skyrocketed from CN¥2.64 to CN¥4.01, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 52%.

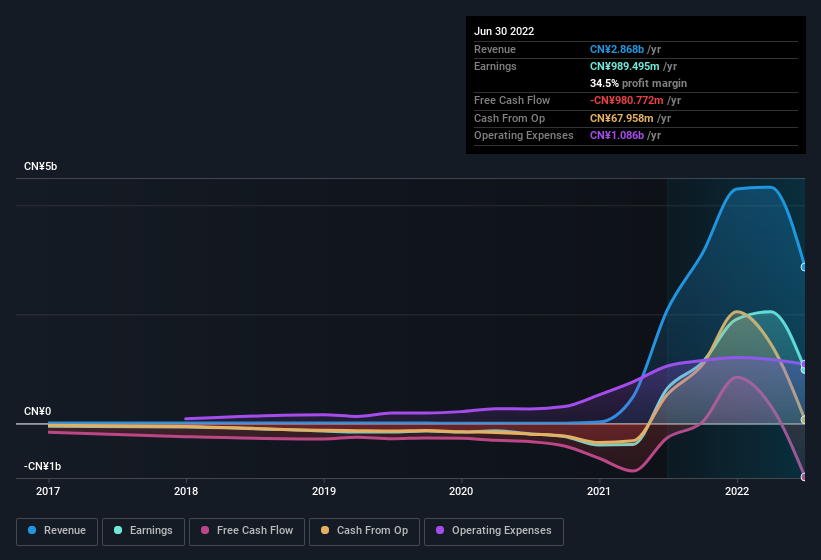

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of CanSino Biologics shareholders is that EBIT margins have grown from 18% to 32% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for CanSino Biologics.

Are CanSino Biologics Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that CanSino Biologics insiders own a meaningful share of the business. In fact, they own 42% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. CN¥10b That level of investment from insiders is nothing to sneeze at.

Does CanSino Biologics Deserve A Spot On Your Watchlist?

You can't deny that CanSino Biologics has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. You should always think about risks though. Case in point, we've spotted 1 warning sign for CanSino Biologics you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6185

CanSino Biologics

Develops, manufactures, and commercializes vaccines in the People’s Republic of China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives